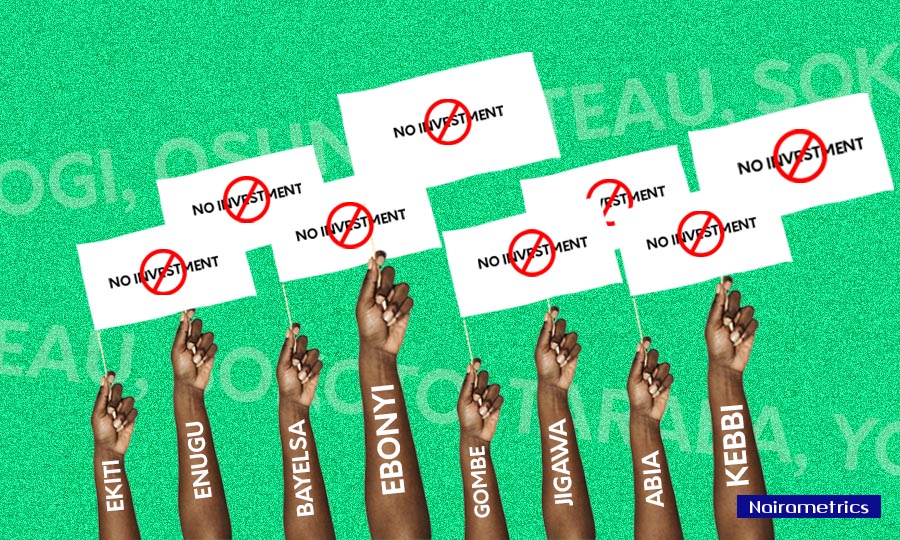

About 21 states in Nigeria attracted zero investments in the last 4 months according to data from the Central Bank of Nigeria.

According to data, the following states, Rivers, Ondo, Edo, Sokoto, Oyo, Abia, and Anambra recorded zero capital importation in the last 4 months. Others are Adamawa, Bauchi, Benue, Borno, Cross River, Delta, Ebonyi, Enugu, Imo, Kastina, Kogi, Kwara, Osun, Oyo, Yobe, and Nassarawa states.

This information is contained in the Capital importation report obtained from the Central Bank of Nigeria, CBN. The report also detailed the total amount of fresh investments attracted to the Nigerian economy during the period.

[READ MORE: States’ IGR hits N691 billion as Osun, others recorded biggest growth]

Note that most of the states that failed to attract investments during the period under review also failed to attract any investments in 2019. This means that it is either the necessary steps were not taken by the governments, or foreign investors could not find attraction in the states or the environments were simply not conducive for investment.

Lagos outshines FCT, Niger, 5 other states

As expected, Lagos topped the list of states that attracted investments during the period under consideration. Lagos attracted the highest amount of $5.39 billion during the period. The investment inflow into the state represents over 87% of the $6.17 billion.

Lagos is followed by the Federal Capital Territory which attracted a total investment inflow of $754.01 million.

Niger State attracted a total investment inflow of $11.60 million. Sokoto State also attracted $2.50 million, while Kaduna State attracted the sum of $1.98 million and Ogun attracted $1.70 million.

Kano and Akwa Ibom states recorded investment inflow of about $700,000 and about $237,000 respectively among others.

The limited investment inflows into some of these states clearly indicate that the states are not really attractive to the investors, even before the pandemic. The Managing Partner, FA Consult, Peter Adebayo, explained that the nation’s economy is not attractive enough to pull investments to states that lack the desired viability.

“Most of the investors are scared of insurgencies in the country, though such is limited to some parts of the nation, except for the well-connected investors that are given special attention,” he said.

Back story: Last March, Nairametrics reported that Ekiti, Kogi, Sokoto, Bayelsa, Ebonyi, Gombe, Jigawa, Abia, and five other state governments failed to attract investments in 2019.