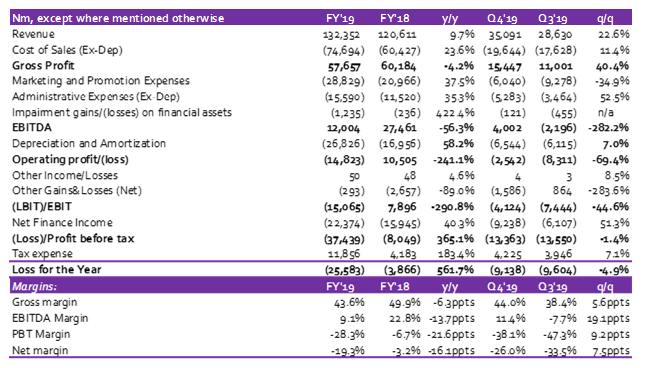

Yesterday, International Breweries released its UNAUDITED results for Q4 2019, thus we merged the results with 9M figures to arrive at our FY 2019 figures. Based on the merged numbers, the company recorded a 9.7% y/y increase in Revenue to N132.4 billion in FY 2019 from N120.6 billion in FY 2018. While Revenue was up on a q/q basis (up 22.6% q/q) due to increased activities during the festive period, our concern is on the y/y decline in Revenue within the quarter (Q4 2019 revenue declined 5.8% y/y compared to Q4 2018).

The y/y decline within a quarter is occurring for the second consecutive quarter after the last round of excise hike. In our opinion, we believe the increasing excise is creating a strain on Revenue growth and the company may be forced to raise prices in line with other competitors with another phase of tariffs expected June.

Cost of Sales (adjusted for depreciation) grew 23.6% y/y to N74.7 billion in FY 2019 from N60.4 billion in FY 2018. The growth in Cost of Sales was driven by double-digit growth in raw material cost which was faster than the growth in Revenue and implies increasing cost per unit. We believe the growing cost is due to elevated malted barley prices.

Consequently, Gross margin declined, down 6.3ppts y/y to 43.6%. In addition, Gross profit followed a similar trend, declining 4.2% y/y to N57.7 billion in FY 2019 from N60.2 billion in FY 2018.

Operating Expenses (adjusted for depreciation) grew significantly, up 36.7% y/y to N44.4 billion in FY 2019 from N32.5 billion in FY 2018. We note the company continues to spend heavily on building its brand via widespread public awareness and promotional activities.

This was evident in the 37.5% y/y surge in Marketing & Promotion Expenses (up 37.5% y/y) while Administrative Expenses adjusted for depreciation increased by 35.3% y/y. Consequently, EBITDA fell 56.3% y/y to N12.0bn in FY 2019 from N27.5bn in FY 2018 while EBITDA margin was down 13.7ppts to 9.1% in FY 2019.

[READ MORE: Flourmills posts impressive Q3, sustains recovery in 2020 financial year)

Furthermore, Depreciation Expense grew significantly, up 58.2% y/y to N26.8 billion in FY 2019 from N17.0 billion in FY 2018. We note the jump in Depreciation Expense is due to the commencement of depreciation on Property, Plant & Equipment associated with the opening of the Sagamu plant. These assets were previously classified as Assets in Course of Construction and were not depreciated. Against this backdrop, IntBrew recorded a Loss before Interest & Tax of N15.1 billion in FY 2019 compared with a profit of N7.9 billion FY 2018.

IntBrew’s bloated debt book continues to pressure earnings as Net Finance cost increased 40.3% y/y to N22.4 billion in FY 2019 from N15.9 billion in FY 2018 on the back of higher Finance Costs (up 39.6% y/y) and lower Finance Income (down 97.9% y/y). Consequently, loss before tax worsened to N37.4 billion in FY 2019 from N8.0 billion in FY 2018 while a tax credit of N11.9 billion cushioned loss after tax to N25.6 billion in FY 2019.

Note: Our FY 2019 figures are a sum of published 9M 2019 numbers and published Q4 2019 numbers.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.