Mutual Fund is an investment vehicle made up of a pool of funds collected from numerous investors to invest in securities such as stocks, bonds, money market instruments, and similar instruments.

They are particularly good for retail investors as it gives them access to professionally managed, diversified portfolios of equities, bonds, and other securities.

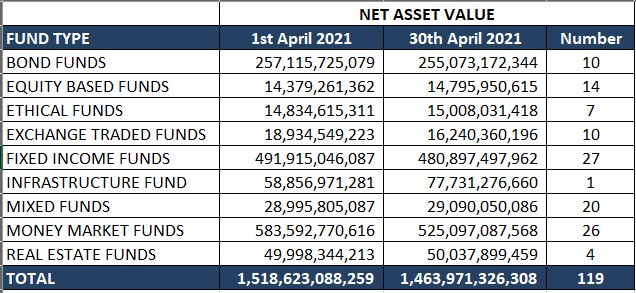

Mutual Funds in Nigeria recorded a slightly bullish performance in the month of April 2021, as 53.8% of the funds appreciated compared to 21.2% recorded in the previous month. However, the net asset value declined by N54.65 billion (3.6%) from N1.52 trillion as of 1st April 2021 to N1.46 trillion as of 30th April 2021.

- As of 30th April 2021, there were 119 funds listed on the Securities and Exchange Commission, most of which were fixed-income funds (27) followed by money market funds with 26. The least on the list was the Infrastructure fund (1).

- On average, the entire 119 funds recorded an aggregate gain of 0.38% in the month of April 2021.

- Performance by fund type shows that the ethical fund grew by 1.77% on average followed by equity-based funds with a 1.58% yield on investment. The exchange-traded fund recorded a decline of 0.39% in the review month.

Nairametrics tracked the performance of these mutual funds by comparing the fund prices as of 1st April 2021 with the fund prices as of 30th of April 2021.

Below were the top-performing mutual funds in April 2021. We also highlighted their performance in terms of changes in net asset value and included profiles of the funds as described on their websites.

Stanbic IBTC Nigerian Equity Fund – Stanbic IBTC (Equity Based Fund)

Stanbic IBTC Nigerian Equity Fund (SINEF) is an open-ended fund, which was launched in February 1997 with the aim of achieving long-term capital appreciation by investing a minimum of 70% of the portfolio in listed equities and a maximum of 30% in high quality fixed income securities.

The fund has a 91 days minimum holding period, with a minimum investment amount of N5,000.

April 1st, 2021

Fund price – N9,888.31

April 30th, 2021

Fund Price – N10,242.49

Return – 3.58%

Ranking: Fifth

Commentary: The fund managed by Stanbic IBTC Asset Management grew by 3.58% from N9,888.31 recorded at the beginning of the month to close at N10,242.49, while the net asset value increased by 3.58% to close at N6.29 billion. This is the second fund on the list, which is managed by Stanbic IBTC Asset Management.

Stanbic IBTC Imaan Fund – Stanbic IBTC (Ethical Fund)

Stanbic IBTC Imaan Fund (SIMAAN) was launched in October 2013 with the aim of achieving long–term capital appreciation by investing a minimum of 70% of the portfolio in Shariah-compliant equities and a maximum of 30% in other Shariah-compliant assets such as Sukuks, with the approval of an Advisory Committee of Experts.

April 1st, 2021

Fund price – N210.58

April 30th, 2021

Fund Price – N218.33

Return – 3.68%

Ranking: Fourth

Commentary: The Stanbic IBTC Imaan Fund is the second ethical fund in the list of top performers in the month of April, with a 3.68% return on investment in April 2021. It also grew its net asset value by 8.68% from N235.5 million recorded as of 1st April 2021 to N255.9 million at the end of the month.

ARM Ethical Fund – Asset & Resources Mgt. (Ethical Funds)

The ARM Ethical Fund is a fund suitable for Islamic investors who want long-term capital growth by investing strictly according to the principles of Islamic finance and ethical values. The Fund invests only in investments screened by a Shari’ah Advisory Board.

It invests in equities, real estates, and other investments that do not involve interest-bearing transactions.

April 1st, 2021

Fund price – N36.55

April 30th, 2021

Fund Price – N37.97

Return – 3.89%

Ranking: Third

Commentary: The ARM Ethical Fund has posted impressive growth so far in the year 2021, it was the fifth-best performing fund in the first quarter of the year, and now, the third on the list in April 2021. The unit price appreciated by 3.89% while the net assets value increased by 8.1% from N370.27 million as of 1st April 2021 to N400.27 million as of 30th April 2021.

Nova Dollar Fixed Income Fund – Novambi Asset Management (Fixed Income Fund)

Nova USD Fixed income fund is an actively managed open-ended unit trust scheme managed by Novambl Asset Management. The fund has an asset allocation range target of 0% – 80% on sovereign Eurobonds, 0% – 80% on corporate Eurobonds, 0% – 50% on money market instruments, and finally 0% – 5% on Cash.

The issue price is $100 per unit and the minimum initial investment for the offer is 5 units of the funds, while additional/subsequent investments will be issued in multiples of 5 units and payable in full, upon subscription.

April 1st, 2021

Fund price – N395.38

April 30th, 2021

Fund Price – N410.9

Return – 3.93%

Ranking: Second

Commentary: Nova dollar fixed-income fund, managed by Novambl Asset Management Ltd, recorded unit price appreciation of 3.93% from N395.38 recorded at the beginning of April 2021 to N410.9 by the end of the month. The fund’s net asset value also increased by 3.93% from N103.39 million as of 1st April 2021 to N107.4 million at end of April 2021.

The fund had also ranked third amongst the best performing mutual funds in February 2021, as it posted 4.23% gain in the month.

NewGold ETF – NewGold Managers Ltd (Exchange-Traded Fund)

The NewGold Exchange Traded Fund (NewGold) is an ETF listed on the Nigerian Stock Exchange in December 2011. NewGold tracks the price of gold and offers institutional and retail investors the opportunity to invest in a listed instrument (structured as a debenture) that is fully backed by gold bullion.

The fund is managed by NewGold Managers Limited while the sponsoring broker is Vetiva Capital Management Limited.

April 1st, 2021

Fund price – N8,600

April 30th, 2021

Fund Price – N9,000

Return – 4.65%

Ranking: First

Commentary: Gold prices posted higher gains during the period, hence resulting in a 4.65% increase in the price of the ETF fund to stand at N9,000 as of 30th April 2021. The net asset value, however, declined by 22% to stand at N9.76 billion.

The boost in New Gold could be attributed to investors who found dual-listed companies as a means of repatriating dollars out of the country. This is done by buying shares locally and then selling on a foreign stock exchange so as to get their money out.

Bubbling under…

The following Funds make up the rest of the top 10 on our list:

Vantage Equity Income Fund – Investment One Funds Management (Equity-Based Fund)

Return – 3.33%

ARM Aggressive Growth Fund – Asset & Resources Mgt. (Equity-Based Fund)

Return – 3.15%

Vantage Balanced Fund – Investment One Funds Management (Mixed Fund)

Return – 2.92%

Lotus Halal Investment Fund – Lotus Capital Limited (Ethical Fund)

Return – 2.92%

PACAM Balanced Fund – PAC Asset Management Limited (Mixed Fund)

Return – 2.83%

I am desirous of having a reputable broker or company that can handle my investment. Scam free. I am happy seeing records proper ly put together, this way to intimidate customers.