It is official. The total asset value of mutual funds in Nigeria has hit the trillion Naira mark, according to the recent report by the Securities and Exchange Commission. What a milestone!

In my April 2019 article on the state of the mutual fund industry in Nigeria, I projected that the asset value would hit the trillion Naira mark before the end of the year, going by observable trends as at that time. And here we are.

NAV summary report

The recently released NAV Summary Report by the Securities and Exchange Commission of Nigeria indicates that the total Net Asset Value of mutual funds in Nigeria is now N1,017,705,544,066. Who could have imagined that what started in 1991 with Paramount Equity fund as the only mutual fund in Nigeria, could balloon to an industry with over 100 funds and total asset value in trillions of Naira? A historical movement along memory lane shows that as at December 31, 1991, the total net asset value of mutual funds in Nigeria was N17.5 million in an industry of one mutual fund.

How did we get here?

Money market funds played an important and pivotal role in pushing the net asset value of mutual funds to the finish line towards the trillion Naira mark. Nigerians love their yield or interest rate, no matter how small. It is that quest for yield and the flight to safety that made money market funds the darling of most mutual fund investors in Nigeria. On a year to date basis, the whole mutual funds in Nigeria attracted an estimated N481.6 billion in additional contributions, so far in 2019. Out of that sum, money market funds attracted N337 billion, according to analysis by Quantitative Financial Analytics. Within the year, three new money market funds were included in the SEC’s NAV Summary report. They are Legacy Money Market fund, FSDH Treasury Bill fund and GDL Money Market fund.

Together, those 3 added about N14 billion to the money market category’s net asset value. Though investors withdrew an estimated N125 billion from mutual funds, on a year to date basis, so far, mutual funds made an estimated gain of N9.3 billion. That analysis, therefore, boils down to the fact that money markets continue to dominate the entire mutual fund industry. 69.89% of the total assets of mutual funds are invested in money market funds, while 9.78% is in Eurobond funds (those denominated in dollar), 7.7% is in fixed income or bond funds, while 4.52% is in real estate funds. It does look like Nigerian investors are yet to either understand funds like Exchange Traded funds, Ethical and Target funds because not much investments are made in those categories. The reason can as well be due to the poor performance of those fund types.

Fund ranking by asset value

Stanbic IBTC money market fund remains the largest fund in Nigeria, with 32.29% of the total asset value of the industry. The second largest is FBN Money market fund, whose asset value makes up 17.64% of Nigeria’s mutual fund asset. Stanbic IBTC Dollar fund has taken over from ARM money market fund as the third-largest mutual fund in Nigeria.

[READ MORE: Mutual Fund: Nigerian investor discloses his 10 years investment that nosedived)

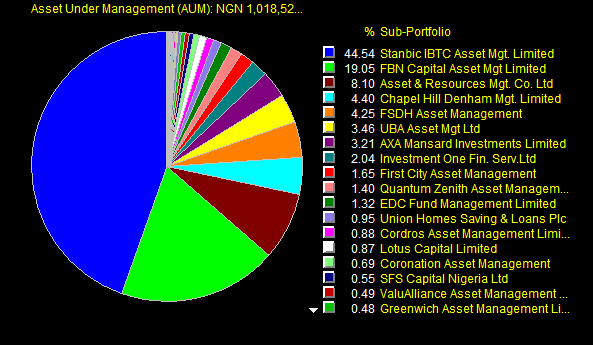

Fund manager ranking by asset value

The dynamics remain the same as Stanbic IBTC sits atop other fund managers as the fund manager with the largest asset under management, AUM. On the day that total mutual fund assets hit the trillion Naira mark, Stanbic IBTC housed 44.54% of that total. Again, FBN Capital Asset Management company retains its second position with 19.05% of Nigeria’s total mutual fund asset value. Once again, Asset and Resources Management company, ARM, is the third-largest fund manager with 8.10% of total assets of mutual funds in Nigeria, while Chapel Hill Denham Management limited took the fourth position from FSDH Asset Management company with 4.4% of mutual fund assets.

Too large to fail

If things continue the way they are, it would not be a surprise if Stanbic IBTC controlled 50% of Nigeria’s mutual fund assets. That should start to concern the regulatory authorities and they should begin to look at issues like too large to fail, in Nigeria’s mutual fund industry.

Good job Uche. Please, I need a guide on how to start an investment club. Can you help?