There is no doubt that COVID-19 has done some devastating damage to various parts of the Nigerian economy and indeed, the world economy. Price of oil fell so much such that, buyers were figuratively or literarily being begged to buy, stock markets became jittery, unemployment rate spiked, the need for social services skyrocketed, the list goes on and on.

One industry in Nigeria that has remained resilient in spite of it all, is the mutual fund industry. The health and wellbeing of the asset management industry is usually measured or gauged with trends in inflow, outflows, and total Net Asset Value (NAV).

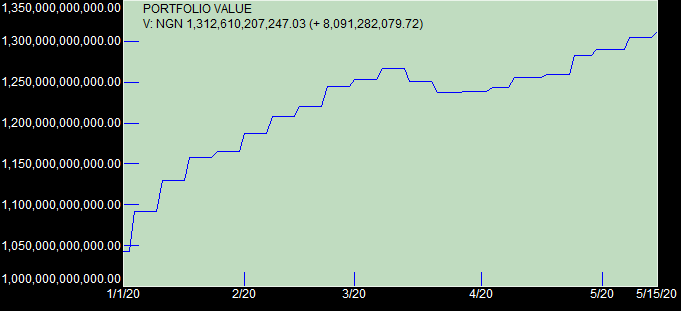

Using those metrics as a measure of the extent to which the Coronavirus impacted the industry, one can say that the mutual fund industry in Nigeria is alive and well, and is defying all the odds against a virulent virus that visited the world with vengeance. Before the advent of COVID-19, early in 2020, the total asset value of Nigeria’s mutual funds stood at N1.042 trillion (according to the December 27th 2019 edition of NAV Summary Report from the SEC). Fast forward to May 15th 2020, after COVID-19 took hold on the world economy, the total net asset value of mutual funds in Nigeria has increased to N1.31 trillion. This represents an increase of N270 billion or 26%

Fund Flows: Of the N270 billion increase in asset value, N260.5 billion came from increase in net flows while N9.5 billion came from investments returns. The fact that the industry saw a positive inflow of that magnitude in periods where people were almost at the verge of dipping hands into their savings and investments is indicative of how resilient the industry has been. Although the industry was shaken by the effects of the virus and the trends in the oil market between March and April, it regained its strength towards the end of April and has since maintained a positive trend.

Flight to Safety: In what looked like flight to safety, much of the positive fund flows went to Bond Funds and Money Market Funds. While Money Market Funds recorded a year to date net positive flow of N97.5 billion, Bond Funds generated N110.4 billion in net inflows. This is the first time any fund category is generating more positive flows than the Money Market Fund category. The reason could be because yields on bond funds are slightly better than what is obtainable from money market funds. Eurobond funds, recorded N12 billion in positive net flows while Infrastructure fund category saw N27 billion come in.

(READ MORE: What you need to know as banks rebrand CBN intervention funds to woo borrowers)

Performance Indicators: In an apparent justification for the flight to safety, almost all funds under the equity fund category made losses except ACAP Canary Growth fund and PACAM Equity fund. In all, that category of funds has lost an estimated N1.2 billion within the period under review. On the other hand, only 6 out of the 21 Bond funds made losses as that category of funds gathered an estimated gain of N3.5 billion. Eurobond funds seem to be basking in the euphoria of Naira devaluation as they gain massively from what is lost from the value erosion in the Naira. The Eurobond category generated an estimated N9.8 billion from January to May 15th 2020. It does look like this category of fund may be a good hedge against Naira devaluation. Much of the gains however, came from Stanbic IBTC Dollar fund and United Capital Euro Bond fund.

Though there are pockets of gains by some funds, most of the categories made lose within the period under review, arising mostly from their increased exposure to the equity market.

Elsewhere in the World: This trend does not seem to be peculiar to Nigeria. Recent news from Canada indicates that Canadian Pension Plans defied the COVID-19 menace and added $17 billion to increase the total net asset value to $409 billion, as at March 31st 2020. Like the Nigerian mutual fund industry, $5.5 billion of the increase in Canada’s pension plans came from contributions or net flows while $12.1 billion was as a result of positive performance.

Future Expectations: The year 2020 is still too young and the world economy too volatile for credible prediction, one can therefore not say with great certainty if the yield driven funds like the Bond Funds and Money Market Funds will maintain the momentum in generating positive gains. In terms of generating positive net flows, it does look like that trend will continue till the end of the year when it becomes clearer what direction the world economy will be heading to following the devastating effects of COVID-19. Until then, we are watching.

- This analysis is based solely on data obtained and obtainable from the Security and Exchange Commission, Nigeria