In an attempt to reduce the demand for foreign stocks in Nigeria, the Securities and Exchange Commission (SEC) is proposing tighter and stricter regulatory oversight and requirements for foreign stockbrokers in the country.

In an interview monitored by Nairametrics, the executive commissioner for operations of the SEC, Dayo Obisan revealed the commission was planning to actively monitor the local facilitators of foreign stocks.

“At least 400,000 Nigerians have invested in foreign stocks through brokers in the past 18 months,” Obisan said, with Nigerians actively trading or holding foreign equities now exceeding those investing in the local market and about 70% of these participants being less than 40 years of age.

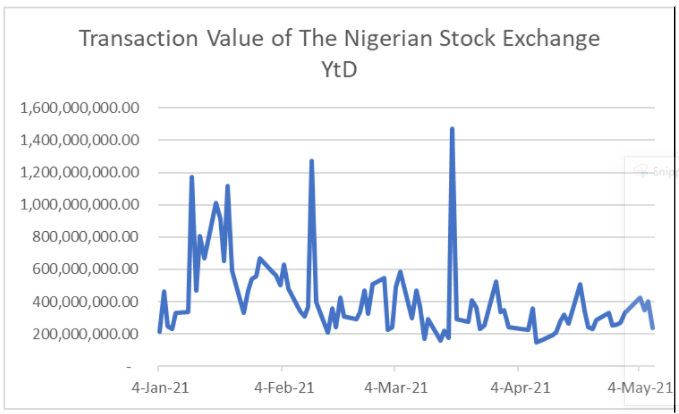

This is despite the Nigerian Stock Exchange being dubbed the best performing last year after it gained 50% YTD. Stocks are however down 5% YTD.

In contrast, the S&P 500 Index is currently trading 14.50% YTD, creating a new all-time high.

Also, the value of transactions is down YTD as demand shifts from the Nigerian stock exchange market to the Cryptocurrency and foreign stock market.

“There is an increasing interest among the younger population and this is of concern to the commission primarily because it creates an avenue for exploitation,” Obisan said.

The SEC intends to license firms offering foreign stocks under a “digital sub-broker” regulation, which Obisan says should provide a form of clarity to their activities.

He also stated the requirement will ensure “regulatory responsibilities in on-boarding clients, custody of assets, and compliance with reporting requirements are met”.