According to a publication by The Nation print media, there are indications that the National Insurance Commission (NAICOM) will extend the deadline for the recapitalisation of insurance and reinsurance companies for the second time.

The publication cited that the Commission is concerned about the negative impact of COVID-19 pandemic on the exercise. Prior to this, NAICOM had announced an extension of the deadline to 31 December 2020 from 30 June 2020 previously.

We recall that in May 2019, NAICOM re-introduced the previously suspended recapitalisation exercise albeit with more stringent capital requirements. Under the revised capitalisation requirements, life insurance firms are required to have a minimum paid-up capital of N8.0 billion from N2.0 billion previously while general insurance companies are required to raise their minimum paid-up capital to N10.0 billion from N3.0 billion previously.

The regulatory capital for composite insurance was raised to N18.0 billion from N5.0 billion previously while reinsurance businesses are now required to have a minimum capital of N20.0 billion from N10.0 billion previously.

[READ MORE: Riding the pandemic wave: Time to stock up)

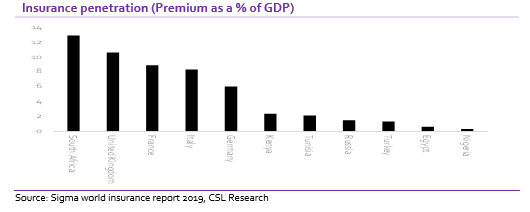

Although we think the recapitalization of the industry is long overdue considering the substantial increase in the value of insured assets as well as the adverse impact of fragile macro conditions since the last recapitalisation exercise in February 2007, we believe the decision to extend the deadline may be imperative in light of the weak investor sentiment, brought about by the dual shock of COVID-19 and the downturn in oil prices.

Accordingly, we think the issuance of debts instruments may come at a very high cost to the players at this time considering the risk premium that will be demanded by investors. On the other hand, raising equity capital does not appear feasible. Some of the under- capitalised players currently have negative book value of equity and are trading below their par values. Weak macro conditions would further deter investors as they remain sceptical on the ability of the players to unlock the potentials in the industry.

Nonetheless, we expect to see a flurry of mergers and acquisitions in the industry once conditions become more favourable.

FG grants three-year tax holiday to 25 companies: The Federal Government has granted a three-year tax incentive to 25 companies under the Industrial Development Income Tax Act. Pioneer status is an incentive from the Federal Government, which exempts companies from basic income tax. The incentive is also known as tax holiday and it is generally regarded as an industrial measure aimed at stimulating investments into the economy.

READ MORE: FG ready for OPEC talks, as brent crude risk plunging to single digit low

This means companies with a pioneer status do not have to pay tax for a certain period of time, thus allowing the firms to get established. This can be a full or partial tax exemption. Source: punchng.com.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State.