Nigeria recorded a total tax collection of about N8.8 trillion in 2020 translating to a tax to GDP ratio of 6.1%. Total taxes collected include oil and non-oil tax plus taxes collected by states. Nigeria has a nominal GDP of N145.6 trillion as at December 2019. This is according to data collated from the FG and States taxes for 2019.

Data was sourced from the 2019 Budget Implementation report and the 2019 IGR report published by the National Bureau of Statistics (NBS). Nairametrics Research keeps a database of government data.

The Numbers

VAT – In the 2019 budget, Nigeria projected a total VAT revenue of N1.7 trillion as it anticipated higher tax revenues from vatable goods and services. VAT is collected by the Federal Inland Revenue Service and by law businesses who charge Vat are expected to remit same to the government after netting off the vat they paid on supplies (otherwise called input vat) from their sales proceed (output VAT).

- According to the data, actual VAT collected during the year was N1, 188.85 (millions) compared to a budget of N1,703.89 billion representing a negative variance of N515 billion or 30%.

- Since 5% was charged on invoices as at 2019, the amount upon which VAT was charged and remitted was N23.77 trillion only.

- This suggest the total transaction base for VAT in the country in 2019 was N23.77 trillion or 16.2% of GDP. Nigeria’s total nominal GDP N145.6 trillion.

- In 2018, the government earned a total VAT revenue N1,090 billion which also translates to a transaction base of N21.8 trillion. Between 2018 and 2019, Nigeria’s VAT transaction base has risen by N1.98 trillion or 9% year on year.

- Nigeria increased its VAT rate to 7.5% in 2020.

Corporate Tax – Nigeria also charges a corporate tax of 30% on chargeable profits (this represents income after deducting all allowable expenses). According to the budget implementation report a total of N1,517.51 billions was collected as corporate tax in 2019 compared to budget of N1,761.53 billion.

- At 30% corporate tax rate, total tax base was N5,058 billion (N5 trillion) which is also the total profits upon which Nigerian companies paid tax on.

- In 2018, the government collected N1,429.93 billion in corporate taxes which indicates the Federal Inland Revenue had a better year in 2018.

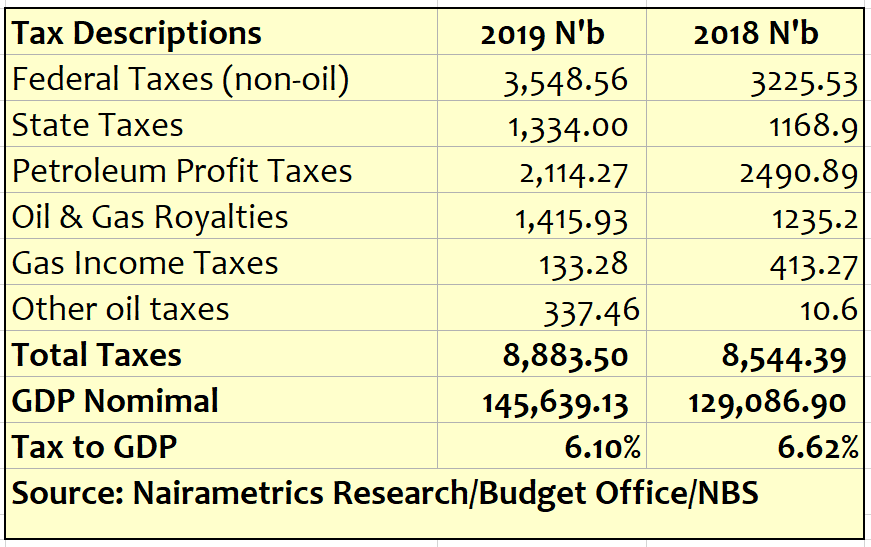

Total Taxes – Nigeria collected total non-oil taxes of N3,548.56 billion in 2019 which comprises of N1,517.51 billions (Corporate Taxes), N1,188.85 billions (Vat), N792 billion (Customs, import, fees and excise duties). Total oil taxes and royalties in 2019 was N4 trillion

According to data from the National Bureau of Statistics, state governments collected a total taxes of N1, 334 billion which includes PAYE (N809.23 billion), Direct Assessment (N47.6 billion), Road taxes (N30. 2billion), other taxes (N225.4 billion) and MDA revenues of N221.5 billion.

Based on the officially published tax figures for Nigeria (Federal and States) total taxes collected in 2020 is about N8, 883.5 billion. As a percentage of GDP, Nigeria taxes represents 6.1% one of the lowest in the world. According to data from the OECD (a group of some of the most developed countries in the world) indicates their average tax to GDP ratio is about 32.9% of GDP on average. France, one of the OECD countries has a tax to GDP ratio of over 46%.

Upshots

Nigeria seems set to rely heavily on taxes to fund its federal and stage government expenditure. To achieve its target it will have to broaden its tax base and hope that economic activities pick up to be able to meet projections. Nigeria’s very low tax to GDP ratio has often been blamed on low tax base as over 50% of the economy remains informal. In the recently approved 2020 revised budget, the FG is projecting total VAT and Corporate tax revenue of N2, 029.3 million and N1,694 trillion respectively.