These are stocks that offered their investors the highest dividends for every naira invested in 2020 based on announced dividends so far in 2021.

For an investor interested in dividend income, the dividend yield is a good metric to measure the profitability of his choice of stock. Dividend yield shows the amount of cash an investor will be getting back for every unit of money invested. Investors can make returns on their stock investments in two ways, dividend income or capital appreciations.

Whilst investors focused on capital gains saw their equity wealth increased in 2020 on the back of the 62.42% growth in equity market capitalisation on the NSE according to the CEO of NSE; dividend-focused investors are starting to receive announcements of proposed dividends on their stock holdings for 2020.

READ: A case for investing in dividend stocks

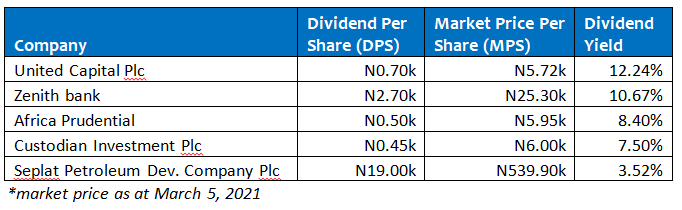

An analysis of the Dividend yield of the stocks listed on the Nigerian Stock Exchange whose dividends were announced in 2021 showed the following as the 5 top best stocks on the NSE based on their dividend yield in 2020:

To determine the dividend yield, we divided the dividend per share by the market price per share. This ratio shows the return an investor gets on every naira he spent on purchasing a stock assuming he bought the stock at the market price used in the calculation.

These were the highest dividend yield stocks on the NSE based on announced dividends in 2021. Delving deeper into their performance we highlighted some other financial ratios.

READ: Beginners’ Guide: How to compute capital gains tax in Nigeria

United Capital Plc

United Capital Plc is a financial and investment services Group that offers investment banking, asset management, trustees, and consumer finance services to its clients.

2020 revenue growth rate – +49.84%

2020 EPS – N1.30k

YTD Capital gains – 21.44%

Zenith Bank Plc

Zenith Bank Plc is a leading multinational financial services provider in Nigeria that primarily offers commercial banking services.

2020 net income growth rate – +12.23%

2020 EPS – N7.34k

YTD Capital gains – +2.02%

READ: How to use profits to determine what stock to buy

Africa Prudential Plc

Africa Prudential Plc is the only listed registrar business on the NSE focused on providing innovative solutions, investor relations and business support services.

2020 revenue growth rate – -10.20%

2020 EPS – N0.72k

YTD Capital gains – -4.80%

Custodian Investment Plc

Custodian Investment Plc. is an investment company with a significant holding in companies and brands including Custodian and Allied Insurance Limited, Custodian Life Assurance Limited, Custodian Trustees, Crusader Sterling Pensions Limited, and UACN Property Development Company Plc.

2020 revenue growth rate – +22.22%

2020 EPS – N1.96k

YTD Capital gains – +2.56%

Seplat Development Petroleum Company Plc

Seplat Petroleum Development Company is a Nigerian independent oil and gas company listed on both the London and Nigerian stock exchanges with a strategic focus in the Niger Delta of Nigeria.

2020 revenue growth rate – -10.85%

2020 EPS – -N46.42k

YTD Capital gains – +34.20%

The following are the dividend yields of other companies that have announced their dividends in 2020;

The rest of this content is for our Premium Newsletter Subscribers SSN. Subscribe here to receive this newsletter every week via your email.

Your competition of the dividend yield should include both interim and final Dividend added together not taking final dividend dividend ignoring the interim since dividend yield is per annum.