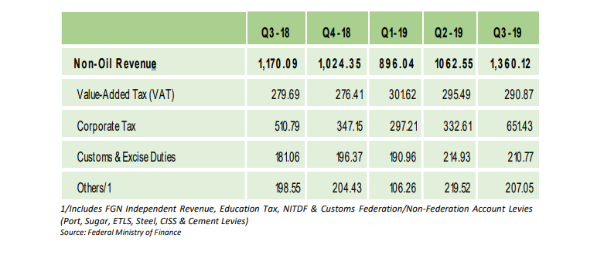

Nigeria generated a whooping N1.36 trillion from the non-oil sectors of the economy between July and September 2019. This is disclosed in the third quarter 2019 report released by the Central Bank of Nigeria (CBN).

The CBN report showed that the non-oil revenue generated in the third quarter rose above the quarterly budget of N1.34 trillion, a surplus of 1.4%. According to the CBN report, Nigeria’s non-oil revenue rose by 16.2% when compared to the sum of N1.17 trillion recorded in the third quarter of 2018.

[READ MORE: NIPC to generate N1.46 billion from its activities in 2020]

Data Breakdown

Specifically, the components of Nigeria’s non-oil revenue include Value Added Tax (VAT), Corporate Tax, Customs and Excise Duties and Other sources. Numbers obtained from the CBN report showed that the biggest source of the nation’s non-oil revenue is corporate tax.

- As at the end of September 2019, Nigeria generated N651.43 billion from corporate tax. The data further showed that in the last one year, revenue generated from corporate tax rose by N140.64 billion.

- Also, the sum of N290.87 billion revenue was generated from VAT within the period, while N210.77 billion was generated from customs and excise duties.

- The CBN noted that the higher non-oil revenue, relative to the quarterly budget was as a result of increased receipts from Corporate Taxes, and improvements in the collection of the Nigeria Customs Service.

Oil Revenue drops

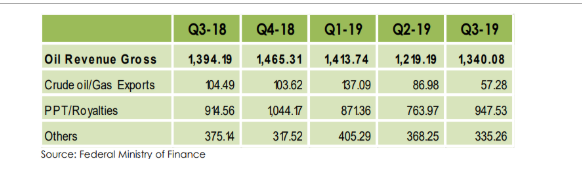

Meanwhile, gross oil revenue fell below both the budget target and receipt in the preceding month. In the third quarter, Nigeria generated N1.34 trillion gross oil revenue, representing 49.6% of the total revenue collected by the government.

Also, the oil revenue received was 4% lower than the revenue recorded in the corresponding period of 2018. In Q3 2018, Nigeria generated the sum N1.39 trillion as against N1.34 in Q3 2019. The breakdown shows crude oil Petroleum Profit Tax (PPT) accounted for N947.53 billion to the total revenue, others (N335.26 billion) and crude oil sales (N57.28 billion).

The CBN stated that the decline in oil revenue, relative to the quarterly budget, was due, largely, to shortfalls in all the components of oil revenue, except Domestic Crude Oil and Gas sales.

[READ ALSO: Nigeria generates over N1.2 trillion oil revenue in 3 months, up by 44.1%]

Upshots

Nigeria currently faces huge revenue shortfall and this has cast doubts on the possibilities of achieving the 2020 budgets. The improvement in the non-oil revenue is a big booster to the nation’s already depleting oil revenue.

To implement the 2020 budget, the Federal Government will borrow the sum N2.18 trillion as deficit financing. Meanwhile, to reduce the revenue strain in the economy due to dwindling oil price, the government has tasked revenue generating agencies to improve revenue collection targets to ease pressure on the economy.