The introduction of 6% tenancy and lease agreement stamp duty in the country will cause more hardship for the Nigerian workers who form the majority of the tenant population.

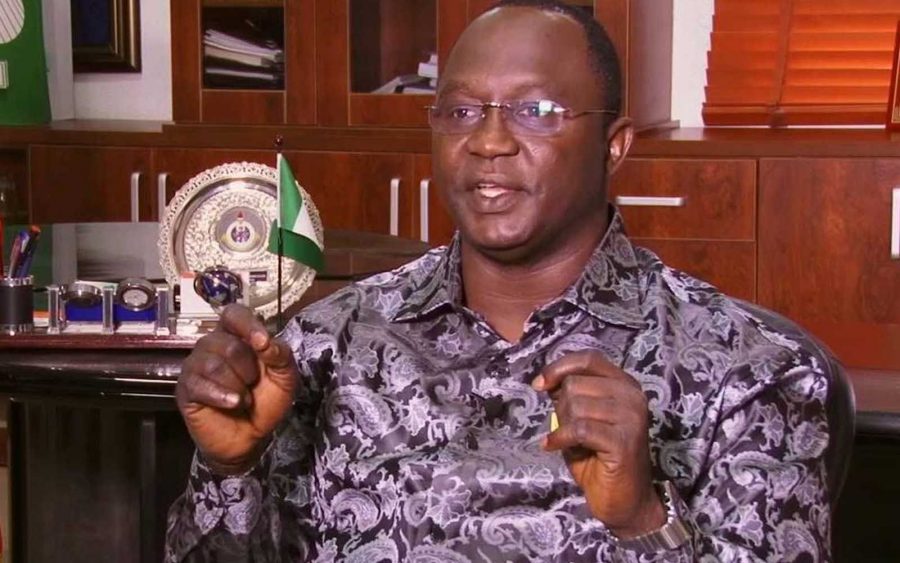

This was contained in a statement from the President of the Nigeria Labour Congress (NLC), Mr Ayuba Wabba, and made available to NAN on Saturday.

It was also stated that introducing hikes in taxes and user access fees at a time when governments of other countries are offering palliatives to their citizens, does not portray the image of a government sensitive to the needs of its citizens.

Wabba urged the government to reverse the policy, as Nigerians are still struggling with the socio-economic pressure arising from COVID-19 fallouts.

READ ALSO: FIRS introduces stamp duty on house rent and C of O transactions

“We call on the Federal Government and the Federal Inland Revenue Service to rescind this harsh fiscal measure as it is boldly insensitive to the material condition of Nigerians which has been compounded by the Covid-19.

“Nobody would want to be a tenant if they had alternative. This means that tenants which this new policy targets are some of the most vulnerable people in our society” he said.

He noted that accommodation is a fundamental right guaranteed by Nigeria’s constitution, and should not have a higher tax rate of 6% when sales tax is 1.5%.

Why this matters

Recent weeks have been ridden with several probes and scandals on misappropriation of public funds, and Wabba noted that these issues have further dampened the trust of the citizens in the government.

NLC noted in its statement that given the scandals, it does not make sense to ask Nigerians to make sacrifices when they are daily regaled with putrid stories of how public officials are accused of swallowing money in billions and making a comedy of ‘fainting’ afterward.

READ ALSO: FIRS’ Nami doubtful of meeting Buhari’s revenue target, runs to Lagos for help

He added that the government should make more efforts towards reducing official graft and corruption, and in line with the principle of public taxation, have a tax policy where the rich subsidizes the poor.

Wabba noted that the principle of public taxation, especially progressive taxation all over the world is that the rich subsidizes for the poor, and that every tax policy that would be enforceable must create a safety net for the poor.

Backstory

The federal government, through the Federal Inland Revenue Service (FIRS), introduced a new policy stipulating an additional 6% stamp duty fee for every tenancy and lease agreement in the country.

READ ALSO: NIPOST workers picket Ministry of Finance over stamp duty

The implementation of this new policy implies that tenants will have to pay more to make up for the stamp duty charge.

“While we expect the reversal of the 6 per cent tenancy and lease stamp duty policy, we remind government that its highest responsibility is to ensure the security and welfare of every Nigerian,” Wabba said.