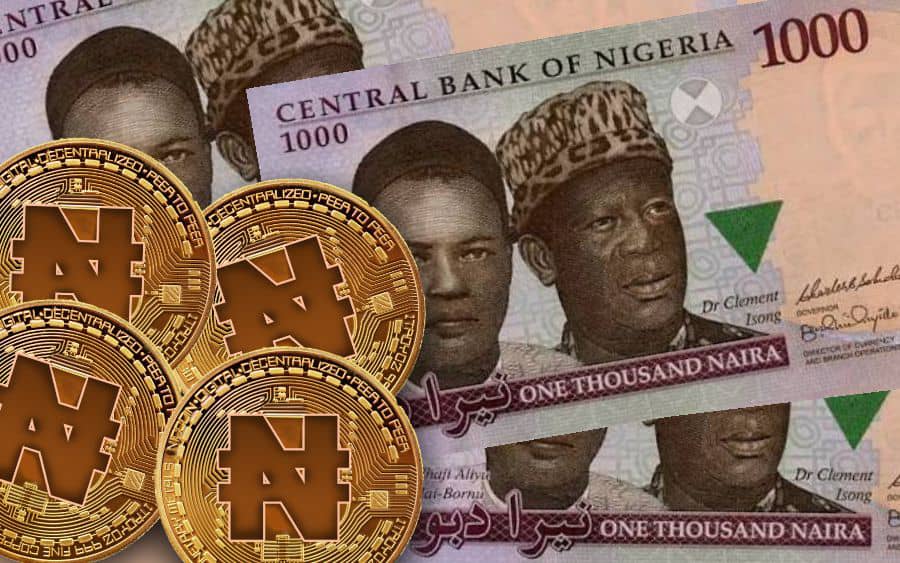

The Central Bank of Nigeria (CBN) has intensified its efforts towards the introduction of a digital currency as it has announced the formal engagement of the global fintech company, Bitt Inc., as the technical partner for its proposed digital currency, also known as e-Naira.

The CBN which had been conducting research on the digital currency for the bank since 2017, said that it is expected to be launched later this year.

According to a statement signed by CBN’s Director Corporate Communications, Osita Nwanisobi, this disclosure was made by the Governor of CBN, Godwin Emefiele, in Abuja, who listed the benefits of the digital currency to include macro-management and growth, financial inclusion, cross border trade facilitation, monetary policy effectiveness, revenue collection, faster remittances inflow, improved payment efficiency and so on.

Project Giant, as the Nigerian Central Bank Digital Currency (CBDC) pilot is known, has been a long and thorough process for the CBN, with the bank’s decision to digitize the naira, following extensive research and explorations. Given the significant explosion in the use of digital payments and the rise in the digital economy, the CBN’s decision follows an unmistakable global trend in which over 85% of Central Banks are now considering adopting digital currencies in their countries.

Nwanisobi, in the statement, said that the selection of Bitt Inc. from among highly competitive bidders was based on the company’s technical competence, efficiency, platform security, interoperability, and implementation experience.

He said, “In choosing Bitt Inc. the CBN will rely on the company’s tested and proven digital currency experience, which is already in circulation in several Eastern Caribbean countries. Bitt Inc. was key to the development and successful launch of the Central Bank Digital Currency (CBDC) pilot of the Eastern Caribbean Central Bank (ECCB) in April 2021.”

What you should know

The CBN had earlier in July announced that its digital currency will be unveiled in October 2021, with the apex bank saying that the digital currency would be treated as a critical national infrastructure to protect it from operational and cyber-security risks. Emefiele said that transactions will be cheaper and more efficient.

However, the International Monetary Fund (IMF) had cautioned that countries seeking to adopt digital currency should be wary of its disadvantages.

Meanwhile, just like the CBN had warned previously, the IMF sued for caution by countries seeking to use crypto-assets as their national currency. The multilateral institution reiterated that the demerits of adopting crypto-assets as national currency outweighed its merits.