Some refer to him as a “silent billionaire”, and this is not a wrong statement about the man who has stakes in a number of airports around the world, including Gatwick Airport, the second-busiest airport by total passenger traffic in the UK and the ninth-busiest in Europe.

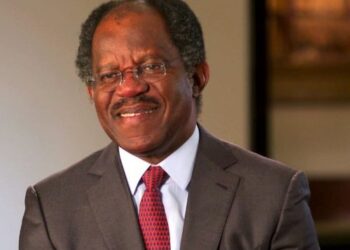

Adebayo Ogunlesi, a Nigerian who started out as a lawyer and later an investment banker, has spread his wings around the globe and is now currently the Chairman and Managing Partner at the private equity firm Global Infrastructure Partners (GIP). Though his name does not ring a bell like Aliko Dangote, Otedola and Mike Adenuga, Ogunlesi is equally a billionaire in his own right.

Early years

Adebayo hails from Makun, Sagamu, Ogun State, and was born on the 20th of December 1953 to the family of Dr Theophilus O. Ogunlesi, who later became Nigeria’s first Professor of Medicine in Ibadan.

He had his primary education there in Sagamu and then attended the prestigious King’s College, Lagos before travelling to England where he bagged a B.A. with first-class honours in Philosophy, Politics and Economics from Oxford University.

He went on to pursue two degrees concurrently at Harvard, and in 1979, received a J.D. magna cum laude from Harvard Law School and an M.B.A. from the Harvard Business School.

He worked as a law clerk to Associate Justice Thurgood Marshall of the United States Supreme Court from 1980 to 1981, and as an attorney at Cravath, Swaine & Moore – a law firm in New York City till 1983.

Armed with his MBA, Adebayo made the switch to investment banking when he joined First Boston Investment Bank as an advisor on a Nigerian gas project in 1983. He also worked with the Project Finance Group, as a financial advisor to several clients on the transactions of North and South America, the Caribbean, Europe, the Middle East, Africa and Asia.

Other places Adebayo worked include the Credit Suisse First Boston (CSFB) (earlier known as Global Energy Group) where he advised clients on strategic transactions and financing for some years, before becoming the Global Head of CSFB’s Investment Banking Division. He was appointed member of the Credit Suisse Executive Board and Management Committee in 2002, and became the Executive Vice Chairman and Chief Client Officer of CSFB between 2004 and 2006.

While at the CSFB, he was also lecturing at Harvard Law School and Yale School of Management.

He was appointed a member of the Board of Directors of Goldman Sachs in October 2012 and became Lead Director on the 24th of July, 2014.

Ogunlesi, the investor

In July 2006, he founded a private equity firm Global Infrastructure Partners (GIP) in New York City, with CSFB and General Electric as the first investors; and assumed the role of Chairman and Managing Partner. In the same year, GIP bought London City Airport an international airport located in the Royal Docks in the London Borough of Newham in the City of London. GIP later sold off the airport after a decade.

Three years later in 2009, GIP invested £1.455 billion to acquire the majority share in London Gatwick Airport, a major international airport near Crawley, Sussex, England. Another three years after in 2012, GIP bought Edinburgh Airport, said to be the busiest airport in Scotland in 2019, handling over 14.7 million passengers.

GIP also bought Nuovo Trasporto Viaggiatori in February 2018.

Some other GIP Investments In the Transport Sector include Terminal Investment Limited, Port of Melbourne; Pacific National; Italo; Access Midstream Partners; Biffa Group Limited; Port of Brisbane; Great Yarmouth Port Company.

GIP also had stakes in infrastructure assets around the world, with selected equity and debt investments in several sectors. The company manages a portfolio of combined annual revenue greater than $46 billion, and investments of over $51 billion for its investors.

The company is an infrastructure investment fund that makes both equity and selected debt investments. It has investments in high-quality infrastructure assets in the energy, transport, water and waste sectors.

In the energy sector, Gip has investments in Guacolda Energia, Freeport LNG, CPV, Saeta Yield/Bow Power, Hess Infrastructure Partners, Vena Energy, Naturgy Energy Group and several others.

Other interests

Ogunlesi is now a Member, Board of Dean’s Advisors at the Harvard Business School; Member, Leadership Council of New York at Harvard Law School; and Member, Global Advisory Council at Harvard University.

He is also a Member, Board of Directors of the Partnership for New York City Fund; National Board of Directors NAACP Legal Defense and Educational Fund; Board of Trustees NewYork-Presbyterian Hospital; and the King’s College Old Boys Association.

He is a member of the District of Columbia Bar Association. He taught a course on transnational investment projects in emerging countries, as a lecturer at Harvard Law School and the Yale School of Management, while also working at Credit Suisse First Boston.

In October 2012, Ogunlesi was appointed to the Board of Directors at Goldman Sachs and became Lead Director in 2014. There is no confirmed source of his net worth, but Wallmine estimates that Ogunlesi is worth at least $22.5 million dollars and owns at least 66,677 units of Goldman Sachs stock as of 7 May 2020.

In December 2016, Ogunlesi was named among business leaders that would be part of Donald Trump’s Strategic and Policy Forum, but the forum was disbanded 8 months later.

Ogunlesi was given The Award of Excellence by The International Center in New York, and in 2019 was cited as one of the Top 100 most influential Africans by New African magazine. He is still actively engaged in several volunteer works across Africa.

Congratulations. I will like you to mentor me on so investment banking programs

Awesome Job Ruth..thank you

What investments has he brought to his native Ogunsolu State and Nigeria at large?

Bayo Ogunlesi, like all.his siblings, attended Abadina Primary School, University College Ibadan, which the became University of Ibadan

22.5 million dollars???…. Like, is that a mistake or its the actual thing

Dear Mr Ogunlesi,

I and one of my colleague where having a discussion about going on holiday and how expensive tickets are and for some reason he mentioned that Heathrow and some other Airports and how you have a share in them.

I decided do my research. And I most say a massive congratulations on all your achievements may you continue to succeed and leave long to see you children’s children in Jesus name Amen!!!

Yours sincerely,

Amanda Adiohwo