Globacom gained over 1 million internet subscribers in the third quarter of 2021, growing its customer base to 38.9 million as of September 2021 from 37.9 million at the beginning of the quarter. This is according to monthly data tracked by Nairalytics, the research arm of Nairametrics from the Nigerian Communications Commission (NCC).

According to data obtained, MTN lost about 1.2 million subscribers in the review quarter, as its data customer base dropped to 58.4 million from 59.6 million as of the end of June 2021. This represents a 2% decline in internet subscribers.

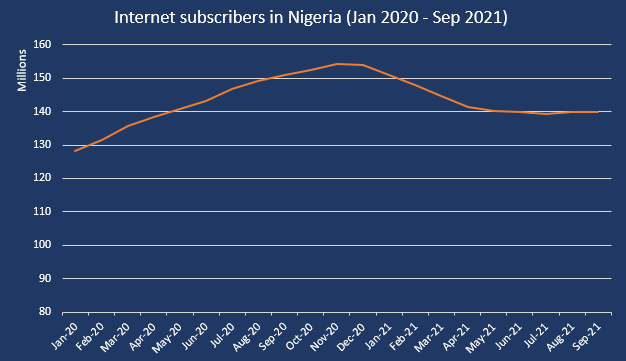

It is worth noting that the number of telco customers is beginning to pick up from the downtrend recorded earlier in the year, when the NCC directed the telcos not to register new sim cards due to the NIMC registrations.

READ: Glo dominates voice and data subscriptions in July

Highlights

The total number of data subscribers increased by 107,766 customers in Q3 2021. MTN lost the highest customers, followed by 9mobile.

Airtel gained 470,906 customers in the period under review while Globacom gained 1.03 million customers. Meanwhile, 9mobile data subscribers dropped by 206,768 in Q3 2021.

Further analysis of the number of subscribers that switched network providers in the period under review shows that 3,277 users ported out of 9mobile.

In the same vein, 918 users ported out of Airtel, while 881 and 863 subscribers ported out of Globacom and MTN respectively.

On the flip side, MTN received 3,368 subscribers followed by Airtel, which received 2,541 subscribers in the third quarter of the year.

Meanwhile, MTN still boasts of the highest customer base in the country, accounting for 41.7% of the total internet customers as of the end of September 2021.

READ: Glo propels growth in the telecoms sector in Q3, 2020

A look at their Q3 2021 numbers

A cursory analysis of the financial statements of the two listed telecommunications companies on the NGX shows stellar performances from their data revenue, recording double-digit growth in top and bottom lines.

MTN Nigeria recorded a 23% increase in its revenue between July and September 2021, printing gross earnings of N414.99 billion, while its data earnings surged by 57% from N87.62 billion recorded in Q3 2020 to N137.75 billion in the review period.

On the other hand, Airtel Nigeria generated a sum of $450 million as revenue, representing an increase of 19% compared to $377 million recorded in the corresponding period of 2020, with data earnings skyrocketing by 33% year-on-year to $179 million.

Both companies recorded double-digit profit growth in the period under review, as MTN Nigeria recorded a 59% increase in net profit while Airtel Nigeria grew its operating profit by 28% in the same period.

According to MTN’s financial report, their active data users increased by 2.5 million to 33.2 million users as of September 2021.

What they are saying

Wale Okunrinboye, an Investment Analyst, while commenting on the performance of the telcos during the “On TheMoney series” on social media platform, Clubhouse, last Saturday, explained that the stellar performance of Nigerian telcos is majorly driven by data earnings as Nigerians continue to spend more on internet services.

“Nigerians continue to visit more social media sites, Facebook, Twitter, Instagram, TikTok amongst others; the telcos are obviously the highest gainers,” he said.

Since the pandemic, Nigerians have turned to social media as online comedians have stepped up efforts in providing video content on various social media platforms, which has been a major boost for the Nigerian entertainment industry.

Also, the increased adoption of remote working in Nigeria after the covid-19 lockdown has resulted in increased data cost, as corporations move their various meetings and seminars to webinars. Company AGMs are now done virtually, as they also report their earnings in the same manner.

READ: Data war: MTN, Airtel, others lose over 8 million subscribers in 3 months

What regulators are saying

Adeleke Adewolu, the Executive Commissioner, Stakeholder Management (ECSM) at NCC, while speaking at a breakout session at the recent 2021 Annual General Conference of the Nigerian Bar Association in Port Harcourt, explained that the ongoing implementation of the new Nigerian National Broadband Plan (NNBP), 2020-2025 and its Strategic Vision Plan (SVP), 2021-2025 will drive the development of new technologies and local content in Nigeria.

According to him, the Nigerian National Broadband Plan (NNBP), 2020-2025 has four critical pillars which are: Infrastructure, Policy, Demand Drivers and Funding/Incentives. A major uniqueness of the plan is the fact that it clearly defines ‘broadband’ for Nigeria as “connectivity delivering a minimum of 10 Mbps in rural areas and a minimum of 25 Mbps in urban areas to every Nigerian at an affordable price and quality.”

On the other hand, Umar Dambatta, the Executive Vice Chairman, Nigerian Communications Commission (NCC) at the Nigeria e-Government Summit 2021, who was represented by Adewolu Adeleke said the commission is working with stakeholders to deepen penetration of broadband infrastructure and services in Nigeria.

He highlighted that electronic communications have greatly improved the efficiency of interactions among governments, citizens and businesses.

Why this matters

Nigerian telcos continue to print impressive numbers despite the decline in the number of subscribers occasioned by the restriction placed last year by the NCC on registration of new lines. Meanwhile, Nigerian telcos continue to compete for market share, providing various attractive data plans in a bid to attract more customers to their services.