For anyone who has faced a near death experience being given a second chance to live is an opportunity to redress old ways and start a new life.

In 2018, Polaris Bank experienced a rebirth after its precursor Skye Bank was nationalized. Skye Bank’s acquisition of Mainstreet Bank and its related party excesses had ultimately led to the downfall of the once thriving bank.

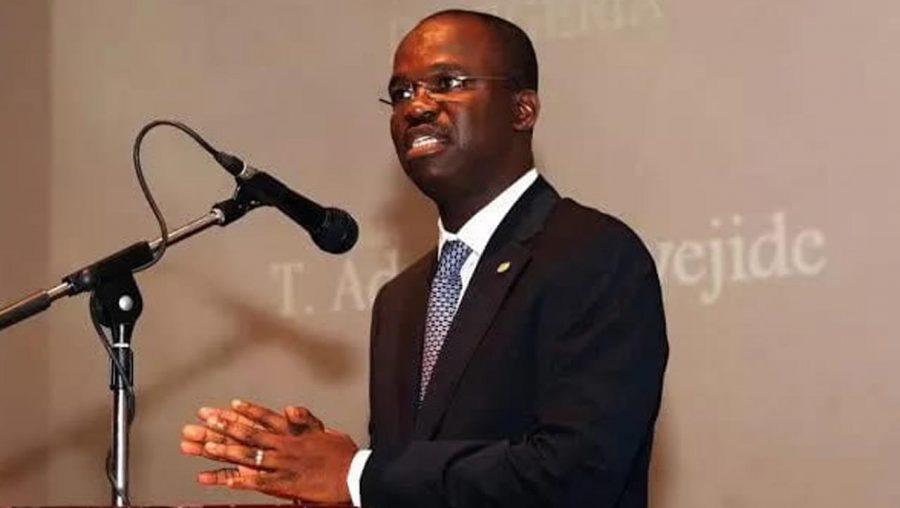

Since then, the bank has undergone a restructuring under the leadership of its CEO Adetokunbo Abiru who took over the bank in 2016 following a CBN action that dissolved the bank’s then board and management.

The bank’s first set of financial statements since its nationalisation was released this week providing an opportunity to see how the bank is taking on its new lease of life under the stewardship of Dr Abiru

This is the banks first set of results in over 4 years and provided a glimpse into its first 20 months as a nationalized bank. The bank reported a profit after tax of N28.5 billion for the year well ahead of tier 2 banks like Sterling Bank, FCMB and Union Bank Plc. The defunct Skye Bank was one of the larger tier 2 banks in its hey days, but one would have thought that its reincarnation will at least need some time to recover before being back in the fringes. A cursory dig at the results provides an insight.

READ ALSO: Access Bank merger: This is what will happen to your Diamond Bank Deposit

It turns out Polaris Bank did what anyone who has just come out near death experience would do, play safe. Out of the bank’s total deposit of N857.8 billion, the bank only recorded loans and advances of N188.7 billion.

No surprises that its loan to deposit ratio was just 22% significantly lower than the CBN approved 65%. In fact, out of its total assets of N1.1 trillion, N518 billon was invested into investment securities like treasury bills and bonds. The rest were either held as cash with banks, CBN and AMCON or invested in assets. Skye Bank had to play safe in its road to recovery.

The result is a 5 folds increase in profits year on year and a return on equity of 33% besting industry best (no pun intended) GTB’s 31.1% as at end of 2019. Out of the bank’s N131.6 billion in interest income N79.1 billion of it came from investment in CBN securities such as treasury bills and the now restricted Open Market Operations (OMO). Same period last year (2018) the bank earned just N15.1 billion from investment securities.

READ MORE: Report identifies banks expected to raise equity after COVID-19 flattens

The bank’s cost to income ratio, a metric for how cost-efficient banks are, also moderated to 68%, again far lower than most of the Tier 2 banks on our radar. The bank also has a high liquidity ratio of 81% compared to the CBN’s 27.5% target.Capital Adequacy ratio of 14% suggest the bank’s capital is just about right for its balance sheet size.

Despite the impressive results Polaris bank still lives with a remnant of its old sickness. The non-performing loans of 46% is one of the highest in the industry despite coming down from the high of 80%. Bringing this ratio down to the single digit level espoused by the CBN for other banks will be an onerous task still.

It may have to write off more loans while it continues to battle multiple lawsuits in its quest to seize assets of chronic debtors. With the outlook for the economy looking gloomy flipping assets and chasing after creditors will only get harder.

Polaris Bank is still a bridge bank so its challenges will take time to be surmounted. The bank’s future probably lies in a marriage or adoption with or by a rival bank. AMCON has been shopping the bank since 2019 and has made little success. The recent charter that First Bank could be setting up to acquire the bank should boost morale especially with this decent result.

READ ALSO: Updated: CBN debits banks N1.4 trillion for failing to meet CRR targets.

Now, the bank is in a good financial position to face scrutiny with some cover. Strong earning numbers and indicative ratios bode well for the target company in a corporate deal.

Before then the bank will have to wait out the Covid-19 pandemic and the effects of the crash in oil prices whole also proving in the next coming months that this result was not a fluke. It cannot afford to relapse.

Thank you for timely updates on happenings in banking industry.

Can we get data regarding profitability, total deposits, assets of banks that are not public? The likes of Keystone Bank and the likes.