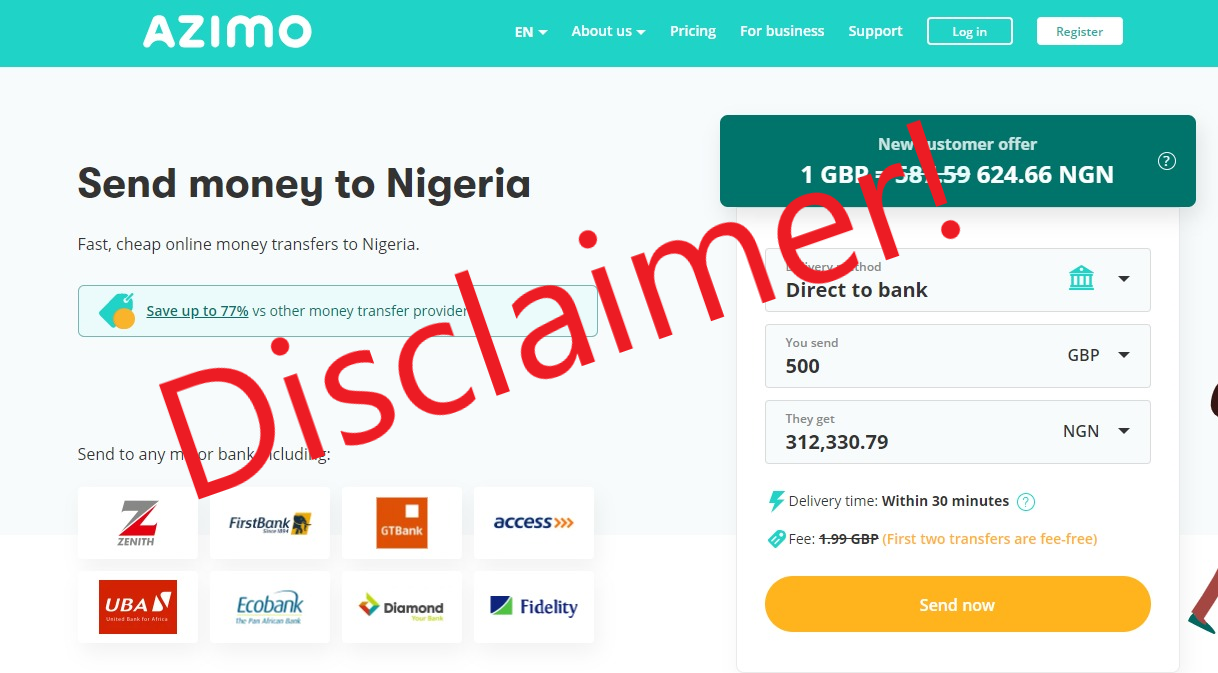

Nigerian banks have issued disclaimers against Azimo, a money transfer application that claims to facilitate global money transfers.

Azimo is a London Based money transfer service founded by Michael Kent in 2012 and is one of the fastest rising money transfer startups in Europe. It list as part of its investors, European Investment Bank, Greycroft, Rakuten (Japan). It was also once listed as one of the fasted growing companies in the UK.

Nairametrics had earlier report First Bank sent a disclaimer to its customers, however nearly all the banks on the list posted on the website of Azimo have put out a disclaimer. This includes Fidelity Bank, UBA, GT Bank, Zenith, and First Bank.

The Disclaimer

In one of the emails sent to its customers by a bank, it warned its customers that it is not one of the receiving banks on the platform and that Azimo is also not a registered Money Transfer Operator (MTO).

- “We disclaim the listing of FirstBank as one of the receiving or paying Banks on Azimo.com by Azimo Limited, offering Global Money Transfer Services. FirstBank has no affiliation with Azimo and hereby publicly disassociates itself from it.Azimo is not a registered Money Transfer Service with the Central Bank of Nigeria (CBN) as such, not licensed in Nigeria. Anyone who transacts with Azimo is therefore doing so at his/her peril.”

- Another email from a bank revealed that informed Azimo to take out their name for their list of partner banks. “We have written to Azimo to take down the misleading advertisement and have put up this disclaimer to correct the misrepresentation.”

- In another email, one of the leading banks complained that including their name as one of the agent banks could attract regulatory sanctions. “This act of yours is unprofessional and illegal capable of sending a wrong signal to the public that the Bank is in some sort of alliance with or support your operations, thereby exposing it to regulatory sanctions in Nigeria. We therefore demand that you delete from your website all references to the Bank’s name and logo within 7 days of receipt of this letter failing which we shall be left with no option than to report you to the appropriate law enforcement agencies and commence legal action against you in the United Kingdom. This we shall do without further recourse to you.”

Azimo on transfer to Nigeria

On its website, Azimo states that it allows money transfer to Nigeria stating the following in its caption;

- “Save up to 70% on money transfers to Nigeria. Need to send money to Nigeria? No wahala. With great exchange rates and a low, honest fee, you’re better off sending money in Nigerian naira (NGN) with Azimo.”

- It claims to charge just £3.84 for a £120 transfer claiming it is one of the least in Europe.

The disclaimer from FirstBank may have been as a result of Azimo listing the bank as one of the receiving banks in Nigeria. The central bank approves the list of MTO and it is understood this is a heavily monitored activity by the apex bank as it tightens regulations around transfers from abroad to beneficiaries in the country.

Note: This article was updated to reflect new information.

“Nigerian banks issues…” That says everything about your care and attention to detail.