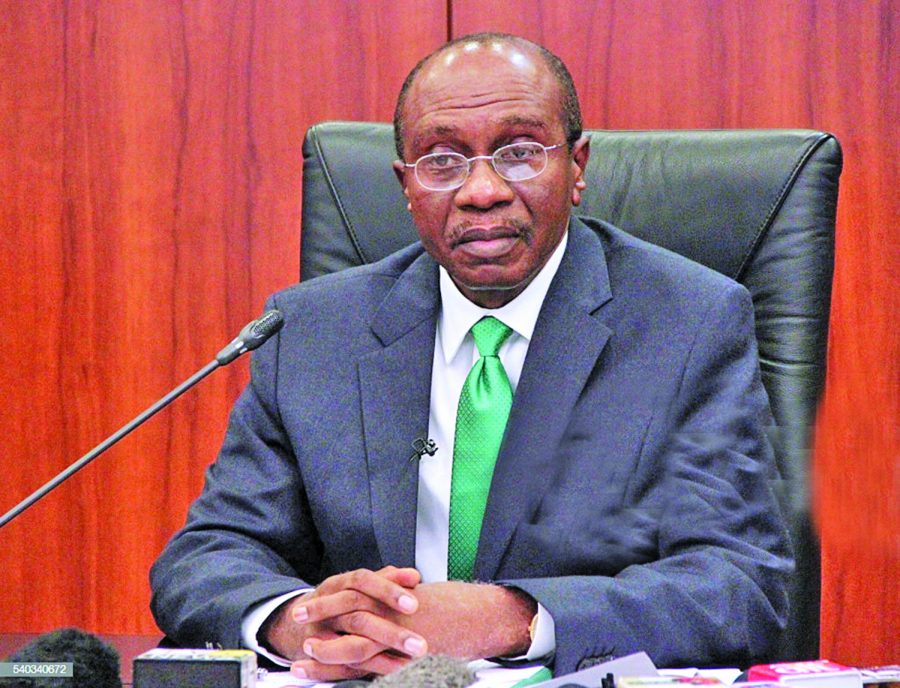

Nigeria’s central bank governor, Godwin Emefiele has informed the public that the central bank would discontinue the sale of dollars to Bureau De Change (BDC) and would only supply forex to banks.

This was disclosed at the Monetary Policy Committee (MPC) meeting on Tuesday, 27th July 2021.

Emefiele informed the public that this action was taken as a result of the apex bank’s misgivens about BDC operators and their disregard for CBN exchange rate policies.

The governor expressed his distaste for the wanton greed displayed by BDC operators as they sought to make abnormal gains, putting the financial system at risk in the process.

Some of the shortcomings noticed by the CBN was the huge rent-seeking by operators who are only interested in wide margins, dollarization of the Nigerian economy, subversion of the CBN’s cashless policy, prevailing ownership of several BDC by the same owners in order to get multiple FX and ‘regrettably,’ international organisation and embassy patronage of illegal forex dealers.

These were the reasons that led to the decision made by the CBN. The MPC expressed confidence that banks are doing the right thing in managing the country’s economic situation by increasing access to credit to the real sectors of the economy.

The governor threatened to crack down on banks still dealing illegally with unauthorized forex traders and urged the international organisations to participate in the I&E window.

Long overdue development.

A situation where a country has two different FOREX rates is not acceptable. The CBN has tolerated this for too long that the BDC operators owned by wealthy connected to politicians have so much dollars in their ecosystem that they can challenge CBN policy directive and influence economic activities on major scale. No matter what the official rate, the BDC parallel market that the banks themselves used to profiteer from the FOREX trade can charge higher at a premium. The CBN should go a step further, all BDC should be given one month to sell their FOREX to banks or lose their license or get discounted value after that date. This will compel those hoarding dollars to push them out as it would be detrimental to stash them.

Fully agreed Ufuoma. There’s a cartel working to keep the disparity at around 20% which clearly shows that the BDCs (Aided by bank officials) are a large part of the problem and unless something significant is done, it will never stop. They will just keep shifting the goalpost to keep the 20% differential.

What is CBN saying? Have they not been supplying $ to the Banks before? The Banks are complicity in this round tripping game. Now with Banks as the sole seller, they will sell undercover (clean their books) to BDC in their network, and Naira to Dollar might hit 1000/$ by Dec 2021. CBN does not have the guts to sanctions erring banks, if not, why going the whole hog back to a policy tried in 2016 that failed woefully? Methinks that there are pecuniary interest here or we are bereft of ideas that can take us out of this economic doldrums.

If not in Nigeria, there is no country where forex is diverted to black markets in the name of BDE and resell to the needing public. The commercial banks have always been the authorized dealers who sells to the needing public. If not for PDP government who introduced BDE in Nigeria for their selfish and fraudulent purposes. It better they remain black markets than the glorified name they were given by PDP