N25 billion worth of equity capital has been injected into First Bank of Nigeria Limited by its parent company, FBN Holdings Plc. The move is coming on the heels of FBN Holdings’ recent divestment from FBN Insurance Ltd.

A statement signed by FBN Holdings’ Company Secretary, Seye Kosoko, as seen on the Nigerian Stock Exchange’s website, noted that the N25 billion is part of the net proceeds from the recent divestment from FBN Insurance Limited.

READ MORE: Nigeria’s tier-1 banks earn N18.4 billion from account maintenance charges in Q1 2020

Following this N25 billion capital injection, First Bank of Nigeria Limited’s Capital Adequacy Ratio (CAR) has increased to 16.53%. This is before capitalising year to date profit for half-year 2020.

More details: While commenting on this development, FBN Holdings’ Chief Financial Officer, Oyewale Ariyibi, said that the “divestment has unlocked significant value embedded in the former subsidiary which is being leveraged to strengthen the core baning business for which the Group is renowned.”

The company also explained that the overriding objective of these recent moves is to “optimise capital across the Group to drive business growth, enhance efficiency, and improve overall shareholders’ value.”

READ MORE: More banks, insurance firms declare closed periods ahead of H1 results release

The backstory: Back in April this year, FBN Holdings Plc first disclosed ongoing talks with Sanlam Emerging Markets (Proprietary) Ltd over a possible sell-off of its 65% stake in FBN Insurance to the South African firm. Fast-forward to early June, FBN Holdings again informed stakeholders that it had completed the divestment process. All the while, no mention was made about the value of the transaction until now.

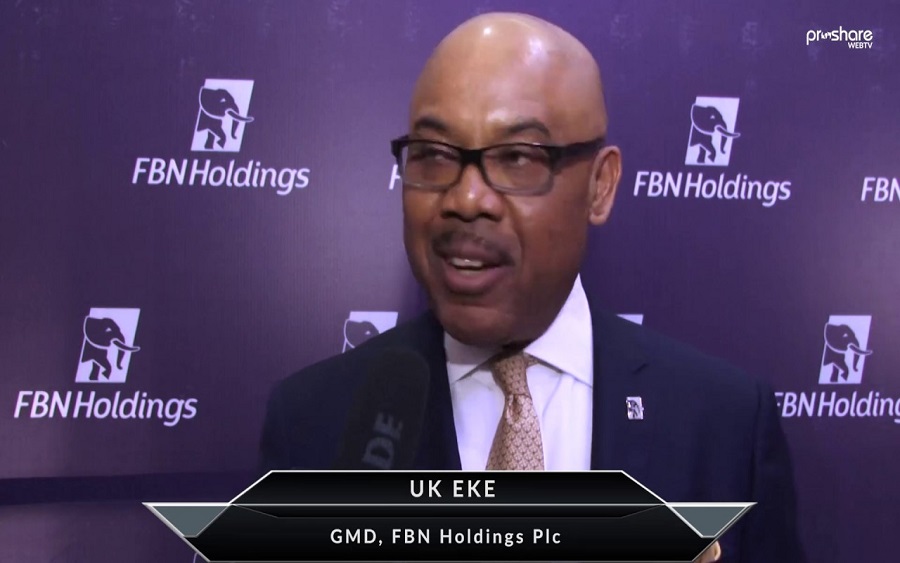

Note that FBN Holdings Plc reported a profit after tax of N49.5 billion for the half-year period ended June 30th, 2020. This represents a 56.3% increase when compared with N31.6 billion reported in H1 2019. The company’s Chief Executive Officer, UK Eke, recently commented on performance, noting that “the H1 2020 financial results are impressive and reconfirm our consistent focus on enhanced shareholder value.”

READ MORE: Here’s how much banks spent on advertising & marketing in Q1 2020

FBN Holdings’ share price on the Nigerian Stock Exchange is currently trading at N5.05. The company has a market capitalisation of about N181.3 billion, according to information gleaned from Bloomberg.