67 years until Nigeria exhausts proven gas reserves

As at the end of 2018, Nigeria’s total proven gas reserves were 202Trillion Cubic Feet (TCF), 37.26% of the total African deposits. With these reserves, Nigeria is second to none in Africa, and 9th in the world. The potential is even more, with 600TCF in unproven reserves. In the one year period between June 2018 and June 2019, gas production printed at 3.04TCF. This amounts to a Reserve: Production ratio of 66.5 – implying consistent production for at least 66.5 more years.

However, with growing LPG adoption and with the NLNG set to finally increase production by an additional 8MTPA (from 21.6MTPA currently), there is a need to intensify the find for new gas reserves. In August, there was some breakthrough for efforts, as the NNPC/NAOC/Oando JV announced a significant gas and condensate find in the deeper sequences of the Obiafu-Obrikom fields, in OML61, onshore Niger Delta. This discovery amounts to 1TCF of gas and 60 million barrels of associated condensate, and brings Nigeria’s total proven gas reserves to c. 203TCF. More relevant than the accumulation of gas reserves is their commercialization.

There is a necessity to invest in the requisite infrastructure to capture and process the gas into Liquefied Natural Gas (LNG), Liquefied Petroleum Gas (LPG) or Compressed Natural Gas (CNG) for domestic consumption and the export market or for use as feedstock for powering gas plants.

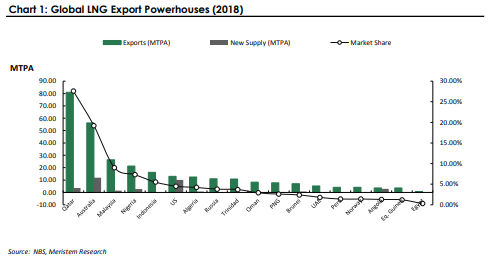

As at 2018, Nigeria had 7.3% of the global LNG export market, with annual export of 21.3MTPA. By October 2019, NLNG is expected to take Final Investment Decision (FID) on the Train-7 project which has been in the pipeline for years. The project is worth an additional 8MTPA and will rank Nigeria 3rd largest LNG export country in the world on completion.

[READ ALSO: NLNG moves to raise $2 billion to fund Nigeria’s Gas Project]

Other local players and IOCs are also ramping up their efforts at gas commercialization. Shell and the SEPLAT/NPDC joint venture are pushing through with the Assa North/Ohaji South (ANOH) Gas Processing Company’s project. The project recently reached FID and requires c. USD700mn in financing. Transcorp Power Plc is also making significant forays into the gas business with its acquisition of 2 oil prospecting licences.

The conglomerate has laid out extensive plans to capture the gas from its oilfields as feedstock for its recently acquired Afam Power plants. Quite importantly, critical transportation infrastructure for export such as the 614km Ajaokuta-Kano-Kaduna Pipeline would be required to complete the value chain and achieve the earning potential of these reserves. As it were, competition in the global LNG export intensifying rapidly, with the US and Australia leading the charge.

Beaming the searchlight on the next phase of NNPC’s DSDP

Effective 1st October 2019, some of world’s top oil trading companies and some reputable downstream players in Nigeria will commence delivery contracts under NNPC’s 2019/2020 DSDP programme. The delivery contracts are expected to run for one year, to be terminated in September 2020.

Notable names amongst the 15 consortia that won the contracts include British Petroleum, Vitol, Total S.A, Trafigura, Cepsa, Mercuria, Sahara, MRS and Eterna. In April 2017, NNPC had commenced the DSDP – the Direct Sales Direct Purchase Programme where NNPC provides monthly crude oil lifting in return for the delivery and supply of Nigerian standard specification of petroleum products equivalent in value to the Crude Oil received.

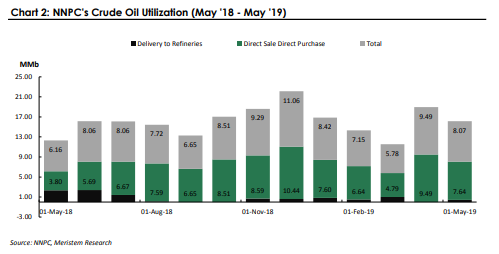

Essentially, participants in this programme are expected to secure contracts with refiners to meet up with NNPC’s requirements. Data from the NNPC reveals that between August 2017 and August 2018, the Corporation allocated 80.77% (249.62 million barrels) of its total crude liftings to the DSDP programme, with only 19.23% going towards domestic refining or export.

[READ ALSO: NNPC/NAOC/OANDO JV Makes Significant Gas and Condensates Discovery in Nigeria]

Worse still, between August 2018 and May 2019 (the latest month for which data is available), the average allocation ticked further upwards to 94.87% (77.94 million barrels), with only 5.13% being processed in the nation’s four domestic refineries (excluding NPDC refinery).

None of the Crude was slated for export, implying that the country loses critical foreign exchange/revenue while expending significantly on under-recovery costs. In the last one year (May 2018 – May 2019), the value of crude swapped under the programme was a whooping USD6.67bn (NGN2.00trn). NNPC’s new leadership has set a revised 2023 date for a complete overhaul of the nation’s 4 existing refineries. Until then, the DSDP will remain what it is – an expensive stopgap.

Budget Performance: Can Nigeria sustain its contempt for OPEC production quotas?

In Q1:2019, Nigeria’s oil production (ex-condensates) averaged 1.74MMbpd. In Q2:2019, the figure was even 2.59% higher at 1.78MMbpd. Last week, August production numbers were published by OPEC, and highlighted a 4.83% m-o-m production ramp-up (+86,000bpd) to 1.87MMbpd.

It is important to reiterate that Nigeria’s production cap for 2019 was agreed and set at 1.69MMbpd at the November 2018 OPEC meeting, for the purpose of managing demand-supply balance and ultimately providing critical support for oil prices throughout the year. With this context, it is therefore surprising to the casual observer that Nigeria, a longstanding member of the coalition has consistently flouted the production ceiling since January.

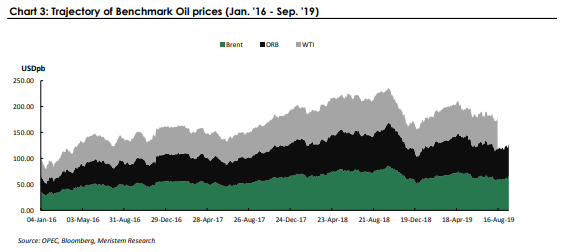

While Nigeria has set its oil production benchmark for 2019 at 2.3MMbpd (including condensates), it has only managed to achieved an average 1.98MMbpd this year. The oil price benchmark was also audaciously set at USD60pb, a USD9pb add-on to the USD51pb set in 2018. Consequent upon below-par production numbers, revenue expectation for the budget has suffered. Similarly, Brent has averaged only USD64.81pb this year, precariously close to the budget benchmark and leaving hardly any scope for accretion to the Excess Crude Account.

[READ MORE: Nigeria to attract $48.4 billion out of Africa’s $194 billion oil and gas investments]

The reality is that OPEC has been rather lenient and overlooked Nigeria’s under-compliance in the first half of the year, with Saudi Arabia having to pick up the tab for other members of the group. However, heading into the final quarter of the year with oil prices grasping for support at USD60pb, (averaged USD59.86pb in the last 6 weeks) the coalition might put in measures to extract maximum compliance from members. Nigeria may have to seek out other means of financing its budget, as we move into an increasingly uncertain period for the oil markets, with increasing competition amongst light crude grades in the international markets.

Herculean task for OPEC, as Oil demand growth outlook steeps further into the doldrums

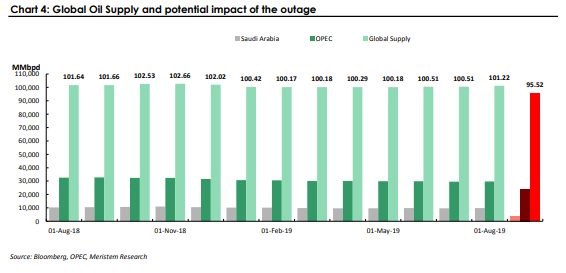

In August 2019, overall OPEC production printed at 29.74MMbpd, coming in 136,000bpd (+0.46%) higher m-o-m. This came as a surprise, given that OPEC’s stance throughout the year has been inclined towards constraining supply, a commitment which was renewed in July at the joint meeting between OPEC and its allies.

The production uptick was remarkably led by Saudi Arabia (+118tbpd) which clocked in 9.81MMbpd during the month and is surprising because Riyadh has been the most aggressive in conformity with the deal so far, consistently surpassing its share of the production cuts which began in January. Nigeria also substantially grew production by 86tbpd, pitching in with 1.87MMbpd for the month. Iraq (+43tbpd to 4.78MMbpd), UAE (+11tbpd to 3.09MMbpd), Gabon (+2tbpd to 0.21MMbpd) and Ecuador (+1tbpd to 0.54MMbpd) rounded up the list of members that recorded m-o-m production growth.

This uptick was slightly counterbalanced by downturns in Venezuela (-43tbpd), Iran (-24tbpd) and Libya (-21tbpd). While this initially hinted at a strategy pivot, it is instructive to note that OPEC alone (without the aid of its allies) has removed 1.05MMbpd (-3.42%) from supply since January 2019 and 2.62MMbpd (-8.09%) since October 2018. Relative to the 810,000bpd it is required to constrain under the deal, OPEC achieved 130% compliance in August, when placed within the context of January’s production numbers.

Up until April 2019, prices were significantly buffered by the OPEC+’s efforts, albeit with the aid of other market wildcards including the sanctions on Iran and Venezuela. However, as the US-China trade rift escalated, concerns about demand matching supply and global economic growth resurfaced, sending prices to an 8-month low of USD56.23pb on 7th August.

[READ MORE: Official: Nigeria’s oil and gas export sales hit $490.03 million in February]

Prices have since slightly recovered, but continue to oscillate around a new support level of USD60pb. The OPEC+ Joint Ministerial Monitoring Committee coalition met again in Abu Dhabi on 12th September and underscored the need for renewed commitment to the Declaration of Cooperation, in the light of extant and emerging risks in the global economy which had profound implications for oil demand. As it were, the US is consistently stealing a march on OPEC market share with its efforts in Shale development and debottlenecking of the Permian basin.

The IEA, EIA and even OPEC also seem to agree on one thing – demand growth projections for 2019 and 2020 are not as bullish as they were at the start of the year. The agenda is therefore set for the final JMMC meeting in December – maintain the cuts or institute an even bigger cut for price support.

USD100pb oil on the horizon… or not?

On 14th September, c. 5% of the world’s oil supply was cut off. Houthi rebels from Yemen (reportedly backed by Saudi Arabia’s regional arch rivals, Iran) claimed responsibility for an attack on the Abiqaiq – the world’s largest oil processing facility, with a capacity of 6.8MMbpd. The attack also impacted Saudi Aramco’s second largest oilfield, the Khurais oilfield sparking fires that could remove c. 5.7m barrels from daily supply.This is significant news because that number is more than half of Riyadh’s current daily production (c. 9.8mbpd) and 19.17% of OPEC’s entire output for August.

Oil prices have underwhelmed in the last month five months, even with OPEC+ extending its voluntary output cuts through till March 2020. Large inventory draws in the US coupled with Iranian and Venezuelan sanctions have also failed to tilt prices north, as the world worries about slowing demand (2019 growth now expected at 1.1mbpd, per IEA) and the protracted trade war. More than anything else, the attacks are the latest and most vicious in recent Persian hostilities that have highlighted the frailty of the security apparatus set up by Saudi Arabia and places a question mark on the Middle East country’s status as a stable supply of large crude volumes.

In the 24 hours following the attack, Brent crude oil futures were up at least 19.48% to USD71.95pb, the biggest single daily gain since 1991. Sentiments in the coming weeks will be dictated largely by the swiftness of Riyadh’s response to this attack and the speed of recovery efforts. More important is the requirement to reassure the markets of its ability to forestall any future attacks to critical oil and gas infrastructure.

[READ MORE: Nigeria’s oil and gas sector gulps 777 billion Non-Performing loans]

Regardless, we believe that USD100pb is a long shot, as Aramco will still be able to draw on its millions of barrels in reserves from within the country and in other strategic locations across the globe – in Europe (Rotterdam, Netherlands), Asia (Okinawa, Japan) and Africa (Sidi Kerir, Egypt) to fulfil demand. Besides, President Donald Trump has authorized withdrawals from the US Strategic Petroleum Reserves, a 645m barrels behemoth accumulated for situations such as this, that require balance to the martkets, and to forestall a price explosion.

While the impact of this incident on prices bodes well for Saudi Aramco’s upcoming IPO from a valuation perspective, we are downbeat as to how much scope oil prices have to rally – they might still fall short of the USD80pb Saudi requires to balance its 2019 budget, as demand-supply balance right now is tilted in the direction of an oversupply.

World’s largest IPO back on track, as Riyadh reshuffles cabinet

In January 2016, Saudi Arabian leaders hatched a grand plan – to float the world’s largest oil company on a public exchange. For a number of casual observers, this was a logical plan, given the economic quagmire the Persian Kingdom had been plunged into, following the global oil price lurch. Americans had discovered and begun to develop some of their vast shale deposits, and this new supply outlet had upended the global oil market balance.

However, Riyadh also intended for this partial listing to fund its economic diversification agenda – the House of Saud had a vision to cut reliance on oil to almost zero by 2030. 3 years later, the IPO was still much of a pipe dream – until April 2019, when Saudi Aramco debuted its first international bond of USD12bn, in a bid to purchase State-controlled SABIC. Bookbuilds revealed a USD100bn demand for the bond – evidence that the world’s biggest moneybags each wanted slices of the world’s most profitable company, notwistanding of the key government and country risks.

At this point, Oil prices were c. USD72pb and it appeared that the IPO was put on hold in anticipation of higher oil prices. With mounting risks to global oil prices and the country needing at least USD80pb to balance its budget this year, Riyadh has reopened preparation for the listing.

In the half year to June 2019, Aramco saw revenues decline to USD147.86bn (-2.26%), as earnings also recorded a steeper 11.54% downturn to USD46.90bn on the back of higher purchases and production costs – a situation which further underscores the imperative for urgent diversification of the economic funding mix. Khalid Al-Falih, who is reportedly a staunch critic of the IPO idea has been axed as leader of the energy ministry and replaced by Abdulrashhid Bin Salman, the Crown Prince’s brother and a longstanding understudy of OPEC. The listing is now expected to be completed as early as 2021.