Nigeria recorded a major progress with the Petroleum Industry Bill (PIB) on Monday as President Muhammadu Buhari signed it into law exactly 48 days after it was passed by both arms of the National Assembly.

This is another historic feat recorded by the Buhari-led administration. Also, one must not lose sight of the major role played by Abba Kyari, the late Chief of Staff to the President, who contributed significantly towards shaping the new oil and gas framework. Kyari was close to launching the long-delayed initiatives to restructure the notoriously underperforming oil and gas sector, a feat that was even acknowledged by the Financial Times of London.

Indeed, the Petroleum Industry Act provides legal, governance, regulatory and fiscal framework for the Nigerian petroleum industry, the development of host communities, and related matters. With this, the oil and gas industry now has a legal, governance, regulatory and fiscal framework.

Special Adviser to the President on Media, Mr. Femi Adesina, said President Buhari, working from home in five days quarantine as required by the Presidential Steering Committee on COVID-19 after returning from London on Friday, signed the bill in his determination to fulfill his constitutional duty. But the ceremonial part of the new legislation will be done on Wednesday, after the days of mandatory isolation would have been fulfilled.

Even though the legislation has been in the works since the tenure of former President Olusegun Obasanjo, successive sessions of the National Assembly were not able to pass it because of vested interests by stakeholders in the oil and gas sector.

The legislation is designed to reform the Nigerian oil and gas industry. The central aim of the law is to foster sustainable development in Nigeria’s oil and gas industry.

The law started as an omnibus bill and was later divided into four separate bills before it was reintroduced in 2020 as a consolidated bill.

During the Senate hearing last month, the bill passed a third reading after Mohammed Sabo, chairman of the joint committee petroleum (upstream and downstream) and gas, presented a report and its clauses were put to voice vote.

Sabo said the legislation is aimed at “promoting transparency, good governance and accountability in the oil and gas sector.”

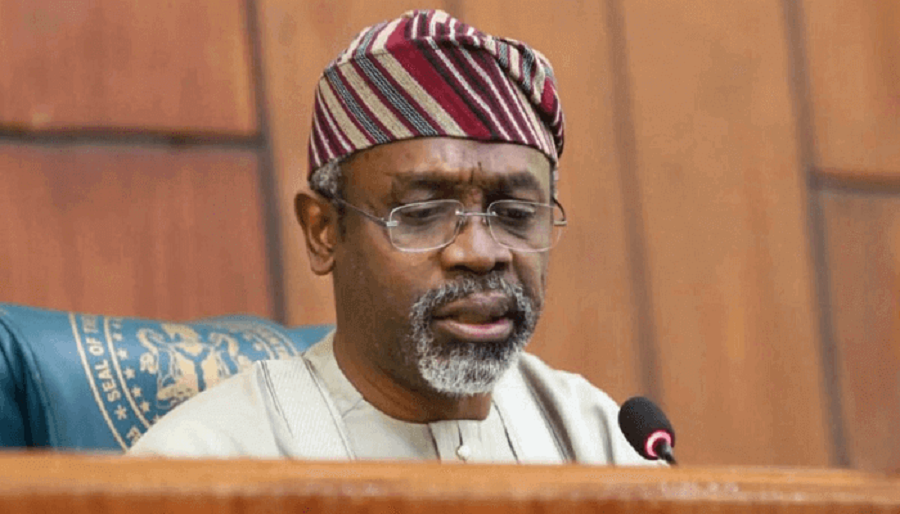

On the other hand, at the House of Representatives, the bill was passed after Mohammed Monguno, chairman of the ad hoc committee on the PIB, presented the report and the lawmakers voted on 319 clauses of the bill. Monguno said that by passing the bill, the ninth house would have succeeded in enacting important legislation.

Indeed, the new legislation is expected to bring governance issues in the oil and gas sector in tandem with international best practices. It is believed that the absence of the legislation greatly stalled the growth of the petroleum industry and its unstable environment made international investors lose confidence in the nation’s oil and gas industry.

That is why the bill over the years attracted the attention of stakeholders and investors in the country’s oil and gas industry because of the significant impact the sector has on Nigeria’s economy.

More so, while the oil and gas sector contributes about 10 per cent to the country’s Gross Domestic Product, it contributes about 90 per cent of the foreign exchange earnings; 60 per cent of total income and to a large extent is a major barometer to determine the health of the country. That is, any adverse change in the industry will have a major impact on government finances as was the case last year when the price of crude oil dropped significantly.

Clearly, one of those that has been at the forefront of transforming the oil and gas industry, and who also contributed significantly to the new structure in the sector is Group Managing Director of the Nigerian National Petroleum Corporation (NNPC) Mallam Mele Kyari. Since his appointment, Kyari has remained focused on ensuring the passage of this very important legislation by rallying all the relevant stakeholders.

The NNPC boss has been vocal and a major advocate on the need for the lawmakers to pass the bill which has been largely described as a game-changer for the country’s oil and gas industry. For instance, in addressing the National Assembly’s House of Representatives’ Petroleum Resources (Upstream) Committee, Kyari had urged swift passage of the PIB in order to attract capital, strengthen cost recovery and ensure decent returns on investment.

Kyari had also called for the new law to enshrine a clear separation of roles between industry operators and regulators, and questioned the over-hasty manner in which local content had been pursued in the oil and gas sector.

“You cannot but rely on foreign investment if you want to grow; we have seen the cost of local content shoot up in the last 10 years, magnifying the cost of doing business in Nigeria,” Kyari said recently.

He had also at a separate meeting stressed the need for the lawmakers to quickly move from the unstable situation the country was previously on the matter, to a stable one, saying the only way out was the passage of the PIB.

According to Kyari, foreign capital was needed in the upstream sector and the only way to attract it was to have stable laws and a friendly business environment that could guarantee cost recovery and a decent return on investment for investors.

He had disclosed that the uncertainty in the sector created by the long delay in the passage of the PIB has led to a number of divestments from the country in the recent past.

The GMD had also stated that the drive by the management of NNPC to entrench the culture of transparency in the corporation had improved its business fortunes and creditworthiness as lenders are now willing to grant credit to it.

Kyari had consistently maintained that for Nigeria to make the most of the industry, the passage of the PIB was imperative as it has the prospect to guarantee a robust fiscal regime, protect the environment, ensure development of host communities, ensure proper alignment with other sectors and encourage investors to expand their investments in Nigeria.

“Getting the petroleum legislation passed is the right thing to do because investors will not invest their money if they are not sure of how they are going to get their investment back and what benefits can they get from their investment and how stable the investment climate is.

“We must resolve the petroleum legislation and am aware that this administration is working assiduously to get the law passed within the shortest frame of time,” Kyari had said at a different forum.

Kyari’s passion to the PIB’s passage ties up with his desire to bequeath to Nigerians a vibrant oil and gas industry as contained in the transformative agenda he unveiled when he assumed office. That was his Transparency, Accountability and Performance Excellence (TAPE) agenda, a five-step strategic roadmap.

According to Kyari, ensuring energy security is one of the cardinal agenda of the President Muhammadu Buhari administration. Furthermore, he said closely related to energy security was the rehabilitation and expansion of the local refining capacity.

To global professional services firm, KPMG, if Nigeria must achieve its ambition of 40 billion barrels of oil in reserves and four million barrels of oil per day, it needs to attract new investments into the sector.

This task, it noted, has even become more daunting in the light of the various challenges facing the industry, especially with respect to the renewed focus on renewables and energy transition.

“The oil in the ground is of no use to the country if it cannot monetise it.

“Therefore, the PIB must lead to a massive transformation of the industry and succeed in attracting the desired investment required to reposition the industry. Otherwise, Nigeria’s production will continue to decline significantly.

“Hopefully, the provisions of the PIB will be enough to stimulate the desired investment though it has not addressed the issue of energy transition from fossil fuel to clean energy. The key question is whether those investments would pay off or would they be a risky bet?”

Therefore, it is expected that the signing of this new law would unlock enormous investment opportunities in the sector, attract much-needed investments as well as significantly raise the country’s oil revenue.

It is definitely a new dawn for Nigeria’s oil sector as increased orderliness and transparency are expected to turn around for good.

James Ume writes from Abuja