At the end of the first Monetary Policy Committee (MPC) meeting for the year, which was concluded on 24 January, the committee decided to hike the Cash Reserve Ratio (CRR) by 5% to 27.5% while maintaining status quo on other key policy parameters (MPR; 13.5%, Liquidity ratio; 30%, Asymmetric corridor; +200/-500 basis points).

The committee’s decision to increase the CRR came as a surprise to us as it appears to contradict recent efforts by the CBN to stimulate the flow of credit to the private sector. That said, we suspect that the decision was driven by the need to mop-up excess liquidity in the system to contain inflationary pressures.

Most liquid banks were already exceeding CRR of 27.5% effectively as CBN does not return funds when deposits drop. Even the penalty for not meeting the minimum LDR is a further squeeze to liquidity and before now, a bank like Guaranty Trust Bank had over N500bn sterilized by CBN with effective CRR over 30%.

The rise in CRR will result in further liquidity squeeze for banks, hindering their ability to create risky assets and in turn meeting up with the LDR of 65% stipulated by the apex bank.

Prior to this development, there had been a significant decline in deposit rates as banks were not willing to accept deposits. In some cases, some banks were outrightly rejecting deposits. Accordingly, this led to a decline in funding costs. With this development, we think funding costs may begin to trend higher as banks review their deposit rates to meet their liquidity needs. Some banks have however stated clearly that they will not be forced to lend and would rather have their funds sterilized by CBN rather than give bad loans.

[READ MORE: 2020 Nigerian Equities Outlook: Breaking the Jinx?)

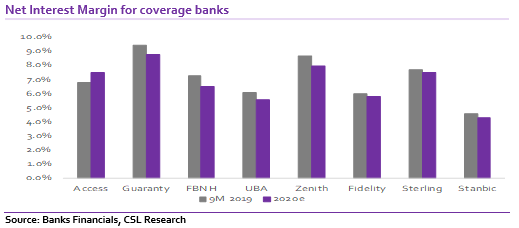

Overall, we believe all of these policies will continue to squeeze bank’s Net Interest Margins in the short to medium term. With yields on NTBills down, lending rates declining in the light of strong competition for loans and continuous liquidity constraints as CBN continues to sterilize funds that should be bearing interest income, we believe assets yield would suffer a steeper discount than funding costs. We had estimated that the big banks in our coverage will suffer an average of 70bps decline in NIMs but with this announcement, we may be faced with a steeper decline.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.

.gif)