The Nigerian Electricity Regulatory Commission (NERC) has suspended the payment of the new electricity tariffs earlier scheduled to take off today, April 1, for at least three months because of the impact of the coronavirus pandemic which has led to a shutdown of most economic activities in the country.

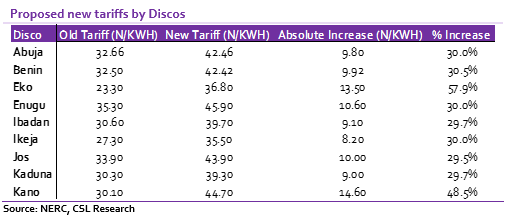

The Nigerian Electricity Regulatory Commission (NERC) had earlier issued the “December 2019 Minor Review of MYTO 2015 and Minimum Remittance Order for the Year 2020” to all DisCos which was expected to take effect from 1 April 2020.

The commission and other industry players are, however, concerned that a review of tariffs at a time like this would worsen the situation of the average Nigerian, majority of whom are daily wage earners who cannot earn any income, particularly with the lockdown in FCT, Lagos and Ogun states.

According to NERC, the delay will give them a chance to negotiate and get commitments from the DisCos for service level improvements which must be commensurate with the extent of the planned tariff increase. The issue of a hike in electricity tariff has been a contentious issue for some years now.

[READ MORE: Dangote Cement Plc: Frail macro conditions to pressure earnings in 2020)

In 2015, NERC tried to implement cost-reflective tariffs proposing a 45% hike, following which labour unions took it to court. Consequently, tariff hike plans have been on hold since then. The argument by those against a hike was that, given persistent inflationary pressures on households and shrinking consumer wallets, it would have been unreasonable to introduce tariff hikes.

On the other side of the divide, many also argue that they will like to see an improvement in power supply to households before they can agree to further tariff hikes.

While we agree totally with the suspension of any tariff hike considering current conditions, we remain staunch proponents of cost-reflective tariffs, as we believe low tariffs have a ripple effect on the entire value chain and in turn the development of the power sector. Accordingly, we believe the implementation of tariffs that reflect market conditions will be a major boost towards improving electricity supply in the country.

Although revised tariffs are scheduled to take effect from July, we understand that the revised tariffs are still not cost-reflective and require the government to pay the shortfall to the DisCos.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State.

Really, I do believe they have implemented the increase on the Prepaid meters. I thought it was because of the lockdown until I checked night time (12 midnight to 6a.m) usage which has doubled since Apr 1st.