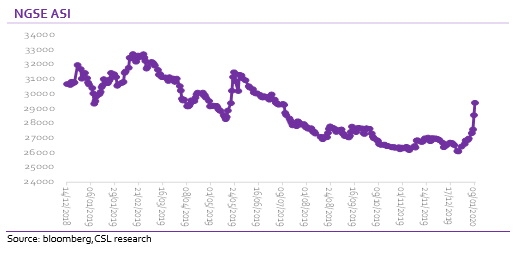

Following a bearish run in 2019, with a negative return of 14.6%, the local bourse began the year on a positive note and has sustained the upbeat performance for the sixth trading session of the year.

In 2019, despite attractive valuations and subdued political risk following the conduct of the general elections, investors appetite for Nigerian equities remained largely underwhelming. With a more stable political climate, investors appear to be reassessing their risk appetite.

The NSE has gained 9.5% year-to-date, making it the world’s best performing bourse, albeit fueled largely by local investors participation. Hence, we ask; How sustainable is the rally? An analysis of the buying trend shows a lot of buying interest in banking stocks and high dividend yield stocks.

Notably, we have seen banking stocks like UBA, Zenith, FBN, Ecobank, showing significant gains while stocks like Flour mills, Nascon and Dangote Cement have also seen strong buying interest based on expectation of consistent and high dividend yield. That said, we expect some profit-taking in today’s session given nine straight days of gains, nonetheless, we still expect decent activity level in the market.

Following two consecutive years of negative close, we think the market may stage a comeback in 2020, albeit the bullish performance will be capped by modest economic expansion. While we do not believe we are going to see foreign investors returning to the market in droves, we believe activity level will be better than we saw in 2019.

Our view is hinged on the unconventional monetary tools adopted by the CBN which we believe will buoy system liquidity and spur local investors demand for risky assets.

[READ MORE: Nigeria’s fintech industry 2020: The growth frontier of the new decade)

The decision of the apex bank to stop individuals and Pension Fund Administrators from investing in OMO bills has led to a significant moderation in yields on treasury bills and bonds, pushing real yields into negative territory. As more liquidity is expected to hit the system from maturing OMO bills, we anticipate there will be a surge in volume of the funds chasing existing investment vehicles. Accordingly, we believe some of the liquidity will flow into the local bourse.

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.