If you have ever been to Oja Eko (Lagos Island market), then you can simply infer the activities in the equities market last week by examining the experiences garnered in this commodity market. There was a lot of buying; many got value for their money while some had to live with the regret of missing out on great opportunities or even lost money. On the local bourse last week, for all, it was a buying frenzy, but for many people, it was like the stock market held its first giveaway.

In nominal terms, the market gained N2.10 trillion W/W, representing a 12.97 percent uptick in both all share index and market capitalization. The WOW moment was on Thursday when the market had to throw in a circuit breaker for the first time, which is simply the exchange’s way of telling market participants to “please calm down.” The exchange paused trading for 30 minutes, after the market gains climbed past 5 percent, and resumed activities afterward. At the close of the week, the market had improved its year-to-date return to 30.53 percent, making the Nigeria Stock Exchange the best performing in the world. Great news, right?

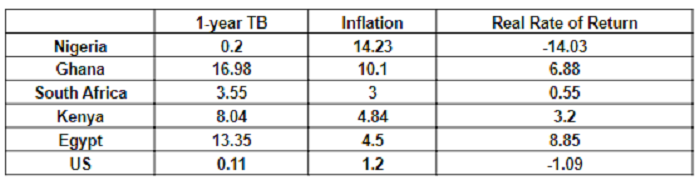

The major push behind this aggressive buying interest seen in the equity space can be traced to the depressed stop rates at Wednesday’s treasury bills auction. The auction was concluded with stop rates at 0.035%, 0.15% and 0.30% for the 91-day, 182-day, and 364-day treasury bill, respectively (as against, 0.34%, 0.50%, and 0.98% recorded in the last auction). Compared to its peers, Nigeria Treasury Bills is the only paper yielding negative real rate of return. It is safe to say we should not be expecting any FPI inflow in the fixed income space soon.

In a desperate hunt for higher investment returns, a plethora of retail investors rushed to the equities market to pick up stocks cutting across all sectors, irrespective of what the fundamentals dictate. Another factor that lent support to the bullish momentum was the circular from PENCOM instructing PFAs to restructure their business models, making the various fund categories reflective of the permissible risks of the underlying demographics. This action is expected to push some funds into the equity market over the four months period given by the regulators to restructure their asset allocation, and we saw some position taking by large fund managers at the start of last week. and we saw some positioning by large fund managers at the start of last week.

The bullish sentiment seen in the equities market is not unique to last week, as we have witnessed eight consecutive weeks of market appreciation, driven by the low rates in the fixed income market. Hence, this puts us at a crossroad, as we are faced with the possibility of further gains as fixed income rates are expected to remain low.

Overvalued or Undervalued?

Some school of thought still believes Nigeria equities market is undervalued despite the rally and believes there is still room for a sustained rally based on a relative PE analysis. Compared to its peers PE average of 14.13x (JSE 25.87x, Nairobi 10.09x, BRVM 6.62x and Vietnam 15.63x) the Nigeria All Share Index is still relatively undervalued with a current PE of 12.43x. While the opposing school of thought believes stocks are overvalued based on technical indicators.

So, this brings us to the vital question, ‘Are you too late to the party?’

Please find attached our stock recommendation for the week.

Guess who is back on top?