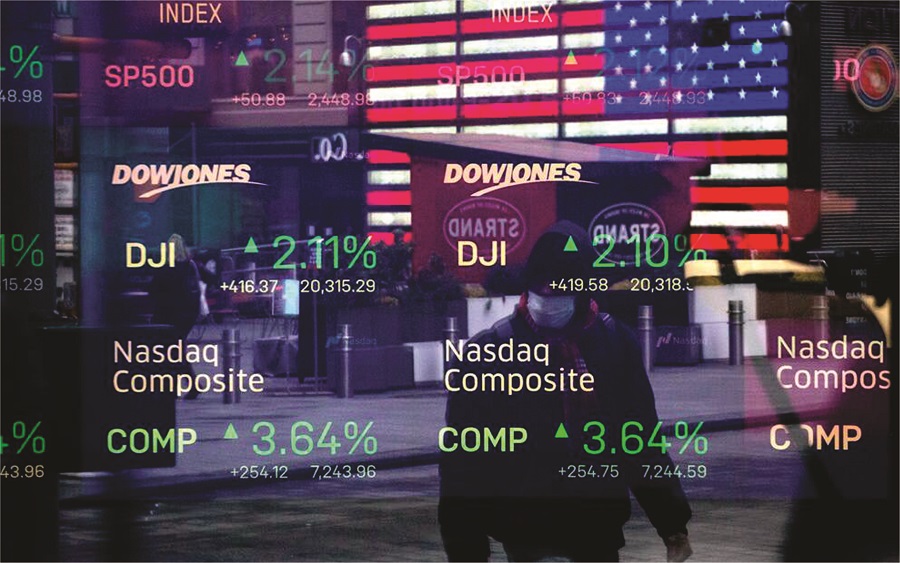

After a massive sell-off on Monday that cost the Dow about 900 points, the Dow Jones Industrial Average rebounded well in Tuesday’s market. The S&P 500 and the Nasdaq composite both recovered some, but not all, of their Monday losses.

On Monday, a return of Covid-19 cases in many heavily vaccinated countries resulted in significant losses. However, the market recovered a large portion of those losses on Tuesday. After falling on Monday, the Dow rose over it on Tuesday.

Bitcoin fell below $30,000, a critical long-term support level, potentially implying even lower cryptocurrency prices in the near future. However, Bitcoin saw a recovery as the price soared to $30,696.20 up 3.35% at the time of writing this article placing the market cap at $576.25 billion.

Financials and industrials outperformed the other 11 S&P 500 sectors. Consumer staples, on the other hand, trailed the market, closing practically unchanged.

The 10-year Treasury yield, which has remained a key number throughout the economic recovery, fell to 1.13% early Tuesday. In afternoon trade, money flowed from bonds to equities, bringing the yield back to 1.21%. The bond market has been fluctuating between a recent high of 1.76% in March and lows of approximately 1.13%. The bond market is being influenced by inflation and concerns about Covid.

Quick market analysis

The Nasdaq ended the day with a 1.6% rise. Meanwhile, the S&P 500 index increased by 1.5%. The Dow Jones industrials gained 549 points or 1.6%. The small-cap Russell 2000 index, which led the rally, increased by 3%. According to early data, volume on the NYSE and Nasdaq was lower than it was at the closing on Monday.

American Express (AXP), Honeywell (HON), and Boeing (BA) were among the Dow Jones’ top performers on Tuesday, each gaining more than 3%. Apple (AAPL), the tech behemoth, increased by over 3%, The stock broke a three-day losing streak. Last week, reaching an all-time high of $150.

Goldman Sachs (GS) and Walt Disney (DIS) both saw their stock prices rise by more than 2%. Goldman Sachs is constructing a fresh flat foundation with a buy point of 393.36. The stock is 7% away from the buy zone, but it is still trading below the 50-day moving average.

Meanwhile, Disney’s stock is still 12% away from its nearest purchase mark of 203.12. The stock market is also trading just below crucial support levels.

IBM (IBM) led the Dow Jones earlier on Tuesday after exceeding analysts’ expectations for Q2 earnings. However, after hitting resistance at its 50-day moving average, IBM’s 5% advance collapsed to only 1.8%.

DocuSign (DOCU) outpaced the market with a gain of almost 4%. Last week, the stock found support at the 21-day exponential moving average, propelling shares back into the $290.33.