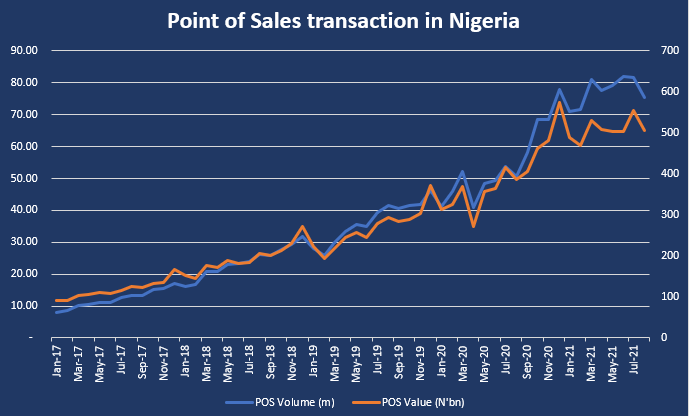

Point of sale transactions carried out in Nigeria in the first eight months of the year stood at N4.06 trillion, representing a 45% increase compared to N2.81 trillion recorded in the corresponding period of 2020. This is based on data obtained from the Nigeria Inter-Bank Settlement System (NIBSS).

According to the data, POS transactions hit its highest levels for any eight-month period, increasing by 44.8% and 108% compared to N2.81 trillion and N1.96 trillion recorded in the similar period of 2020 and 2019 respectively.

Similarly, the volume of POS transactions recorded between January and August 2021 stood at 619.3 million, increasing by 61.8% compared to 382.9 million recorded in the corresponding period of 2020. It is worth noting that a total of 686,577 POS terminals were deployed nationwide as of August 2021, representing an 84.4% increase compared to 372,333 recorded as of the same period of 2020.

Highlights

The value of POS transactions in the country for the month of August 2021 stood at N504.88 billion, lower than N554.67 billion recorded in the previous month, while it rose marginally compared to N503.91 billion carried out in June 2021.

A total of N4.06 trillion worth of POS transactions have been carried out so far in the year. Meanwhile, according to data made available by the NIBSS, N1.41 trillion, N2.32 trillion, N3.2 trillion, and N4.73 trillion were recorded in 2017, 2018, 2019, and 2020 respectively.

In terms of volume, 146.27 million, 285.89 million, 438.61 million, and 655.75 million transactions were carried out in 2017, 2018, 2019, and 2020 respectively, while a total of 619.28 million transactions have been recorded so far this year.

The number of terminals deployed as of the month of August 2021, increased by 4% to 686,577 from 660,402 recorded in the previous month, while it increased by 49.5% year to date.

The data paints a clear picture of the increased interest in the use of POS as a means of transaction, especially with Nigerians continuous adoption of cashless policy, and the downsides of having to move around with cash and queue at the banking hall for withdrawals and deposits.

Considering the long-term trend of the data from January 2017 to August 2021, one can see that the value and volume of POS transactions recorded in the country, elevated during the heights of the pandemic, when Nigerians were forced to work remotely and banking halls admitted only a limited number of customers.

Meanwhile, in the short-term, the value of POS transactions declined in recent months, dropping by 9% in the month of August 2021 from N554.67 billion in July to N504.88 billion. The same was noticed in terms of the volume of transactions recorded in the period. Notably, it dropped by 7.4% from 81.62 million recorded in July to N75.55 million in August.

Nigeria’s increased adoption of cashless payments

If there was anything COVID-19 lockdown taught us, it was that certain kinds of work can effectively go on remotely. Buying and selling, and other related financial services are common examples. The lockdown also exposed young Nigerians to delivering financial services at the local level.

A similar article by Nairametrics revealed that insecurity, covid-19 and waiting time at the bank are part of the reasons for the increased POS activities in the country. The report highlighted that using ATM cards to withdraw in Nigeria is safer, considering the level of insecurity in the country.

Young Nigerians have tapped into the opportunity presented by the fact that more people are now working from home, by providing POS services in the various localities. Findings by Nairametrics research team show that POS terminals and kiosks are now popping up in most areas of the country and have become a major business in South-West Nigeria.

Findings have also shown that the business is highly profitable as some of these agents make an average of N20,000 to N100,000 daily, a great incentive for other young people to go into the business. Survey also shows that Nigerian students are now setting up shops in their various institutions of learning, to bring banking transactions closer to fellow students.

What they are saying

In an interview with a student at the University of Ibadan, Miss Aisha explained that considering the stress of walking down to the ATM point and having to wait in line before getting served, she prefers to pay an additional N100 to nearby POS vendors to withdraw her cash and use her time for other productive activities.

The story is similar for Nigerians who patronise these vendors within their home environment. In a brief discussion with Mrs Olaitan, an analyst who works remotely, she mentioned the cost of transportation as the major factor for her.

“The cost of moving to the bank to use the ATM is about N300, coupled with the risk of facing long queues, why not just pay an additional N100 to N150 to get my withdrawal or deposits done as fast as possible?” she stated.

However, when the withdrawals are significantly large, it becomes imperative to visit the banks as most of the POS kiosks are situated in open places and could attract the unwanted attention of criminals while the multiplying effect of the transaction fee could outweigh the cost of transportation and queuing at the bank.

Also, while POS businesses are on the high, delivery companies are beginning to insist on POS payment on delivery services rather than cash payment, while some businesses have stopped collecting cash, opting instead for bank transfers or POS payments. This is according to findings made by Nairametrics Research.

Bottomline

While it is a point of interest that the once cash-oriented Nigerian populace are now adopting cashless payments as a form of transaction, it is also worth noting that it is helping to solve Nigeria’s unemployment problem whilst increasing financial inclusion.