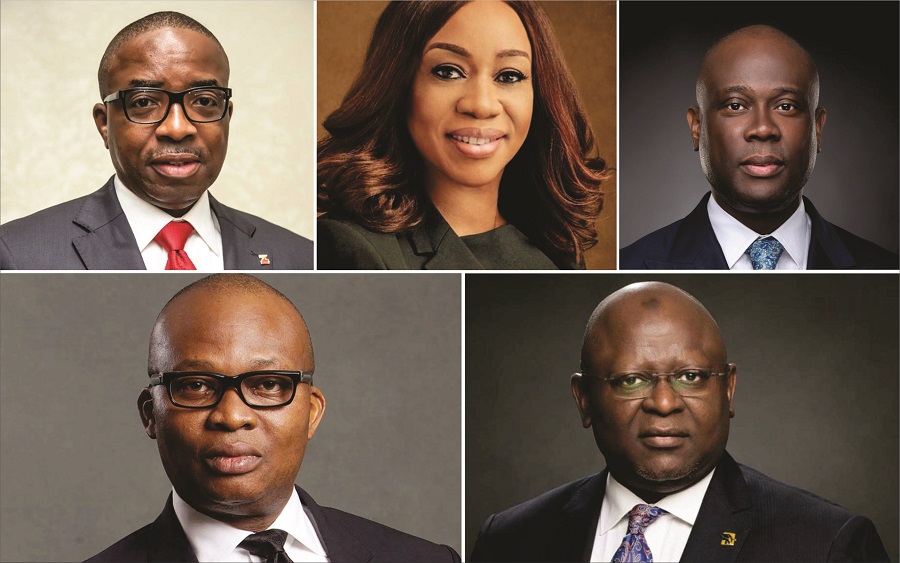

The market capitalization of the top five banks, referred to as the Tier-1 banks decreased to N2.41 trillion at the close of business on the 10th of September 2021 as investors in these banks lost N30.02 billion during the trading week.

According to data from the Nigerian Exchange (NGX), the market capitalization of the top five banks declined to N2.41 trillion, a depreciation of 1.2% during the week.

The loss can be attributed to the sell-off witnessed in the share prices of most of the banks, during the five trading days.

A summary of the performance of each bank is captured below.

FBNH PLC

First Bank Holdings Nig. Plc gained N1.79 billion as its market capitalization grew from N269.21 billion to N271.01 billion at the end of the week, making up 11% of the Fugaz capitalization. Amid sell-offs and buy-interests, at the end of the five-day trading session, FBNH share price appreciated from N7.50 to N7.55.

During the week, investors traded about 289,184,146 units of the bank’s shares valued at N2.16 billion. The volume of shares traded appreciated by 683.90%, when compared to 36.89 million units traded the previous week, making the bank’s stock the most traded in volume amongst the FUGAZs during the week. The bank traded its highest number of shares on Thursday of 97.73 million units valued at N729.64 million.

The bank released their second-quarter result which revealed that Interest income for the period decreased by 19.36%. However, net profit for the period reported a growth of 79.76% from N12.50 billion in Q2 2020 to N22.47 billion in Q2 2021.

UBA PLC

United Bank for Nigeria Plc lost N5.13 billion as its market capitalization depreciated from N265.05 billion to N259.92 billion, due to the decrease in its share price from N7.75 to N7.60, reflecting a decline of 1.9%.

UBA Plc, during the week, traded a total of 53,887,323 units valued at N409.26 million at the end of the trading day.

In comparison, the bank’s share volume appreciated by 59.96%, from 33.69 million traded last week.

UBA Plc released its half-year financials revealing a 33.4% growth in profit before tax which rose to N76.2 billion, up from N57.1 billion in the same period of 2020. In addition, the company’s gross earnings appreciated by 5.0% to N316 billion from N300.6 billion, while total assets grew to N8.3 trillion from N7.7 trillion.

GT Holding Company Plc

GTCO Plc lost a total of N23.54 billion after market capitalization depreciated to N796.11 billion from N819.66 at the end of the week’s trading session.

The decline can be attributed to the decrease in the share price, from N27.85 traded at the end of last week, to N27.05 at the close of business, reflecting a depreciation of 2.9%.

During the trading week, investors traded a total of 47,931,179 units of the bank’s shares valued at N1.31 billion.

In contrast with the volume traded last week, share volume for this week increased by 92.88% from 24.85 million.

The Group reported a decline of 15.2% in profit before tax from N109.7 billion recorded in the corresponding period of June 2020 to N93.1 billion in the current period. Also, post-tax profit depreciated by 15.76% from N94.27 billion in 2020, to N79.41 in the current period.

Access Bank Plc

Access Bank Plc’s share price remained unchanged at the end of the week as the market capitalization stood at N327.02 billion to close the week at N9.20 per share.

At the end of the week, investors had traded a total of 236,306,579 units of the bank’s shares valued at N2.22 billion. The total volume traded for the week grew by 164.77%, from a total of 89.25 million traded in the previous week. The bank traded the highest number of shares in value amongst the FUGAZ, trading its highest on Tuesday.

Access Bank Plc released its Q2 financial result for the year which recorded an improvement in gross earnings by 14% to N450.6 billion, while profit rose by 42.4%, surging from N61.03 billion in June 2020 to N86.94 billion in half-year, 2021.

The bank has approved the payment of interim dividend, to the tune of N0.30 to existing shareholders on the 29th of September, 2021.

Zenith Bank Plc

Zenith Bank Plc lost N3.14 billion after its market capitalization depreciated to N753.52 billion from N756.66 billion at the end of the week. This decline can be attributed to the 0.4% decrease in its share price from N24.10 traded at the end of last week, to N24.00 at the end of this week.

Hence, a total of 48,512,186 units of the bank’s shares were traded during the week, valued at N1.17 billion. The total volume, in comparison with the previous week, depreciated by 14.19%, from 56.53 million units traded last week.

The bank released their second quarter result which revealed that net Interest income for the period increased by 1.61%. However, post-tax profit for the period reported a slight growth of 2.21% from N103.83 billion in Q2 2020 to N106.12 billion in Q2 2021.

Zenith Bank has approved an interim dividend of N0.30kb to be paid to shareholders on the 20th of September, 2021.

What you should know

The Nigerian Exchange Limited (NGX) closed negative week-on-week as ASI depreciated by 0.86% to close at 38,921.78.

The FUGAZ banks make up over 70% of the NSE Banking sector index, hence, strongly influence the growth or otherwise of the index.

The NGX banking Index closed negative to decrease by 0.96% and closed at 373.16.