The world’s most valuable crypto was all fired up, triggering the crypto market to gain over $200 billion in value amid strong reports that powerful hedge fund manager and billionaire, Ray Dalio, revealed some bullish bias on Bitcoin.

The billionaire gave his thoughts on why the flagship crypto asset, is gaining mainstream attention:

“Bitcoin has proven itself over the last 10 years, it hasn’t been hacked. It’s by and large, therefore, worked on an operational basis. It has built a significant following. It is an alternative, in a sense, store hold of wealth. It’s like digital cash. And those are the pluses.”

READ: Bitcoin, Ethereum, others crash as China announces fierce crackdown on cryptos

Such positivity boosted buying pressure in the crypto market as its market value stood at $1.63 trillion, a 12.97% increase over the last day. The flagship crypto was trading comfortably at $38,246.20 with its daily gains nearing 9%.

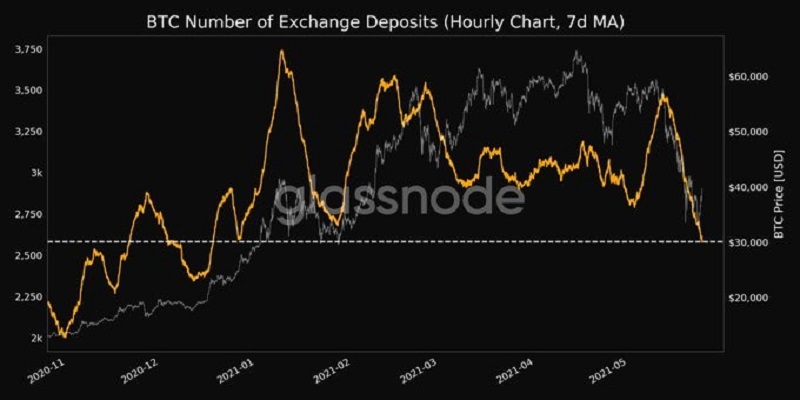

Investors in the past few hours increased their buying pressure at record levels, with the number of Bitcoins on Crypto exchanges plummeting, thereby suggesting that there are more holders than sellers.

READ: Crypto-Tsunami as over 247,000 investors lose $1.7 billion

Adding credence to this bias is data retrieved from Glassnode showing the Number of Bitcoin in Crypto Exchange Deposits (7d MA) just reached a 5-month low of 2,581.643.

A previous 5-month low of 2,596.435 was observed on 26 December 2020.

However, in a recent interview with the editor-in-chief of Yahoo Finance, the founder of the world’s biggest hedge fund, Bridgewater Associates, stated that Bitcoin still faces headwinds with the U.S. banning Bitcoin just as it did with gold ownership 9 decades ago.

READ: British hedge fund earns £540 million from selling half of its Bitcoin holdings

“They don’t want other monies to be operating or competing because things can get out of control. So, I think that it would be very likely that you will have it, under a certain set of circumstances, outlawed the way gold was outlawed.”

What you should know

Bridgewater Associates is the world’s biggest hedge fund, founded in 1975. The firm serves institutional investors that include foundations, foreign governments, pension funds, endowments, and central banks.

Its major strategy includes the global macro investing style based on economic macros such as currency exchange rates, inflation, and gross domestic product.

Ray Dalio has been the man behind the powerful hedge fund. He has grown one of the world’s biggest hedge funds, managing about $150 billion in assets.