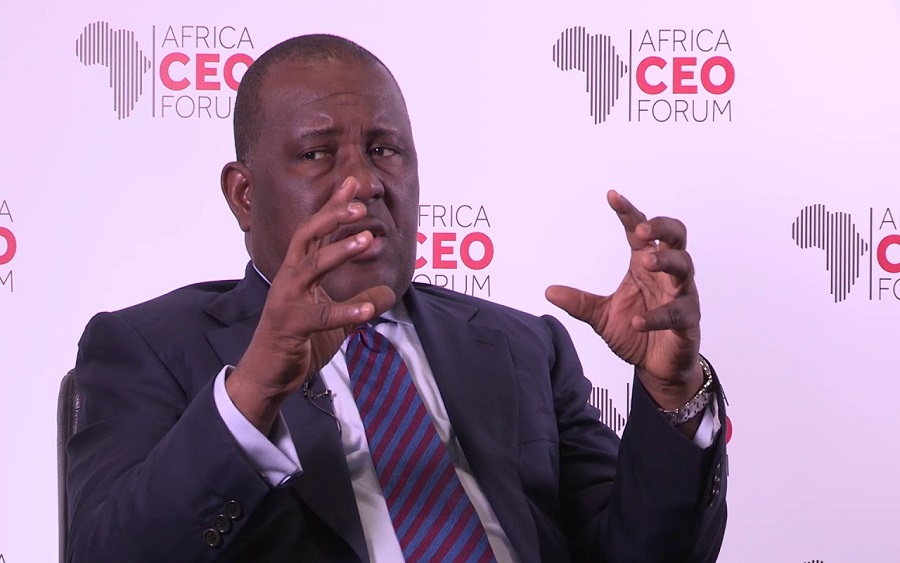

When Abdulsamad Rabiu fell off the Forbes list of Africa’s billionaires in 2015, no one expected him to make the kind of comeback he did 3 years later. Abdulsamad Isyaku Rabiu is the founder and Chief Executive Officer of BUA Group, a conglomerate with interests in agriculture, infrastructure, manufacturing, logistics, and port operations.

He re-joined the list in January 2019 by taking up the number 16 spot, and with a net worth of $1.6 billion. One year afterwards, his net worth had grown to $3.1 billion. This was in spite of the decline of his company (CCNN’s) stock value by a whooping N23.6 billion.

The latest Forbes ranking placed Mr Rabiu as 8th richest person in Africa, ahead of Folorunsho Alakija whose net worth was previously ranked above his.

(READ MORE: COVID-19: Nigerian industrialist, Abdulsamad Rabiu donates N1 billion in cash for support in Nigeria)

Rabiu is the only Nigerian billionaire who can be seen as a serious contender for Aliko Dangote’s numerous accolades – the largest cement producer, the richest man in Nigeria, and the richest man in Africa.

What he did to bounce back

In a 2019 interview with Forbes, the billionaire explained that he had fallen off the list as a result of the naira devaluation. The Nigerian currency had been devalued from N190 to N300 against the dollar. To ensure that he get back to being a billionaire in spite of the setback, Rabiu and his team ensured to undertake deliberate business moves between 2018 and 2019.

In 2018, BUA cement completed construction of two new cement plants–Kalambaina Cement plant line 1, Sokoto state and Obu II Cement plant, Okpella in Edo state and commenced operations. Together, both plants increased the group’s production capacity by 4.5 million metric tonnes, bringing its output to 8 million metric tonnes annually.

The proximity of these plants to major markets was not lost on industry experts, as most analysts pointed out immediately that the BUA boss was warming his way back into the heart of Forbes.

(READ MORE: The Zero to Hero Story of Abdulsamad Rabiu)

Next was the historic merger of Kalambaina Cement, a subsidiary company of BUA Cement, with the publicly traded Cement Company of Northern Nigeria Plc where he holds majority shares. This increased his worth by $650 million.

Shortly after, the BUA group again announced the signing of a contract with world-renowned cement manufacturing company, CBMI, to facilitate the construction of a new Kalambaina Cement plant in Sokoto. This was planned to become the Kalambaina Cement plant line II, and was coming 7 months after commissioning the line I.

According to Rabiu, the 3 million MTA plant, which was expected to boost the group’s capacity to 11 million metric tonnes per annum, was in line with the company’s strategic midterm expansion programme, and meant to serve the Nigerian market in view of the projected infrastructural growth in the coming years.

By the last quarter of 2019, BUA announced the merger of the publicly listed CCNN and the 6 million MTA Obu Cement Company Plc. The mogul must have initiated this merger, understanding what the previous one with Kalambaina cement plant did for his fortunes.

The move was consolidated in January 2019 when BUA Cement Plc listed on the NSE with a market capitalisation of N1.2 trillion.

Indeed, Abudulsamad Rabiu has demonstrated that big moves equal big money.