First Bank of Nigeria Limited has expressed its commitment to driving financial inclusion across Nigeria. With currently over 37,000 Firstmonie Agents, present in 99% of the 774 Local Government Areas in Nigeria, the Bank is the leading financial institution at promoting financial inclusion in the country to all Nigerians, regardless of where they are.

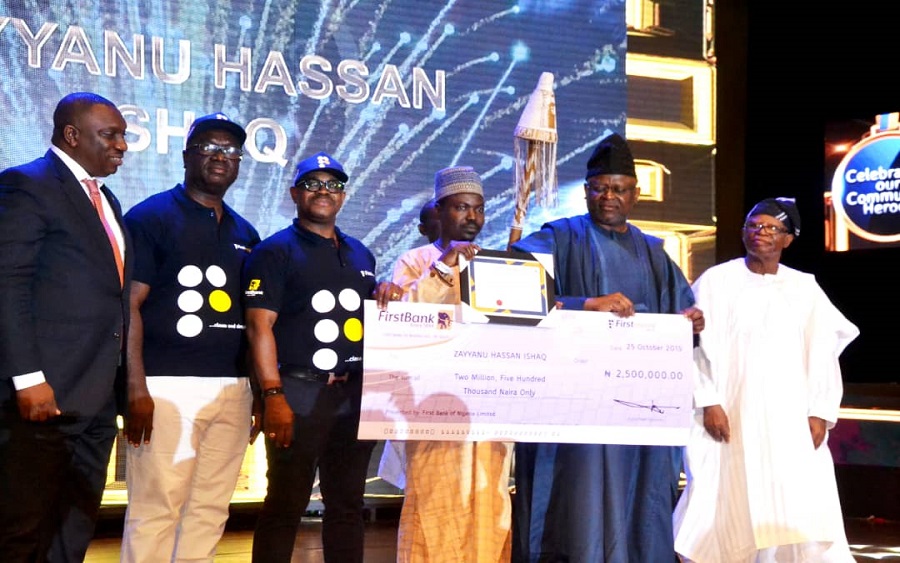

Speaking during the Firstmonie Agent Banking national award ceremony, recently held in Lagos, the Chief Executive Officer, FirstBank, Dr. Adesola Adeduntan, said the Firstmonie agent network is a bespoke channel through which the Bank expresses its unalloyed commitment and passion to promote opportunities and access to financial services by every Nigerian, especially within the low-income segment. The Firstmonie Agent Banking awards had the Bank – FirstBank – reward 37 leading Agents that have promoted financial inclusion in the country. The sum of N250,000 was won at the State level by 31 Agents; N1,000,000.00 at the Regional level by 5 Agents with the grand prize being the sum of N2,500,000.00 at the National Level.

Adeduntan explained that with the initiative, the gap between the tech-savvy and the low literacy clients has been breached as Firstmonie agent network represents the convenient and comfortable alternative for customers, that are unacquainted with sophisticated digital channels.

In his remarks, the Deputy Managing Director, First Bank of Nigeria Limited, Mr. Francis Shobo, noted that the agents are the most critical part of the banking ecosystem because they take deposits, make payments and open accounts, provide transfers and sell airtime at locations with little or no access to financial services.

Shobo lauded the Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele for the role the apex bank has played, stating that the CBN has made a lot of changes in regulation around agency banking, “they have allowed the programme to scale as much as it has scaled.”

In chat with newsmen after receiving the cash prize at the event, the N2.5 million grand prize winner at the national level from Abuja (North Central), Zayyanu Hassan Ishaq, expressed his amazement at his prize, one he noted he finds very encouraging and a miracle from God.

“I want to thank FirstBank for this gesture. It took me by surprise, because I never expected it from them. This is a miracle. “FirstBank is truly different. This will spur me to work harder and ensure more people have access to the top-class financial services offered by FirstBank” joy-filled Ishaq concluded.

That’s wonderful.we that are new what would be our gain.we need money to forge ahead.thanks