On Wednesday, the Dow Jones Industrial Average climbed to a new all-time high amid a lower-than-expected rise in inflation rate. Meanwhile, the Nasdaq continued to fall as tech stocks lagged.

The US Labour Department said on Wednesday that the consumer price index increased 5.4% from a year ago in July, matching the highest increase since August 2008.

CPI rose 0.5% month over month, according to the government, matching a consensus expectation from economists polled by Dow Jones.

However, investors were focused on the core rate of inflation, which could indicate that inflation will remain moderate and the economy will continue to grow. Last month’s CPI, excluding energy and food costs increased by 0.3%, slightly less than the 0.4% increase forecast.

On a year-over-year basis, core prices increased by 4.3%. Used car prices, which have been watched by investors as a sign of out-of-control inflation, rose just 0.2% in July after surging more than 10% the month before.

The inflation result backed up the Federal Reserve’s assessment that elevated pricing pressures are only temporary while the economy recovers from the pandemic-caused recession.

Quick market analysis

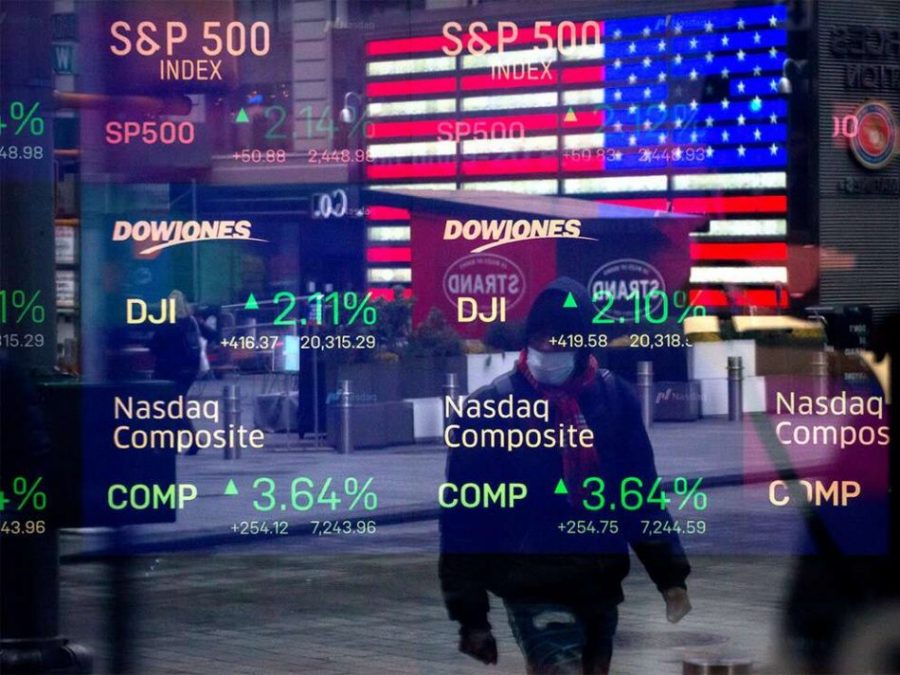

The Nasdaq dropped 0.2%, while the S&P 500 rose 0.2% to a new high of 4,449.44 base points. The Dow Jones industrials led the way higher, rising 0.6% to a new high of 35,492.66 base points. On the Nasdaq and the NYSE, volume was lower than it was on Tuesday.

The stock market indexes were mixed on Wednesday. Tech stocks were hampered, and they continued to fall. Meanwhile, blue-chip stocks continued to rise when the Labour Department reported that the consumer price index increased 0.5% month over month in July.

Caterpillar (CAT), Walgreens (WBA), and Home Depot (HD) were among the Dow Jones’ top performers on Wednesday (HD). Also, Walmart (WMT) saw some increase by 0.9% at the end of Wednesday’s trading session.

Caterpillar rose 3.5%, maintaining a five-day winning streak, as the shares have climbed over 6% so far this week. Infrastructure-related stocks also got increased due to the Senate’s approval of a $1 trillion infrastructure spending package on Tuesday.