Nigeria’s pension asset grew by N228 billion in October 2019 to end the month with an asset value of N9.81 trillion, according to the latest data from the Pension Commission of Nigeria.

Nigerians seem to be heeding the call to start saving for their retirement, as the country’s pension asset has grown by about 13.59% since the beginning of 2019, according to analysis by Quantitative Financial Analytics Ltd. By the end of 2018, pension fund assets stood at N8.6 trillion, but that has increased by about N1.1 trillion to N9.81 trillion as at the end of October 2019.

Pension fund asset growth has been in ascendency since the Pension Fund Reform Act was enacted in 2014 and following increasing financial education by the stakeholders, as well as the constant call for Nigerians to take their retirement savings very seriously. This has resulted in more people seeking coverage by pension plans, which in turn has resulted in increased contributions.

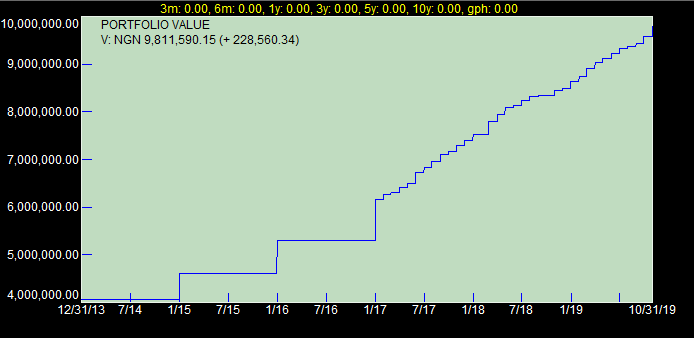

Another factor accounting for the growth is the positive returns being recorded by pension funds month after month. A chart of the trends in pension fund assets by Quantitative Financial Analytics ltd puts the growth in perspective.

According to analysis by Quantitative Financial Analytics, Nigeria’s pension assets grew by 22% and 14% in 2017 and 2018 respectively, and have so far grown by 13.59% in 2019.

Asset allocation

Federal Government-issued securities, comprising FGN Bonds and Treasury Bills, are still the greatest beneficiaries of the growth in pension fund assets. Out of the N9.81 trillion, a total of N6.8 trillion is invested in Federal Government bonds (N4.58 trillion) and Treasury Bills (N2.24 trillion) with N1.05 trillion being invested in banks.

The asset allocation that is favourably and positively skewed in favour of Federal Government instruments can be explainable from the fact that the laws guiding the pension funds do not give the fund managers a lot of freedom to invest in instruments outside those of FGN products. In addition, the need for proper asset-liability management by the pension funds calls for investment in instruments with minimal risk, hence the gravitation to Federal Government securities.

[READ MORE: Pension asset increases to N9.33 trillion – PenCom)

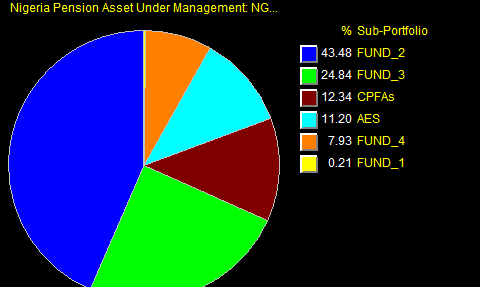

Fund type composition

Pension fund assets are allocated across multiple funds from fund one through four, as well as existing schemes. Out of the total N9.81 trillion pension asset value, N4.3 trillion is being managed as fund two or Retirement Savings Account (RSA), while N2.4 trillion is in the fund 3. Contributors do not seem to be interested in the fund 1 category as that fund type only has N20.7 billion out of the N9.81 trillion. The lack of interest can be attributed to either dislike of the risk characteristics of the fund 1 category which has more risk than the rest, or due to lack of understanding.

World Pension Asset

Just like Nigeria’s pension assets have been increasing, so has the world pension asset value. According to OECD, the World’s pension asset grew to $44.1 trillion by the end of 2018; the growth is attributed to positive real returns as well as increase in contributions arising from more people being covered by pension plans in various countries.

Pension Plan Coverage

Although some strides have been made, many Nigerians are still not covered by any pension plans. According to the OECD, only 7.7% of Nigerians eligible for coverage in pension plans were covered as at the end of 2018. The good news is that this represents over 100% increase when considered against the percentage coverage of 3.4% in 2008, according to the OECD.

Nigeria is, however, among the countries with the highest minimum contribution rate. Nigeria has a contribution rate of 8% for employees and 10% for employers. The country with the highest employer contribution rate is Iceland, with a contribution rate of 11.5%.

Real return

Although pension funds in Nigeria continue to record positive returns, the high rate of inflation in the country has rendered such returns inconsequential, in real terms. According to data from OECD, Nigeria’s pension funds generated negative real return of 1.9% in 2018, a year in which pension funds in Malawi recorded 9.8% positive real return. Among the African countries being monitored by OECD, however, only Malawi (9.8%) and South Africa (0.5%) recorded positive real returns on their pension funds.

[READ ALSO: Nigeria’s pension contributors add N186.43 billion to pension asset)

Conclusion

Retirement savings through participation in pension plans should be a thing that every eligible Nigerian should take seriously, so if you are not yet covered, get covered.

Stop paying pension to civil servants that were dismissed from office/service.

recover these funds to further increase the pension fund!