In an accelerated process during plenary, the National Assembly (NASS) passed the bill amending the offshore and Inland Basin Production Sharing Contract Act 2014. The lawmakers amended Section 5 of the Principal Act and added Sections 17 & 18 to the bill.

The amended Section 5 reads that:

- Royalties shall be calculated on a field basis. The royalty shall be at a rate per centum of the chargeable volume of the crude oil and condensates produced from the relevant area in the relevant period as follows: in deep offshore greater than 200 metres water depth – 10%; in frontier/inland basin – 7.5%.

- Royalty by price is adopted in order to allow for royalty reflexivity based on changing prices of crude oil, condensates and natural gas. This also replaces the necessity for Section 16 of the principal Act.

- The royalty based on price shall be identical for the various water depths in deep offshore beyond 200m water depth, including frontier acreages for crude oil and condensates.

- The royalty rates shall be based on increase that exceeds $20 per barrel, and shall be determined separately for crude oil and condensates as follows: From $0 and up to $20 per barrel – 0%; above $20 and up to $60 per barrel – 2.5%; above $60 and up to $100 per barrel – 4%; above $100 and up to $150 per barrel – 8%.

[READ MORE: Senate rejects Niger Delta ministry’s N23 billion budget]

The newly inserted Section 17 states that: “The minister (of petroleum resources) shall cause the corporation (Nigerian National Petroleum Corporation) to call for a review of production sharing contracts every eight years.”

The new Section 18 which makes any abuse of the law a criminal offence reads: “Any person who fails to comply with any obligation imposed by any provision of the bill commits an offence and is liable on conviction to a fine not below N500,000,000 or imprisonment for a period not (more or less: not indicated) than five years or both.”

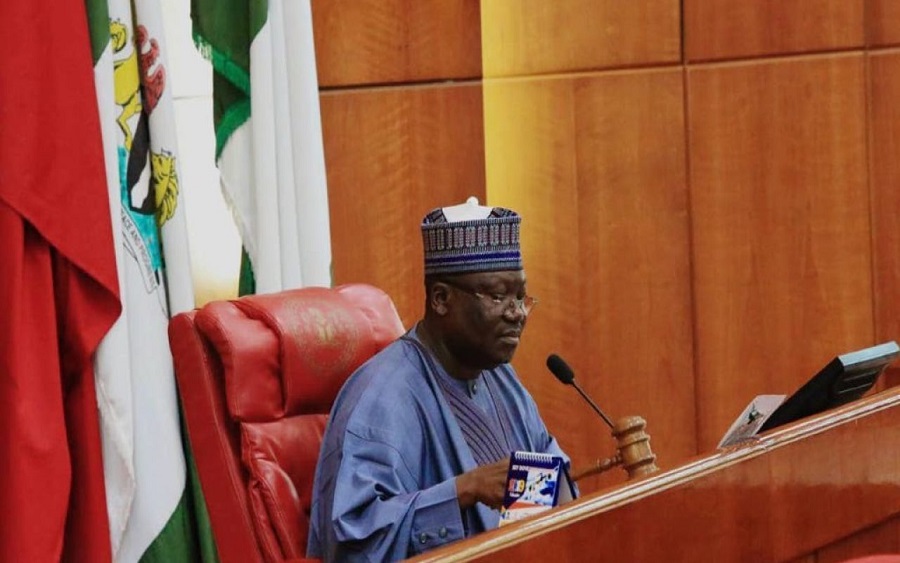

Meanwhile, the passage of the bill is expected to increase the country’s revenue. According to Senator Ahmed Lawan (Senate President), Nigeria will be $1.5 billion richer in 2020 due to the passage of the bill. Nigeria Extractive Industries Transparency Initiative (NEITI) has commended NASS for the passage of the bill, emphasizing that Nigeria has been losing a lot of money without the amendment and the bill would increase revenue.

What about the mineral resources like Gold mining in commercial volume in Zamfara. When will the FG move away from oil to Gold exploitation to soar the revenue of the country. Why is the North protecting its resources from being commercially exploited for the benefit of the country?