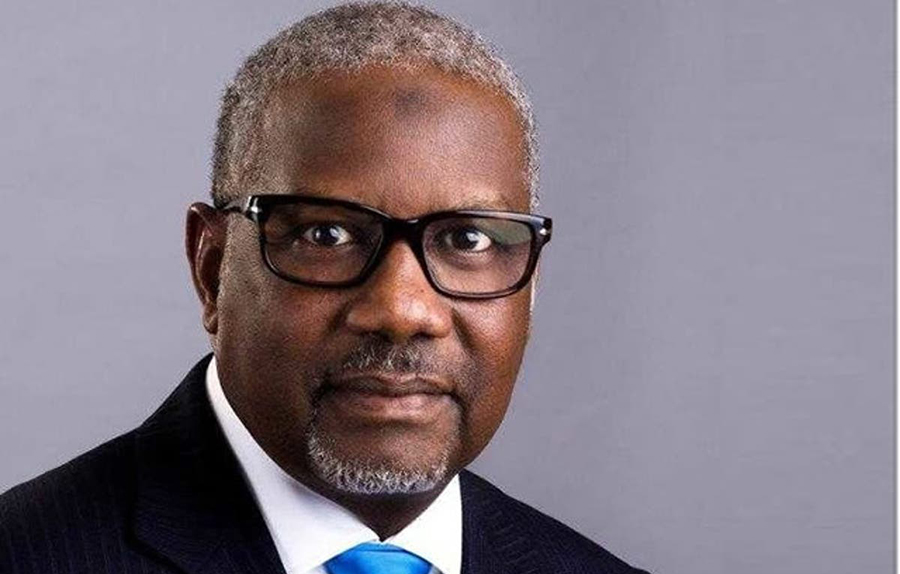

The President of the Manufacturers Association of Nigeria (MAN), Mr Mansur Ahmed, announced on Friday that the recent CBN unification of Nigeria’s exchange rate is a welcome development that will boost investor confidence in Nigeria.

He said the exchange rate unification will enable stable planned production for manufacturers in Nigeria leading to economic growth, adding that the Manufacturers Association had urged for an exchange rate unification to enable a market-friendly business environment in Nigeria.

“Clearly, this is a welcome development and a laudable initiative that has come at the right time. This is more so, particularly, now that the economic outlook is gloomy in light of the impact of the ravaging COVID-19 pandemic that has culminated in uninspiring macroeconomic situations,” he said.

He revealed that the World Bank had attributed Nigeria’s falling Foreign Direct Investment (FDI) to the multiple exchange rates as investors felt a “manipulation of the foreign exchange market.”

“The unification will also boost investors’ confidence, control rising inflation, and promote transparency, entrench better exchange rate management and eradicate distortions to the barest minimum,” he added.

READ MORE: After hitting a 3-year low during the week, Naira stabilizes as traders wonder what next)

He urged the CBN to tackle activities that made speculators manipulate the multiple rates like “round-tripping” which he says expand the inflows of foreign investment into the economy.

He called on the Central Bank to implement 2 strategies to ensure a smooth transition into a unified exchange rate system.

Explore Economic Research Data From Nairametrics on Nairalytics

“The first is to limit the short-term pains until efficiency gains materialize by responding swiftly with an inward-oriented rescue guideline while the second should seek to boost the pace at which such efficiency gains materialize,” he said.

He advised, it’s necessary the CBN “submit all the instruments of exchange rate determination” towards a free-market approach.