The Nigerian Stock Exchange (NSE) ended 2020 on a bullish note as the All-Share index posted a gain of 50.03%, moving from 26,842.07 points recorded as of December 2019 to 40,270.72 points.

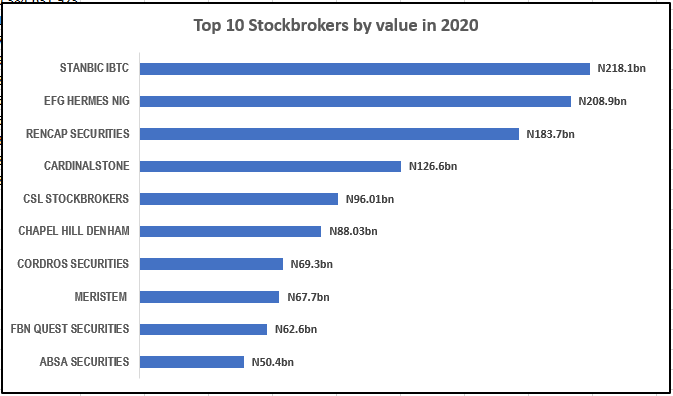

The top ten stockbroking firms on the NSE traded a sum of N1.17 trillion worth of shares between January and December 2020. This is according to the Broker Performance Report for the year ended December 2020.

READ: Nigeria’s non-oil exports increase by 100%

According to the report, the top ten stockbroking firms on the stock exchange accounted for 53.87% of the total value of stocks traded in the year.

Stockbrokers by value

- Stanbic IBTC Stockbrokers is top on the list with trades worth N218.14 billion, representing 10.04% of the total value of traded stocks in The Exchange.

- EFG Hermes Nigeria Limited followed with trade of stocks worth N208.86 billion, accounting for 9.61% of the total value.

- Rencap Securities also traded stocks worth N188.66 billion during the period. It accounted for 8.45% of the total value traded.

- Cardinalstone Securities Limited traded stocks valued at N126.6 billion between January and December 2020, representing 5.83% of the total traded stocks in the year.

- CSL Stockbrokers Limited recorded trades worth N96 billion. This represents 4.42% of the total traded stocks on the bourse.

- Others on the list include; Chapel Hill Denham (N88 billion), Cordros Securities (N69.3 billion), Meristem Stockbrokers (N67.7 billion), FBN Quest Securities (N61.6 billion), and ABSA Securities (N50.4 billion).

READ: ValuAlliance posts N237.96 million profit in Q3 2020; up by over 1000% Y-o-Y

READ: Flour Mills’ outgoing GMD acquires additional shares weeks after announcing retirement

Stockbrokers by volume

The top ten stockbrokers by volume traded in 94.53 billion units of shares, representing 48.75% of the total volume of stocks traded in the year.

- Inter State Securities traded in 19.29 billion stocks during the year, representing 9.95% of the total volume of traded stocks.

- Cardinalstone Securities followed closely with trades in 14.01 billion shares, accounting for 7.22% of the total traded stocks.

- EFG Hermes traded in 10.87 billion units of stocks. This accounted for 5.61% of the total shares traded in the Stock Market.

- Morgan Capital Securities came fourth on the list with trades in 10.31 billion units of stocks, representing 5.32% of the total traded stocks.

- While Stanbic IBTC Stockbrokers traded in 8.15 billion units of shares. This accounted for 4.2% of the total traded stocks.

- Others include; Rencap Securities (7.26 billion), Meristem Stockbrokers (7.08 billion), Chapel Hill Denham Securities (6.7 billion), CSL Stockbrokers (5.92 billion), and Apel Asset Limited (4.92 billion).

READ: Dangote Cement shares gain N605 billion in a week amid share buyback plans

Overall market performance in 2020

The Nigerian Stock Exchange posted significant gains in 2020, growing its all-share index by 50.03% to close at 40,270.72 points despite the downturn caused by the Corona Virus pandemic.

- Also, the equities market capitalisation closed at N21.06 trillion as of 31st December 2020. Indicating a growth of 62.4% compared to N12.97 trillion recorded as of the corresponding period of 2019.

- The best-performing stocks in the year include; Neimeth (+260%), FTN Cocoa (+230%), Japaul Oil (+210%), Airtel Africa (185%), and Livestock Feeds with 178% positive growth.

- The NSE-Main Board Index grew by 49.84% in the year, while the NSE 30 Index recorded a 39.25% positive growth.

- Notably, the NSE Premium Index grew by 64.01%, the Consumer Goods index (+12.25%), while the Banking Index recorded a positive growth of 10.14%.