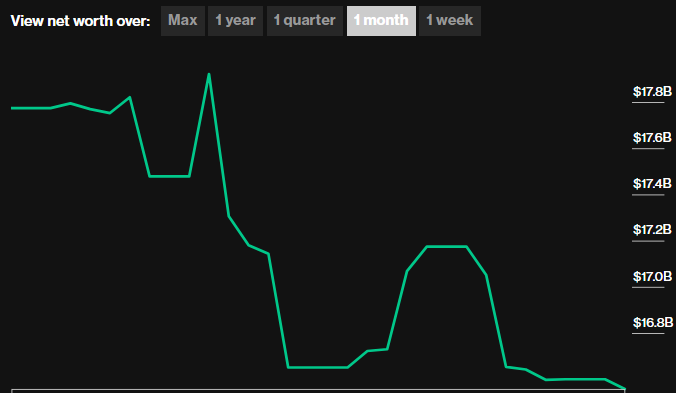

Aliko Dangote, the founder of Africa’s most diversified manufacturing conglomerate, Dangote Industries, has seen his net worth decline by a whopping $1.20 billion in the month of February alone.

Africa’s richest man whose wealth peaked at $18.4 billion this year, saw his wealth declined by $1.20 billion, to $16.6 billion from $17.8 billion recorded on the 31st of January 2021, data retrieved from Bloomberg Billionaire Index reveals.

Source: Bloomberg Billionaire Index

The fall in Dangote’s net worth is partly attributable to the decline in the share price of his flagship company, Dangote Cement Plc (DCP), as well as the share price of his integrated sugar business, Dangote Sugar Refinery Plc (DSR).

The decline in the share price of these companies which impacted their market capitalization was occasioned by profit-taking activities by investors in February, across the market spectrum.

Facts about Dangote’s networth valuation

The majority of Dangote’s fortune is derived from his 86% stake in the publicly-traded Dangote Cement, as the billionaire holds the shares of the company directly and through his conglomerate, Dangote Industries.

He holds stakes in Nascon Allied Industries and United Bank for Africa, directly and through Dangote Industries, a conglomerate that also owns closely held businesses operating in food manufacturing, fertilizer, oil and other industries.

Dangote’s most valuable closely held asset is his fertilizer plant with a capacity to produce up to 2.8MT of urea annually. The $2.5 billion fertilizer plant owned by Africa’s richest man Aliko Dangote, is expected to commence operation in the first quarter of 2021.

The billionaire also owns a $12 billion oil refinery which is expected to be completed this year. However, the plant is not included in his net worth valuation, for some reason.

What you should know

- The shares of Dangote Cement at the close trading activities for the month of February declined by 6.78%, extending the YTD loss on the shares of the cement behemoth to over 10%.

- On the flip side, shares of Dangote Sugar Refinery also declined by 15.29% to close the month lower at N18 per share, thus correcting the YTD gains of its shares to 2.27%.