The year 2019 will go down in the annals of history as one of the busiest for the Nigerian capital market. The continued recovery of the Nigerian economy, which generated a real growth of 1.81% year-on-year by the end of Q3 and improvement in macroeconomic stability, acted as catalysts to the many activities that characterized the Nigerian capital market in 2019.

Market Performance

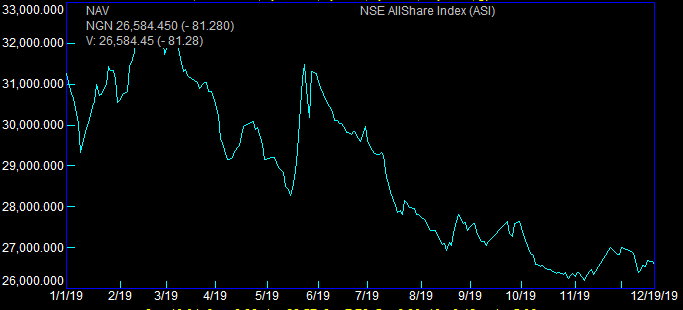

The Nigerian capital market started the year with trends that sent jitters down the spines of investors, as the All Share Index nosedived in January from the 31,430.50 points it ended 2018 with, to 29,336.8 as at January 9th. However, the market made a quick turnaround and rose to as high as 32,614.05 by February 20th. Unfortunately, that has been the highest that the index attained in 2019, as everything indicates that the market will end the year with under 27,000 points.

Increase in Volatility

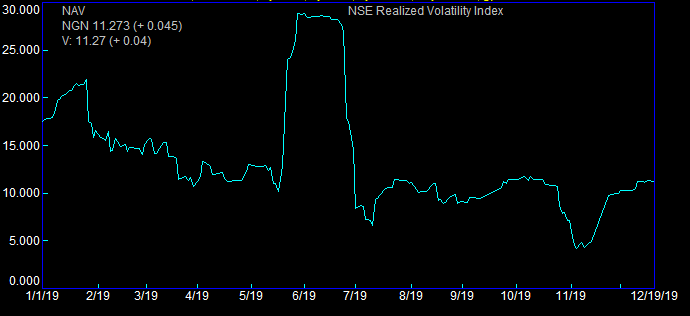

Increase in volatility was an important theme for investors in 2019, as the aftermath of the election increased activities of herdsmen, and the debacle about RUGA took center stage especially around the second quarter of the year. The Quantitative Financial Analytics NSE Realized Index which ended the year 2018 at 17.32 points spiked to 28.66 in June 2019, making June 2019 the most volatile month of the year. The good news, however, is that volatility has continued to moderate since then as it bottomed to 4.91 in November, only to pick up again in December, peaking at 11.27 points as at December 19th, 2019.

Yield in Downward Spiral

Interest rates or yield have fallen drastically so far in 2019. The Nigerian 10-year Bond which reached a maximum yield of 15.856% on December 4, 2018 bottomed to 11.324% on December 10, 2019. Most Money Market Funds in Nigeria are currently making yields in the single digit. Falling interest rate was not peculiar to Nigeria though, as many countries witnessed negative yield in 2019.

The Year of the Rights

2019 could be rightly described as the year of the rights. Nigerian corporate entities issued more rights in 2019 than in any other year. Notable among them are rights issues by C&I Leasing, NPF Micro Finance, Sovereign Trust Insurance and Fidson. Rights issues were seen by corporate management as easier and cheaper ways to raise additional capital. In addition to rights issues, other major corporate actions took place in the capital market, like the optional dividend by Stanbic IBTC and the share buyback by the management of Dangote Cement.

Enter the Initial Public Offerings (IPO)

There seemed to have been an IPO drought in the Nigerian capital market, but 2019 changed that. The Exchange recorded two initial public offerings, with the listing of MTN and Airtel. Elsewhere in the world, in the New York Stock Exchange to be precise, what could be described as Africa’s largest digital retail platform, or Africa’s Amazon.com, Jumia Plc, floated its IPO.

Mergers and Acquisition

One heavyweight corporate action that took investors by storm in 2019 was the acquisition of Diamond Bank by Access Bank. Another big acquisition was that of Dangote Flour Mills by Olam International Limited. The Nigerian capital market witnessed other forms of business combinations, notable among them being the combination of Cement Company of Northern Nigeria, (CCNN) and BUA’s Obu Cement.

Index Launching

in 2019, the Nigerian Stock Exchange (NSE) continued its quest to provide investors with different benchmarks against which to measure the performance of their investments. The Exchange, in collaboration with Afrinvest Asset Management, launched two new factor indices: the NSE-Afrinvest Banking Value Index (NSE-Afr BVI) and NSE-Afrinvest High Dividend Yield Index (NSE-Afr HDYI). Also, the NSE and Meristem Securities Limited, launched two new-style indices – the NSE-Meristem Growth Index and NSE-Meristem Value Index – which would act as benchmarks for the performance evaluation of value and growth stocks listed on the Exchange.

The Nigeria Stock Exchange also launched its Corporate Governance Index which seeks to track performance of companies that meet the most stringent corporate governance criteria in Nigeria.

NSE Inaugural Hackathon

In furtherance of its desire to encourage tech nerds and enthusiasts with the passion for Fintech innovation, the NSE organized its first ever Hackathon challenge at the end of which the first three winners smiled home with N5million, N3million and N2million respectively.

Mutual Funds

Nigerian mutual fund Asset under management hit a new milestone by reaching an all-time high of N1 trillion. This laudable achievement was mostly as a result of the growth in demand for money market funds.

New Fund Launches

Though the performance exchange-traded funds have not impressed shareholders and investors, fund managers still maintain their desire to create new funds. In that regard, Greenwich Asset Management Limited listed a new Exchange Traded Fund, ETF on the floor of the Exchange. The new ETF is the Greenwich Alpha ETF that tracks the NSE 30 Index.

Foreign Participation in Equity Trading

Nigeria continues to be a destination of choice for foreign investors in spite of the insecurity occasioned by Boko Haram and Herdsmen. Though not as much as in 2018, foreign participation in equity trading in Nigeria continues to grow and there is no reason to see the growth waning anytime soon.

The Demise of a Colossus

On a sad note, the Nigeria capital market community lost one of its own, in the person of Mr Cyril Odu, who was a Director at ValuAlliance Asset Management Company and the Chairman of the Board of Directors of Union Bank Nigeria Plc. May his soul rest in peace.

What to Expect in 2020

As 2019 glides to an end and we usher in a new year and a new decade, investors are looking forward to a more rewarding year in 2020. There is the likelihood that interest rates will continue to fall, albeit slowly. The hint came via the US Fed in its last meeting in 2019, disclosing that the Fed was no longer in a hurry to raise interest rate.

Higher Inflation Rate

Nigerian inflation rate fell in September 2019 through October but began rising again in November. I foresee this increase in the rate of inflation to continue, at least to the first two quarters of 2020. There is a relationship between interest rate and inflation such that lower interest rate tends to result in inflation. The Central Bank of Nigeria should, therefore, pay close attention to those two variables in 2020. Another catalyst for inflation in 2020 will be the implementation of minimum wage, which may generate some wage push inflation.

Increase Activities in the Bond Market

As interest rates fall and probably continue to do so, it becomes cheaper for the government and corporate bodies to borrow. There will most likely be increased activities in the bond market as corporate bodies would try to retire their high interest-bearing debts and take on lower coupon debts. In the same way, bond market activities will be on the increase as the government takes advantage of lower interest rate to increase its domestic borrowing and meet up with budget deficits.

Increase in Economic Growth

If the Central Bank can keep interest rate down without heating up the economy with higher rate of inflation, Nigeria will witness some higher economic growth rate in 2020. As corporates and the government borrow to finance investments, it is expected that the results will translate to greater capital accumulation and economic growth.

Volatility Will Remain

The Nigerian capital market may witness a slightly elevated level of volatility in 2020 as a result of the expected increase in fixed income market, the uncertainties in the US-China trade relations and the oil market. However, with Boris Johnson midwifing Brexit, it is expected that the uncertainty from Brexit under Theresa May will not be as much.

Expect More Mergers, Acquisitions and Business Combinations

As the corporate management teams of Nigerian companies evaluate the synergies that are derived from mergers and acquisitions, it is expected that 2020 may see one or two more of such corporate actions than seen in 2019. Given the newfound affection for rights, more corporate bodies will raise capital through right issues in 2020.

Ponzi Schemes

The regulatory authorities and yield-hungry Nigerians should be on the lookout for Ponzi schemes, because as interest rate falls and interest related income dries up, some yield-hungry investors may be tempted to invest in Ponzi schemes in their desperation for increased investment returns. This clamour for higher yield may motivate Ponzi scheme operators to rear their ugly heads in the most unexpected places and manner. Be on the lookout and Happy New Year and New Decade.