The battle for greater market share among Telcos in Nigeria has intensified, as operators in the industry are trying hard to offer quality services and affordable plans in a bid to outdo one another.

According to the monthly industry statistics released by the Nigerian Communications Commission (NCC), a total of 311,183 internet subscribers dumped Globacom and 9mobile in September 2019. Specifically, 156,065 internet subscribers dumbed 9mobile, while 155,118 dumped Glo at the end of September.

Also, for the second time in a row, MTN’s total number of subscribers dropped by 379,795 in September 2019. This means that within three months (July – September), 379,795 users were inactive on MTN network.

Earlier, Nairametrics had reported that MTN was on the losing side, as a huge number of internet subscribers dumped the network in August. While a whopping number of 667,245 internet subscribers dumped MTN, Airtel Nigeria gained the biggest within the period.

Airtel continues to add big Numbers

According to the NCC data, Airtel Nigeria continues to witness additional internet subscribers on a month-on-month basis. In the month of September alone, Airtel added 444,598 internet subscribers, as the telco’s total internet subscribers rose to 33.1 million.

- Further analysis of the data shows that no internet subscriber has dumped Airtel Nigeria network since April 2017, when the telco recorded a decline of 15,910 in internet subscribers.

- On the other hand, in September 2019, MTN improved slightly, adding 73,633 internet subscribers, pushing its total number of internet subscribers to 51.6 million.

- Meanwhile, having recorded growth in the total number of internet subscribers since March 2019, 155,118 internet subscribers dumped Globacom’s internet service in September.

MTN maintains dominance, but…

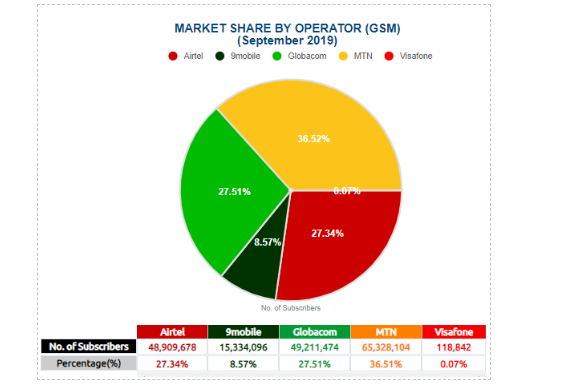

In terms of the total industry market share, MTN Nigeria has continued to maintain market dominance. As at the end of September 2019, MTN maintained a total of 65.3 million subscribers, Globacom – 49.2 million, Airtel – 48.9 million, and 9mobile – 15.3 million.

- However, as stated earlier, 379,795 subscribers were inactive on MTN at the end of September, while Airtel recorded an addition of 987,787 Subscribers to its number of total subscribers.

- Overall, MTN’s market share dropped from 65.7 million (37.20%) in August 2019 to 65.3 million (36.52%) in September.

- Worthy of note also, is Glo edging out Airtel in the total subscribers’ chart, as competition heightens.

- An earlier report by Nairametrics showed that Airtel edged out Glo. However, as at the end of September, Glo added 1.9 million active subscribers, putting its total number of subscribers to 49.2 million, compared to 48.9 million for Airtel.

- According to the NCC September report, MTN controls 36.52%, Glo- 27.51%, Airtel- 27.34%, and 9mobile- 8.57%.

Why Nigerians dump providers

It is no longer news that Nigerians are frustrated most times due to the quality of data services supplied by the ISPs but what is new is the rate subscribers dump one provider for another and that can be confirmed by the data released by the NCC, which covers a cumulative three months of activity and inactivity.

What this means

The subscribers, who were reported to have dumped a service provider in September, have remained inactive in the last three months and this may be due to several factors.

Some of the key factors, which Nigerians have frequently lamented over, are poor services, high cost of data, and quick data exhaustion. For instance, in recent times, Nigerians have continually expressed displeasure over MTN and Airtel data bundles, alleging that they are relatively expensive and exhausted unduly.

According to a Glo user, who spoke to Nairametrics, “Glo data is cheap but the internet connection is very slow as it takes longer time to respond in most cases. Most times, I don’t even exhaust my data in a month. It is frustrating.”

An Airtel user, who also spoke to Nairametrics, says, “Airtel data is fast, but I was surprised recently when I bought 10 gig data, and without any major downloads, it was exhausted in less than 2weeks. I am planning to switch to MTN, but I honestly don’t know, which is better.”

A report from the United Kingdom-based price comparison website, Cable, had disclosed that Nigeria’s internet download speed is among the slowest in the world.

While the telcos are raking in billions from data sales, the regulator (NCC) may need to step in and take a proper monitoring stance, to create a win-win situation for both subscribers and ISPs. That means while the latter make money from services rendered, the former also access quality, cheaper and affordable services.

Its Nigerian Communications Commission not National Communications Commission.

Thanks Aliyu

Its Nigeria not Nigerian

I’m really scared at the extreme cost of date, very scary. The rip off is totally unacceptable. I ran to spectranet a few days ago, and in 1 week my 25gb was whittled away, no major change in my regular usage. We are being mindlessly robbed. This is digital NB TERRORISM. Somebody help!

like

Glo is the most stupid fucking network I know

Nice one, Bamidele. Please keep it up

Thank you Peter

Former Masters of Data