At the height of the COVID-19 pandemic, when most people were seeking ways to hold on to their jobs and prepare for the economic hardship that was bound to ensue, one man was busy resigning from his positions on the boards of several listed companies.

What were his reasons? Well, he wanted to focus on other interests, precisely on the ANAP Foundation COVID-19 Think Tank which he had just founded at the time. The non-governmental organisation was established with the aim of helping combat the pandemic.

That man is Atedo Nari Atowari Peterside, who also goes by the acronym, ANAP. Besides founding IBTC which is currently a part of Stanbic IBTC Holdings Plc, Peterside also founded ANAP Jets. He has been instrumental to the growth of several companies in the private sector and is a key player in influencing public policy in the country. Peterside has also been appointed by successive governments to serve on different important committees.

This week on our founder’s profile, we bring you Atedo Peterside, the man who runs in when everyone is running out.

Explore Economic Research Data From Nairametrics on Nairalytics

Let’s talk about his early years

Mr Peterside was born to the family of Chief Michael Clement Atowari Peterside and Patricia Awune Gboloba Bob-Manuel in 1955. As the only boy in a family of three children, he grew up under a strong parental influence. His father was an Ophthalmologist, and whenever his job allowed him to be at home, he devoted the time to raising his kids with stern lectures as well as he did with lighthearted jokes.

In 1965, ten-year-old Atedo finished his primary education and proceeded to boarding school at Kings College, Lagos. However, the onset of the Nigerian Civil War suspended his education until 1970 when the war ended.

Despite losing all his savings in the war, Chief Peterside worked and saved enough to send his son to the City University, London in 1973. It was there that he obtained his first degree in Economics. He later obtained his Master’s degree in 1977, also in Economics from the London School of Economics and Political Science.

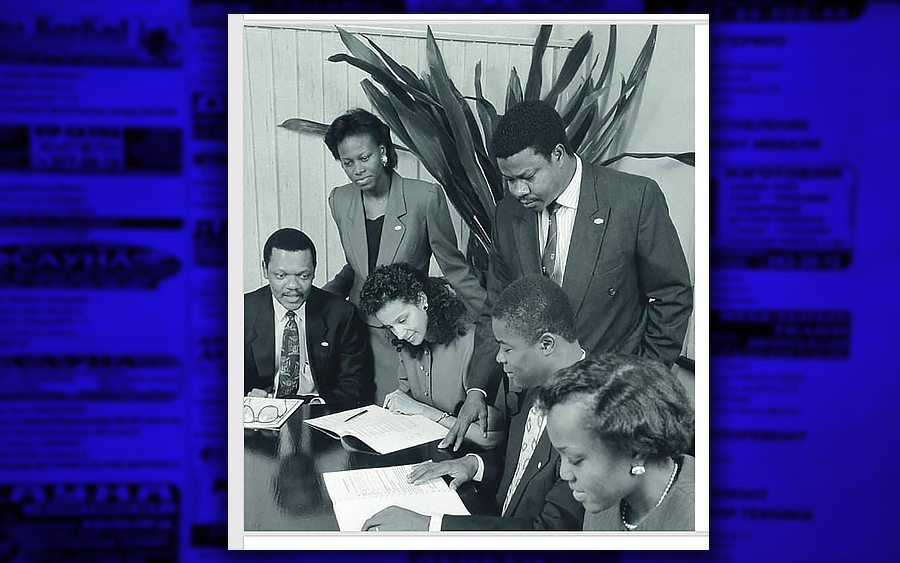

READ ALSO: Atedo Peterside shares throwback picture of pioneer Stanbic IBTC staff members

Why he chose his career path

In a tribute to his father in 2016, Atedo recalled that his father’s profession as a medical doctor meant that he was always on call and hardly at home with the family. Much as he wanted to follow his father’s footsteps and be a “force for good,” Atedo knew even then that there had to be another way to make positive impacts in the world without being a medical doctor.

“Because you were permanently ‘on call’, I decided from a very early age that there must be alternative paths to earning a decent living outside of medicine, which looked like a thankless job to me,” he wrote in the tribute.

Even though that was the time when it was more fashionable to take a career as a medical doctor or a lawyer, Atedo would not go with the flow.

The consciousness that some ‘good soldiers’ had been killed in the coups, political crisis and civil war in the 1960s also discouraged him from toeing that line. The stories of the war, as he later noted, was his first painful encounter with the concept of “collateral damage,” and it seemed so unfair that people should have to suffer such consequences trying to put things right in their fatherland.

It was then that he decided he was going to be an entrepreneur and settled for studying Economics when he went to the United Kingdom for his first degree.

After schooling, Atedo started his banking career with full consciousness of his main objective – becoming an entrepreneur. He took up a job with the NAL Merchant Bank (now known as Sterling Bank Plc), which was considered one of the foremost merchant banks at the time. He already knew for a fact at this time that he wanted to go into Investment banking. And he wanted to own one of such banks.

READ ALSO: Royal Rumble at first trading week of Q3 2020, ASI down 1.99% WoW

While talking about this years later, Atedo said “I was more of an entrepreneur who just happened to be in banking. I took to banking as a career with the clear intention of becoming a bank entrepreneur.”

With these dreams in mind, he attended the Owner/President Management Programme at the Harvard Business School from 1991–1993.

Founding IBTC

Despite knowing that he wanted to start a bank, Atedo had to stay on for 10 years at NAL Merchant Bank. The Central Bank of Nigeria’s regulations at the time stipulated that one needed at least 10 years of banking experience to qualify as the Chief Executive Officer of a bank.

“I stayed for 10 years, not because I couldn’t have started it earlier, but because I needed to have the required 10 years’ experience. And as soon as I did, I went ahead to start the bank,” he said.

To get a bank started around the time Peterside founded Stanbic IBTC, one had to apply for a banking license and also get investors, which at the time was not so easy. So Chief Peterside started off the process by investing in the bank. Atedo had insisted that it would be inappropriate to seek outside investors for a venture which his own father was afraid of.

READ MORE: Atedo Peterside says Nigerian Youths can’t start a bank at 33

Atedo recalled that this act of belief reinforced his desire to preserve the bank’s capital at all cost, knowing that he did not only have his money at stake, but that of his father and other shareholders. He stayed as CEO for 18 straight years after incorporation, taking the bank through the early tough years. Under his watch, the bank continued to grow steadily, showing good figures year after year.

“I don’t think being a CEO at age 33 was such a big issue” he later remarked. “It was being a founder, largest shareholder and entrepreneur, and being the pillar carrying the bank, that was where the pressure really came from. It was a case of being at the forefront taking decisions and bearing the consequences.”

Values he had gotten from his father came in handy at this time. “My father trained me to disbelieve first and question the message anyone was giving me and only proceed if the proposal makes sense to me,” he recalled.

It was courtesy of this trait that he never fell prey to fraudsters in his business. Fraudulent schemes were popular at the time, with some of them pitching fake businesses to investors and banks. Unfortunately for them, they soon understood that it was a waste of time trying to get IBTC.

The experience of working under (now late) Chief Wole Adeosun, his Managing Director and former boss at NAL Merchant Bank, had also given him sufficient exposure. He admitted that the responsibilities which he had to handle so early in his career helped build his confidence, reassuring him that he could run a bank.

Acquisitions and mergers

When CBN raised the minimum capital base for banks to N25 billion in 2005, IBTC acquired two commercial banks – Chartered Bank Plc and Regent Bank Plc. Consequently, IBTC became a universal bank on 19 December 2005, with a new name – IBTC Chartered Bank Plc.

In 2007, the bank again merged with Standard Chartered Bank to form the Stanbic IBTC Bank Plc, and Atedo was elected Chairman in October 2007.

About the merger, he remarked that it was a deliberate decision not influenced by any financial or technical problems in the bank.

“We could have gone on without the merger and still not had any problems. It was a decision we made after 18 years and we took it because we thought we had seen the right banking partners that will take the bank to the next level.

“Also as a founder, I was concerned about the careers of those who had given their lives and careers to grow IBTC, and my priority was getting them into an arrangement and institution that could go on forever so that they could have safe and secure jobs and careers,” he later said.

The wisdom in his decision can be seen in the fact that lots of the staff who had worked with him in IBTC went on to have fulfilling careers in the new entity even long after he left.

For instance, Sola David-Borha, who was his deputy from IBTC and later at Stanbic IBTC, succeeded him as MD and went on to become head of Africa region for the parent bank.

Another principle which Atedo enforced as MD was using merit as a first criterion in all recruitments and appointments. Not even gender or ethnicity could get anyone an appointment unless he was first qualified, and Atedo insisted that he did not mind having all males or all females if those were the most qualified persons.

The implication of this practice was that the bank often had more female representation in its management than other banks, and sometime in 2004, it was the only bank that had more females on its management team than males.

The bank also had a lot of qualified bankers coming in, because they knew that it was an environment where they would be allowed to thrive irrespective of gender, ethnicity or other factors.

Handling Challenges

As CEO and later Chairman of a big bank, Atedo had to deal with many challenges. But he would later recall that the most significant challenge came in October 2015 when the Financial Reporting Council of Nigeria accused the bank of falsifying its 2013 and 2014 accounts by including sums which had not been disbursed as part of its operations costs.

It was a bad day for the bank, especially since the regulatory agency had taken its accusations public whilst asking the bank to withdraw and rectify the statements. The bank’s management also went public with its explanation. Even though the funds had not been disbursed at the time the financial reports were sent in, they had to be included in order to make provisions for disbursement later.

The explanation should have helped set issues straight but this was not to be. As a matter of fact, the issue dragged on for over a year until the Federal Government appointed CBN to conduct an investigation into it. Eventually, CBN cleared the air and upheld the bank’s practice as the standard – making provisions for the expenses which formed part of its operations costs.

“I was conversant with all of the accounts and I knew we had done nothing wrong. The only issue was getting everyone to see it. I was also very confident in the team that I had built,” he said in an interview later.

In his resignation notice later on, Atedo stated that he planned to leave the company in 2015, but the protracted dispute with the Financial Reporting Council forced him to delay his plans.

Pursuing other interests

After seeing to the end of the issues with regulatory agencies, Atedo Peterside retired as Chairman in March 2017. Although he still had interests in the bank, he wanted to give more time to other interests. However, he remained on the boards of both The Standard Bank of South Africa Limited and Standard Bank Group Limited.

His focus after this time was the ANAP Jets Limited which he had started while still heading the board in 2015. He is the Chairman of ANAP Jets Limited, as well as a major shareholder. ANAP Jets provides fractional ownership platform, charter and aircraft management services, to serve the business sector, taking care of every detail in operating, maintaining, crewing, catering, and fueling the jet.

The company has a technical partnership, which brings in Aliserio S.r.l. (formerly Eurofly Service S.p.A.) chaired by Mr Rodolfo Baviera, Aliserio S.r.l., of Italy as a technical partner. Not only is the company over 40 years old, Mr. Rodolfo Baviera has also been the Chairman of The European Business Aviation Association between 2000 and 2016, giving him the expertise and network needed to make a valuable technical partnership.

Atedo also served as board Chairman at Cadbury, and board member of Nigerian Breweries (Heineken subsidiary), Unilever and a Non-Executive Director of Flour Mills Nigeria Plc, until the onset of the pandemic when he resigned to devote more time to combatting the pandemic under the auspices of the ANAP foundation COVID-19 think tank.

He is the Chairman of ART X Collective Limited and Endeavour High Impact Entrepreneurship Ltd/Gte, a non-profit organization that provides mentorship and support to scale-up companies. Mr Peterside also serves on the African Advisory Board of the Prince’s Trust International.

Obviously, his hobbies of boating, polo, reading and traveling are not enough to occupy the 65-year old as he continues to pick up new pursuits. Now, he concerns himself with influencing public policy for a better society and has served on several committees at the instance of the government.

READ ALSO: CBN imposes fresh CRR debits on banks to the tune of N118 billion

“I am sad that today, no young Nigerian at age 33 can start a bank the same way I did because the rules will not even permit him. I feel like the rules have been rigged against the younger generation and that is why you see most of them going into the creative arts like singing, dancing and acting because that is where they feel they have an advantage over the older generation. We need to look at influencing public policy to give them competitive advantage in every sector including public offices,” he said.

Without entering the theatre like his father, Atedo has made his mark in his chosen path. However, what will speak most for the tireless entrepreneur are the professionals whom he has mentored in the banking industry.

He was conferred with an honorary Doctor of Science Degree by the University of Port Harcourt, Nigeria, and also elected an Honorary Fellow of the Chartered Institute of Stockbrokers on 1 April 2019.

A point of correction on this statement: “In 2007, the bank again merged with Standard Chartered Bank to form the Stanbic IBTC Bank Plc, and Atedo was elected Chairman in October 2007.”

IBTC Chartered Bank merged with Stanbic Bank Nigeria, not Standard Chartered Bank.

This caught my attention too.

A wonderful write-up all the same.

I didn’t know this much about Atedo until i read this piece.

Kudos Ruth.