The importance of having a budget cannot be overemphasized. Every day, thousands of people face financial difficulties that make saving a fraction of their income appear impractical. This is why tech companies have created budgeting apps that simplify the process and make it easy for users to save while also monitoring their spending on the go.

Why do you need budgeting apps?

Budgeting apps offer a range of features that can improve your finances.

- They help you figure out your long-term goals and how to work towards them.

- They help you keep track of your progress and also ensure that you do not spend money you don’t have.

- They help you prepare in case of an emergency.

- They help you assess your spending habits. You may realize that you’re spending money on things you don’t actually need.

Here are some free money management apps that can help you control your spending.

Intuit Mint

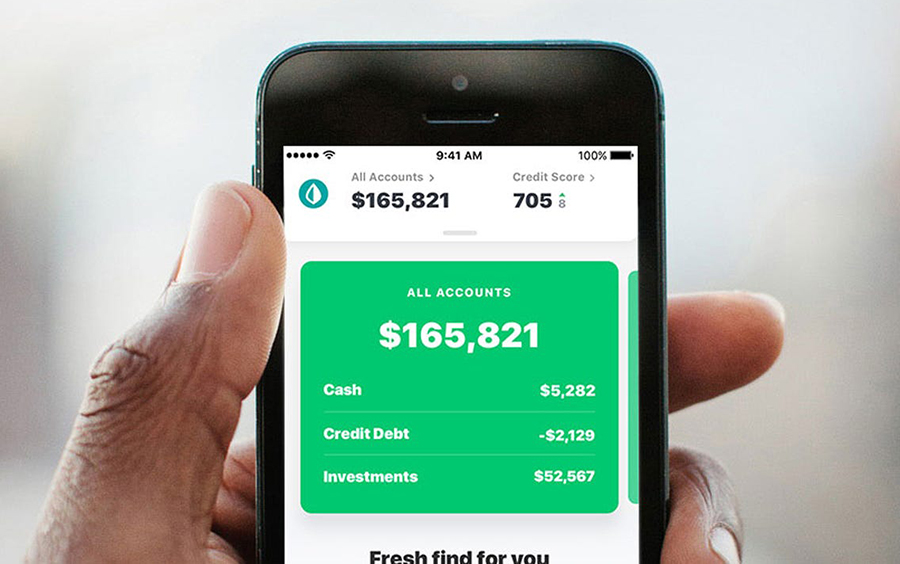

Intuit Mint, also known as Mint, is the money management app that brings together all of your finances. From balances and budgets to financial goals, the platform provides all your money essentials in one place. Mint gives you a more complete picture of your financial health by bringing everything together: account balances, monthly expenses, spending, your free credit score, net worth, and more. You can easily connect your cash, cards, loans, investments, and more to the app. Intuit Mint is available in the Apple store.

Features

- Mint helps track your transactions, budgets, expenses, and subscriptions.

- Mint helps you reach your goals with personalized insights, custom budgets, spend tracking, and subscription monitoring—all for free.

- You can easily see your monthly bills, set goals, and build stronger financial habits.

- The app alerts you when you’re close to going over budget. It also notifies you when subscription prices go up and uncovers old ones you don’t use.

Inflow finance

Inflow is a personal finance management app that allows you to link all your bank accounts in one place, track your spending across expense categories, and create budgets to help you stay on top of your financial game. Inflow is available on the Web, Google Play Store, and Apple App Store.

Features

- Smart Budget: Create budgets for your expenses on Inflow to see where your money is going.

- Intelligent Categorization: Machine Learning models automatically sort your transactions into expense categories, from Transport to Airtime and Data to Food and Entertainment and several more, so you don’t have to do any work.

- Create Custom Expense Categories: Need to know exactly how much you’re spending on car repairs monthly? Or you want to create a budget for your subscriptions? Inflow lets you create custom expense categories.

- Insights to manage spending: Inflow lets you know when you are spending too much and over your budget.

Sparkle

Sparkle is a digital ecosystem providing financial, lifestyle, and business support services to Nigerians around the world. Licensed by the Central Bank of Nigeria (CBN), Sparkle is what most people would refer to as a digital bank.

Features

- Manage your money: Get real-time instant notifications for your transactions and also view how much you spend daily, weekly, and monthly through a simple display showing a breakdown of payments by category, such as transport, utilities, and food, all in-app.

- Save for things that matter to you. Using Sparkle Stash, you can save for different goals at the same time. You can save for a targeted amount or keep your savings open.

- You can also do percentage savings, where you determine what percentage of your account balance will be going to your savings every day, week, or month.

PiggyVest

PiggyVest is the largest single online savings & investment platform in Nigeria. The platform helps over 2 million customers achieve their financial goals by helping them save and invest with ease.

Features

- With automated savings, you can save towards multiple goals and meet all your savings goals.

- You can set multiple savings targets like saving for rent, a car, vacation, or a new laptop.

- Save automatically or on your terms – set daily, weekly, or monthly savings. You can also save as you go.

Why budgeting apps matter

Budgeting apps play a vital role in helping you manage your money. They help to improve your spending habits with customized goals and personalized insights on your spendings.

great article

Piggyvest is not a budgeting app please. I am not aware of any budgeting tool on the app.

As far as I know Mint is an app created by the same company as Quickbooks, but the difference is that it’s for personal budget tracking. A great app, btw. And how about business expenses applications?