Unity Bank Plc’s audited result and accounts for financial year ended December 31, 2019, showed impressive performance as the lender migrated from two years’ consecutive losses to profitability and growth.

Despite the low yield environment during the period, the Bank was able to improve on its total operating income and reduced operating expenses to boost profitability.

After 2017 balance sheet clean up, the bank reported improved balance sheet growth with increases in lending to customers and improved deposits.

The Executive Director, Finance & Operations at Unity Bank, Ebenezer Kolawole at a virtual media briefing recently expressed that the significant increase in total assets in the last three years is great achievement for the management and staff of the bank.

READ ALSO: Unity Bank breaks barriers, introduces USSD code in local Nigerian languages

According to him, “The growth of about 40 per cent in total asset is a great achievement and we also need to look at the bank’s assets base in the last three years.

“In 2017, we closed with total assets of N134 billion. In 2018, it grew to N210 billion and in 2019, we reported N293 billion total assets.”

For the first time in the past five years, the bank declared gross earnings of N44.59 billion and N293 billion total assets, thereby consolidating on the gains on the reforms instituted by the Bank to grow a healthy balance sheet for the past two years.

The bank has improved on its lending to the real sector with over N100 billion granted as loans and advances to customers in 2019.

The solid financial performance for the period ended December 31, 2019, affirms Unity Bank as one of the leading banks in terms of resilience and a transformed bank amid a challenging business environment in Nigeria.

The 2019 results revealed a number of positive performances as the management continued to reposition its stands on value creation for shareholders and improved on lending to the real sector to support the federal government’s drive to revive the nation’s economy.

Reduction in OPEX, Increase in Total Operating Income Drive Profits

Unity Bank for the period under review reported 28.7 per cent increase in gross earnings to N44.59 billion in 2019 from N34.65 billion reported in 2018.

The bank interest income also increased by 21.8 per cent to N35.95 billion in 2019 from N29.5 billion in 2018, over increasing interest generated from loans and advances to customers that moved from N17.64 billion in 2018 to N21.89 billion reported in 2019. Also. interest generated from placement from other banks moved from N361 million in 2018 to N632 million reported in 2019.

More so, interest expense grew by 25 per cent to N19.45 billion in 2019 from N15.5 billion reported in 2018, even as attributed higher bank charges closed 2019 at N10.12billion in 2019 as against N7.7 billion reported in 2018.

Continuing the trend during the year, Net interest Income was stronger in 2019, gaining 18.1 per cent to N16.49 billion in 2019 from N13.97 billion in 2018.

In terms of fees generated from banking operations, the lender reported N4.98 billion net fee and commission income in 2019 from N2.3 billion reported in 2018, an increase of 11.3 per cent.

The Bank improved on its Electronic transactions amid gaining more customers and rolling out more ATMs and POS at strategic locations across the country.

Kolawole explained that “in agriculture, we have over 1.5 million farmers in our primary production that banked with us and the number continued to grow as we speak.”

For the year under review, Unity Bank reported a 31.5 per cent increase in total operating income to N25.13 billion in 2019 from N19.11 billion reported in 2018.

On the cost side, total Operating Expenses (Opex) dropped by 5.5 per cent to N19.6 billion, as against N20.7 billion in 2018, which is below average inflation rate within the period, a reflection of cost-efficiency gains.

The Bank had embarked on several cost minimization initiatives that have continued to yield positive results as personal expenses dropped to N9.43 billion in 2019 from N9.98 billion reported in 2018 while other operating expenses moved to N8.37 billion in 2019 from N9.35 billion in 2018.

Kolawole speaking on cost said, “We have tried to reduce our cost because that is within our control. We have tried to make sure we do not have any waste at all. We make sure where our money is going to, money is coming back to the bank.

“This has contributed to improved cost to income ratio of Unity bank and it has helped us showcase our impressive 2019 financial year performance.”

Notwithstanding the challenging business environment in Nigeria, the Bank’s Profit Before Tax was impressive at N3.64 billion, compared to a loss of N7.55 billion reported in the 2018 financial year.

Furthermore, the Profit After Tax closed positive in 2019, reporting N3.38 billion in 2019 compared to a loss of N7.7 billion reported in 2018.

Stronger Assets Amid CBN Lending Policy

Unity bank closed the year with a 39 per cent increase in total assets to N293 billion from N210 billion in 2018 following an impressive performance in gross loans and advances to customers and customers’ deposits.

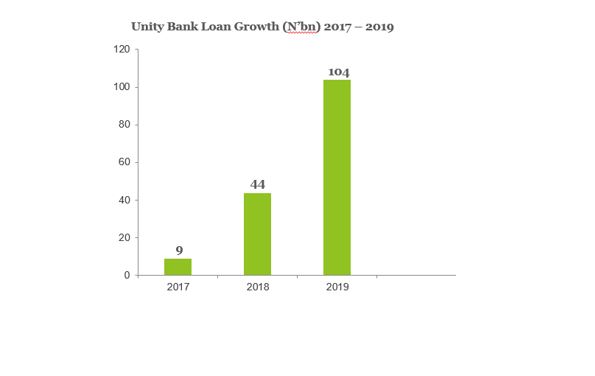

Kolawole said: “We have been able to move our loan trajectory. We have also been able to move from N9 billion in 2017 to N44 billion in 2018. It also increased to N104 billion in 2019.

“Between 2018 and 2019, we have about 104 per cent growth in our loans and that has helped us deliver value and meet the expectation of Central Bank of Nigeria (CBN) in terms of Loan-to-Deposit ratio.”

He explained further that “we have supported key real sector most especially the agriculture sector despite the low yield, we are proud of ourselves for supporting that sector.

“We made sure to give attention to the production of rice, maize among others. We partnered with the farmers to deliver excellent services to the agriculture sector.”

The CBN had mandated commercial banks to lend 65 per cent of the deposit to support real sectors of the economy and Unity Bank last year did a loan of about N104 billion, 136 per cent increase over N44 billion reported in 2018.

Unity Bank’s Customers’ deposits also rose by 104 per cent to N257.69 billion in 2019 from N126.21 billion reported in 2018.

Kolawole further noted that customers’ savings continued to improve on a daily basis as the management continued to deliver products that meet the savings needs of Nigerians.

“To be able to win more savers in this magnitude, it takes a lot of effort. We delivered customer-centric products that met their needs.”

This reflected increased customer confidence, enhanced customer experience early wins from the ongoing business transformation programme and the deepening of its retail banking franchise.

Market Confidence in Our Repositioning Efforts – CEO

Commenting on the Bank’s performance, the Managing Director/Chief Executive Officer of Unity Bank, Mrs. Tomi Somefun said that “the potential in many aspects of the business as reflected in the growing balance sheet of the Bank is indicative of market confidence in our repositioning efforts”.

“It is also noteworthy that playing in the Agriculture Sector as part of growth strategy and as bulwarks to drive value chain businesses in many segments of the retail market have continued to pay off. Looking ahead, we shall consolidate on the gains in the agribusiness, capitalizing on the growing profile in the sector, whilst also focusing on the youth market with increased investment in digital banking,” she further stated.

According to her, “the quest to deepen our retail play will go hand in hand with our focus on digital innovations. Already, we have deployed USSD banking, carried out augmentation of the platform to introduce local languages and further drive financial inclusion and had also launched omnichannel to cater to all segments of the banking public, especially the underbanked. In the coming years, the Bank will be opening more channels and bundled products bouquet for identified cluster initiatives and also leverage and expand relationships with other partners to drive more growth in earnings and profits.”

Meanwhile, the Bank has concluded arrangements to launch a healthcare product called UnityCare to tap into credit support intervention scheme for the Health sector being rolled out by Central Bank of Nigeria as stimulus packages to support the indigenous pharmaceutical companies and healthcare practitioners that hope to build and expand capacity.

The new UnityCare product will thus cater to improve access to affordable credits by players, reduce medical tourism and conserve foreign exchange as well as provide long-term, low-cost financing for healthcare infrastructural development, healthcare product manufacturing, healthcare services and pharmaceutical/medical product distribution and logistics services.

As the Bank’s Executive Director, Finance & Operations, Mr. Ebenezer Kolawole said Unity Bank made these tremendous gains despite the tough operating environment occasioned by the numerous challenges the Nigerian economy witnessed in 2019, coupled with several regulatory headwinds.

“We were able to build our capacity to drive our momentum just to make sure we delivered value. Our challenge was to keep the value up because we were in a capital raising mood and we gave everything to deliver value to our partners,” Kolawole said.

He added: “Overall, it has been a very fantastic year for us as we make sure we have strong liquidity that meets the expectation of CBN and customers. Our capital raising exercise is on course and we’ll make sure all the necessary dots are put in place.”

Analysts are of the view that many things will continue to play in favour of the Bank. Some of these include the sustained effort of the Bank in the area of Agribusiness, the increasing attention of Government and other Agencies in the agriculture sector and the growing interest of the youths in the agribusiness, among others.

How can one get loan from the bank as a customer who have been operating since 2013 and even have some monthly allowance of 30k