Mutual funds are one of the fastest-growing asset classes in Nigeria, as data from the Security and Exchange Commission (SEC), shows that 49.2% of the 118 registered funds recorded positive growth in January 2021.

A mutual fund is a type of financial vehicle made up of a pool of money collected from various investors, with the aim of investing them in securities like stocks, bonds, money market instruments, and other assets.

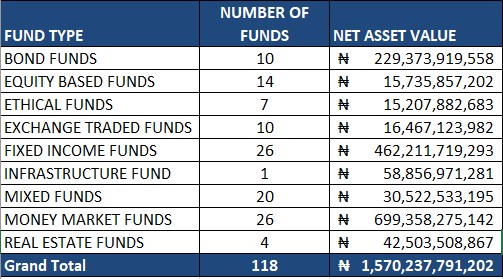

According to SEC, a total of 118 mutual funds were registered as of January 29, 2021, with a net asset value of N1.57 trillion across several fund types.

Nairametrics tracked the performance of these mutual funds by comparing the fund prices as of 31st December, 2020 with the fund prices as of the last trading day of January 2021.

Below were the top-performing mutual funds in the month of January 2021. We also highlighted their performance in terms of changes in net asset value and included profiles of the funds as described on their websites.

READ: Investors pump N7 billions into New Gold ETF

Lotus Capital Halal ETF – Lotus Capital Limited (Exchange Traded Fund)

The Lotus Halal Equity Exchange Traded Fund “LHE ETF” is an open-ended fund that tracks the performance of the NSE-Lotus Islamic Index (NSELII). It is designed to enable investors obtain market exposure to the securities of the constituent companies of the NSE-Lotus Islamic Index and to replicate the price and yield performance of the index.

December 31st, 2020

Fund Price – N12.73

January 29th, 2021

Fund Price – N13.66

Return – 7.31%

Ranking – Fifth

Commentary: This is an Exchange Traded Fund by Lotus Capital Limited, which grew by 7.31% in the month of January. The fund also grew significantly by 51.7% in the year 2020, indicating that the fund is a delight to its investors. Also, the net asset value stood at N655.04 million as of 29th January, 2021, indicating 6.76% growth compared to N613.59 million recorded as of 31st December, 2020.

READ: Understanding how Mutual Funds and ETFs work in Nigeria

Stanbic IBTC Aggressive Fund – Stanbic IBTC Asset Mgt. Limited (Equity Based Funds)

The Stanbic IBTC Aggressive Fund (SIAF), which was launched in June 2012, is an open-ended fund that invests a minimum of 60% of its portfolio in equities of companies listed on the Nigerian Stock Exchange (NSE) and a maximum of 40% in fixed income securities. Notably, the expense ratio for the fund is 1.5%.

December 31st, 2020

Fund Price – N2,525.55

January 29th, 2021

Fund Price – N2,713.93

Return – 7.46%

Ranking – Fourth

Commentary: Stanbic IBTC Aggressive Fund is the second-best performing Equity-Based fund in the month of January, growing by 7.46% to stand at N2,713.93 as of 29th of January, 2021. The net asset value also grew by 7.43% to close at N340.8 million.

READ: DV Balanced Fund to become a Money Market Fund

FSDH Dollar Fund – FSDH Asset Management Ltd. (Fixed Income Funds)

This is an open-ended mutual fund that invests in US Dollar denominated Fixed Income Securities issued by Nigerian Sovereign and Corporate Entities. The objective of the fund is to provide customers with the opportunity to invest in dollar-denominated instruments. Meanwhile, the minimum amount required to invest in the fund is $1,000.

December 31st, 2020

Fund Price – N415.1

January 29th, 2021

Fund Price – N447.7

Return – 7.85%

Ranking – Third

Commentary: The fixed income fund managed by FSDH Asset Management, recorded growth of 7.85% in January from N415.1 recorded as of the end of 2020 to stand at N447.7 at the end of January. The net asset value grew by 18.41% to close at N1.002 billion.

Paramount Equity Fund – Chapel Hill Denham Mgt. Limited (Equity-based Fund)

Paramount Equity Fund is Nigeria’s oldest mutual fund, which invests in a broad range of high-quality equities and fixed income securities. The fund aims to provide an investment vehicle that will enable unit holders to achieve consistent capital appreciation over a medium-to-long term.

December 31st, 2020

Fund Price – N16.27

January 29th, 2021

Fund Price – N17.56

Return – 7.93%

Ranking – Second

Commentary: This is an Equity Based Fund managed by Chapel Hill Denham Management, which grew by 7.93% in the month of January 2021 to stand at N17.56 as of 29th of January 2021, while the net asset value grew by 8.22% to stand at N598.19 million.

Vantage Dollar Fund – Investment One Funds Management (Fixed Income Fund)

Vantage Dollar Fund is an open-ended Unit Trust Scheme by Investment One Funds. The Fund seeks to provide investors with a bias for Dollar denominated securities an access to such securities, which ordinarily would be inaccessible to them by virtue of the minimum amount typically required to make such investments.

December 31st, 2020

Fund Price – N559.87

January 29th, 2021

Fund Price – N502.9

Return – 11.33%

Ranking – First

Commentary: This is the best performing mutual fund in the month of January 2021 and the only fund with a double-figure yield in the month under review. Vantage Dollar Fund grew by 11.33% to stand at N502.9 as of 29th of January 2021 while the net asset value also grew by 10.93%. This is quite an impressive performance as the fund primarily invests in Corporate and Sovereign Eurobonds.

Bubbling under……

The following funds make up the rest of the top 10 our list in ascending order:

AXA Mansard Equity Income Fund – AXA Mansard Investments Limited (Equity Based Fund)

Return – 6.69%

VETBANK ETF – Vetiva Fund Managers Limited (Exchange Traded Fund)

Return – 6.82%

PACAM Equity Fund – PAC Asset Management Limited (Equity Based Fund)

Return – 6.86%

Legacy Equity Fund – First City Asset Management (Equity Based Fund)

Return – 7.14%

VCG ETF – Vetiva Fund Managers Limited (Exchange Traded Fund)

Return – 7.16%