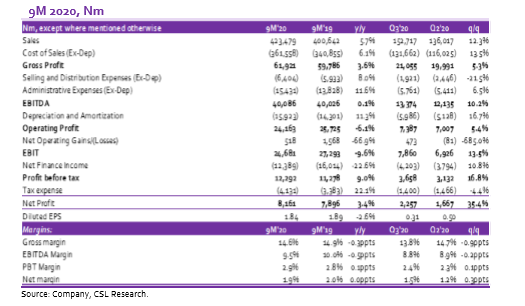

Flour Mills Nigeria Plc (FMN) released its 9M 2020 financial results showing a 5.7% y/y growth in Revenue to N423.5 billion from N400.6 billion in 9M 2019. On a q/q basis, Revenue grew significantly, up 12.3% q/q to N152.7 billion in Q3 2020 from N136.0 billion in Q2 2020.

Net Income was up 3.4% y/y to N8.2 billion in 9M 2020 from N7.9 billion in 9M 2019 but grew stronger on a q/q basis, up 35.4% to N2.3 billion in Q3 2020 from N1.7 billion in Q2 2020.

We raise our Revenue forecast for FY 2020 following strong improvement recorded in Food Revenue and positive surprise in Agro-allied business driven by Fertilizers and Animal feeds sale.

We also note that the underlying driver of the positive Revenue is the closure of the border which we expect to remain in place for the rest of the financial period. We note the company is coming off a high tax base which we expect will result in significant Net Profit growth for FY 2020.

[READ MORE: Zenith Bank: Strong growth in Non-Interest Income offset weakness in Interest Income)

We raise our target price to N25.90/s from N23.66/s previously, implying a 12.6% upside from Friday’s closing price of N23.0/s. We note the increase in our target price reflects lower yield environment. We retain our BUY recommendation on the stock. Our valuation methodology is a Single stage 5-Year FCFF model.

To read the full report, click here.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.