Based on data from the Advisory Power Team in the Office of the Vice President, the nation’s power sector lost an estimated N19.15 billion in 10 days. This is due to constraints from insufficient gas supply, distribution and transmission infrastructure. The losses were recorded in the 10 days to February 14, 2020.

Despite the privatisation exercise that was carried out in 2013, the fortunes of the nation’s power sector are yet to experience a turnaround as the investors that emerged from the unbundling of Power Holding Company of Nigeria (PHCN) are still grappling with the age-long problems that have plagued the sector.

Insufficient gas supply, weak transmission infrastructure, absence of cost-reflective tariffs and poor metering systems have remained largely unresolved. In recent times, the collapse of the national transmission grid has become a recurring theme.

We acknowledge the ongoing efforts of the government to reposition the ailing power sector particularly with reference to the agreement reached with Germany-based Siemens AG. The agreement provides a blueprint on improving power generation and fixing the archaic transmission and distribution infrastructure.

However, since the agreement was signed in July 2019, there has been no update. We expressed our concerns around Siemens’ position in the power value chain given the huge investment it is committing to the project.

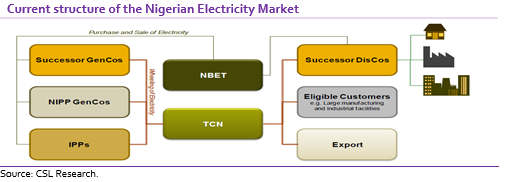

The Transmission Company of Nigeria (TCN) is currently 100% owned by the government while the GenCos and DisCos are privately controlled. While we see a possibility of Siemens getting a stake in TCN, we struggle to see how that will work for then DisCos and GenCos given that Siemen’s huge investments may mean they have to cede control. Also, the government’s desire to maintain a stranglehold on the power sector in a bid to regulate electricity tariffs remains a key risk to any investment in the sector.

[READ MORE: Agriculture: CBN’s revised policy on the dairy industry)

We remain, staunch proponents of cost-reflective tariffs, as we believe low tariffs have a ripple effect of the entire value chain and in turn the development of the power sector. Accordingly, we believe the implementation of tariffs that reflect market conditions will be a major boost towards improving electricity supply in the country. Although revised tariffs are scheduled to take effect this year following the December 2019 Minor Review of MYTO, we understand that the revised tariffs are still not cost-reflective.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.