Fitch Ratings, one of the biggest credit rating agencies, has expressed fears over the continuous depletion of the nation’s external reserves.

The American credit rating agency has disclosed its plans to downgrade Nigeria’s sovereign rating from B+ to Negative if the constant attempt by the country to defend the Naira, despite the continuous decline in crude oil price, eats into the nation’s external reserves.

It would be recalled in February that one of the big three credit rating agencies, Standard and Poors, reviewed downwards its outlook on Nigeria from ‘stable’ to ‘negative’ while affirming the country’s long and short-term sovereign credit ratings at ‘B/B’.

This was mostly due to the decrease in the country’s external reserve from $45.1 billion as of June 30, 2019, to about $38 billion as of January 31, 2020. The decline in the external reserve has persisted as it now $36.18 billion.

In December 2019, Fitch Ratings revised the outlook on Nigeria’s long term foreign-currency issuer default rating (IDR) to ‘Negative’ from ‘Stable’, but affirmed the country’s sovereign credit rating at B+. However, Fitch’s Middle East and Africa sovereign analyst, Jan Friederich, hinted that the B+ rating could be revised downwards to negative.

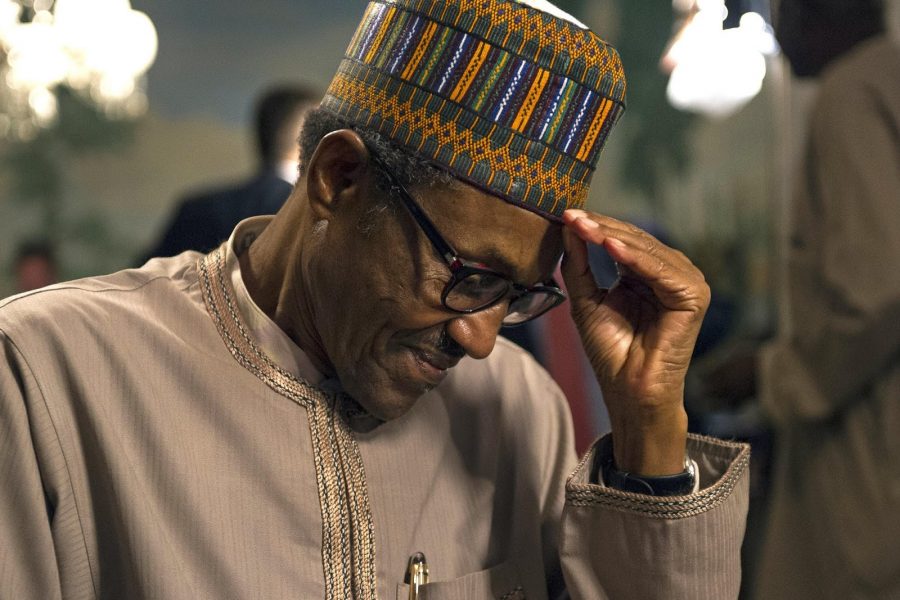

[READ MORE: Fitch rates Nigeria lower, blames Buharinomics for economy crisis)

Friederich, disclosed this yesterday in an interview with Reuters, stressing that if the recent huge drop in the price of crude oil persists, a further downgrade of the sovereign ratings of exporter countries with weaker finances and pegged exchange rates would most likely occur.

He pointed out that oil prices are likely to stay low for some time and as such, the global rating firm would focus on some prominent oil-exporting countries like Saudi Arabia, Oman, Nigeria, Iraq and Angola.

He also went further to say that Saudi Arabia’s financial reserves and its sovereign wealth fund provided a buffer but that there was no ‘infinite leeway’ in the country’s A (stable) rating for the buffers to disappear.

Nigeria’s B+ (negative) rating could face problems if sustained effort to defend the country’s currency further depletes the external reserves.

Sovereign credit rating usually refers to an independent assessment of the creditworthiness of a country or sovereign entity. It indicates the risk level of the investing environment of a county. This usually gives investors insights into the level of risk associated with investing in the debt of a particular country, including political risk.