There are indications that hard times await Nigerians, especially civil servants working with state governments, as states may owe salaries in coming months. This was disclosed by the Kebbi State government when it lamented over the shortfall in the states` revenue, caused by the outstanding disbursement of federal allocation.

It may be difficult for them to survive if there fears of non-payment of salaries become reality, as state governments order sit at home to workers, a move made to curb the spread of Coronavirus (COVID-19).

What it means: Due to the crash in global oil prices, state governments have not received federal allocation for the month of March 2020. From all indications, workers in states like Osun, Ekiti and Kogi among others that have outstanding salaries issues may face difficult times.

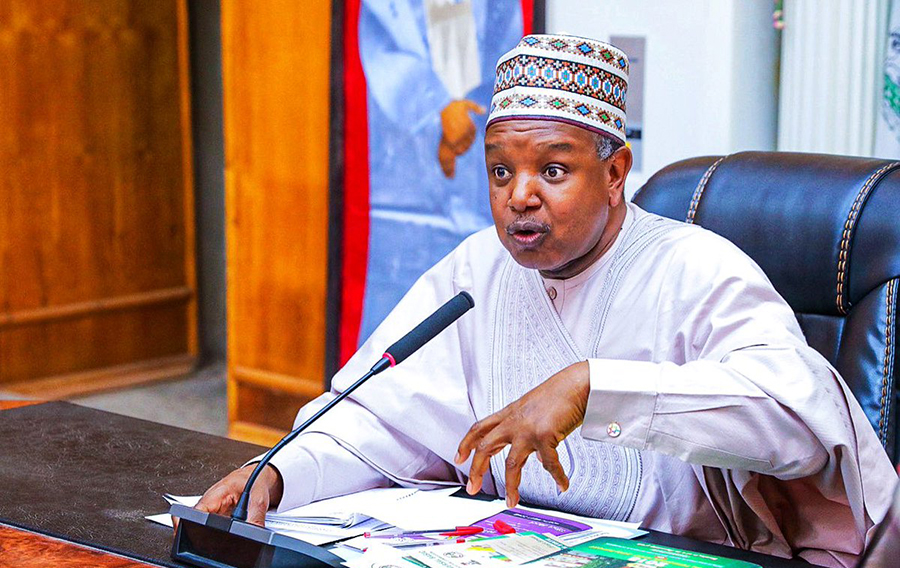

According to the governor, Atiku Bagudu, the salaries and pensions of workers would be paid for the month of March, but subsequent months appear very uncertain as the Federal Government allocation has not yet been disbursed to any state.

The governor spoke at an emergency stakeholders’ meeting in Birnin Kebbi, to chart the best course of action for the financial future of the state, in the face of the looming global economic meltdown.

[READ MORE: The good, bad and ugly of low oil prices for Nigeria)

Bagudu expressed concerns that the slump in oil prices could mean a drop in federal allocation, and informed the stakeholders that if federation allocation falls below the monthly salary bill of the state – estimated at N 1.95 billion – salaries may not be paid in subsequent months.

Bagudu informed the forum that the Coronavirus pandemic had hit hard on the Nigerian economy, making it impossible to market her crude oil, and the situation was worrisome for Kebbi State because it relied heavily on federation allocation without any major source of internally generated revenue.

Meanwhile, Nairametrics had reported that members of the Federal Account Allocation Committee (FAAC) disagreed over the amount presented by revenue-generating agencies for allocation to the Federal Government, State and Local governments.

The committee had met to deliberate and approve the amount that would be shared by the three tiers of the government. However, it was not impressed with what was made available.

The meeting, presided over by the Minister of Finance, Budget and National Planning, Zainab Ahmed, had in attendance, commissioners of finance from the 36 states in Nigeria.

It was reported that the amount presented for sharing by the revenue-generating agencies for the month of February 2020 was lesser than expected, so it left the committee disgruntled, causing the meeting to end abruptly, an official of the Ministry of Finance said.

READ MORE: FAAC disburses N650.8 billion in December 2019, South-South states receive highest share)

Possible reason for allocation drop: Government revenue has dropped in recent times. The Federal Inland Revenue Service (FIRS) did not meet up with its set revenue target of N8.8 trillion in 2019.

According to data from FIRS, the agency generated N5.26 trillion in 2019, which is just 59.8% of the target. And the new FIRS boss, Nami has stated that the tax agency might not meet the target for 2020.

Also, due to the development in the global oil market, as the oil price war between Russia and Saudi Arabia intensifies, government revenue is declining. The oil price war led to the crash of oil price as Brent crude oil fell to $28.14 per barrel – the lowest since 2003.

READ ALSO: 10 Nigerian companies pay a combined N187.9 billion taxes in first half of 2019

The Auditor-General of Kebbi State, Alhaji Faruq Makera also made a comparative analysis of Kebbi revenue earnings and noted that there were glaring economic challenges due to its slim budget.