UAC of Nigeria Plc appears to have finally thrown in the towel in relation to troubled real estate subsidiary UACN Property Development Company (UPDC). In separate notices sent to the Nigerian Stock Exchange (NSE) yesterday, the two firms laid out what they termed recapitalization and restructuring plans.

The plans

- UAC Nigeria will spin off its shareholding in UPDC to its shareholders. Figures from UPDC’s FY 2018 results show that UAC holds 64.16% or 1.6 billion of the 2.5 billion outstanding shares.

- This will however take place after UPDC carries out a N15.96 billion rights issue to repay its short term debt obligations. UPDC will be left with the outstanding balance of a N4.3 billion bond.

- UPDC’s interest in the UPDC Real Estate Investment Trust (UPDC REIT) will be unbundled to its shareholders. UPDC owns about 40% of the REIT.

The plans are however subject to the approval of shareholders, the Securities and Exchange Commission (SEC), and Nigerian Stock Exchange (NSE).

The move by the conglomerate, was a somewhat unexpected one. At the last conference call held by the firm, management gave no inkling of its plans to spin off the firm.

A problem child

For shareholders of UAC, the move would be akin to removing a millstone from the firm’s neck. UPDC has been loss–making for several years, despite efforts to turn it around.

Results for the half year ended June 2019 show that the firm recorded a N1.2 billion loss. 2018 audited results show that the firm recorded a N15 billion loss. Auditors had expressed concern pertaining to the going status of the firm.

This is despite the firm raising N5 billion through a rights issue in 2017 largely to deleverage its balance sheet. Parent company UAC, in 2017, also had to raise funds through a rights issue, with part of the proceeds used to take up its shares in the UPDC fund raise.

UAC feels the pinch

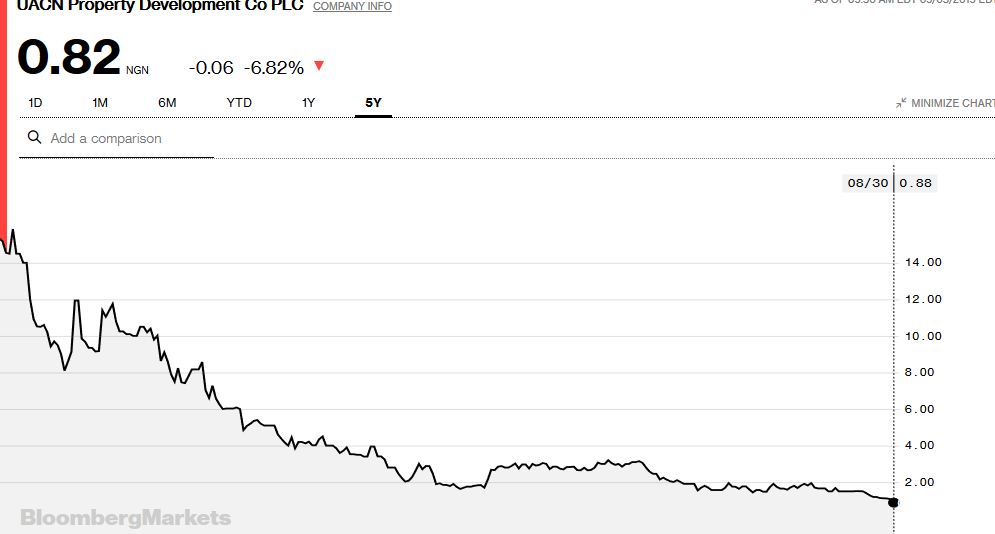

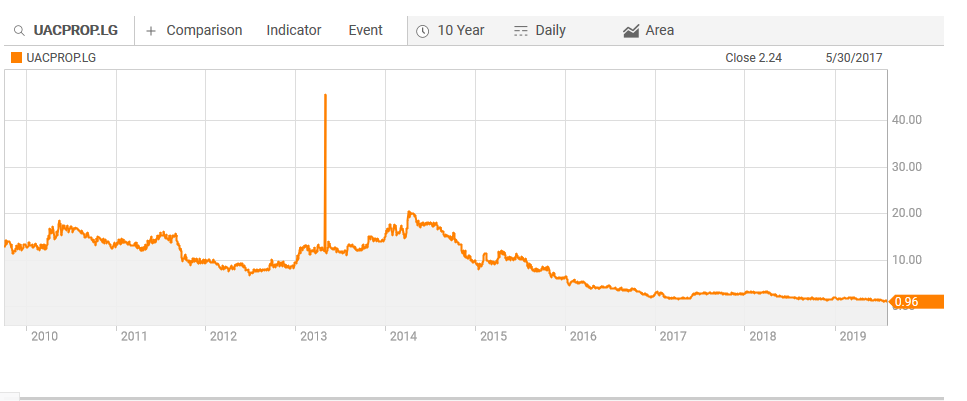

The losses also affected UAC, as it incurred a N9.4 billion loss after tax, in FY 2018, compared to a profit after tax of N1.3 billion made in the corresponding period of 2017. The poor result was largely due to losses in the UPDC, the company’s real estate division. Its share price nose dived and the stock was trading at numbers last seen in well over a decade.

Board changes

In August last year, UAC made several board changes.

Folasope Aiyesimoju was appointed Chief Executive Officer (CEO). Aiyesimoju is the founder of Themis Capital Management, which in April 2018, took up a parent company UAC of Nigeria Plc.

Niun Taiwo was also appointed as substantive Chief Operating Officer (COO). Prior to this, she had been Acting Managing Director since May 2017.

Shareholder woes

The material losses have naturally translated to massive capital losses for shareholders. The company’s share price slumped from N9.50 sometime in January 2015 to N0.88 as at the 30th of August, 2019, down 90.7%

Shareholders who bought the stock at a peak price of N45.29 sometime in 2013 have suffered even more losses, as they have lost 98% of the value of their investments, if they held till date.

Going forward

UAC should witness an uptick in operations as the company can shift its focus to profitable segments. The stock’s share price which has been badly beaten in the last few years (down 52.3% in 2019 alone)) should witness an uptick. UAC gained 1.11% yesterday and over 15 million shares were traded.

The road to recovery for UPDC is still a long one, as the company would need a new majority stakeholder. Underperforming assets such as the Golden Tulip Hotel, will either have to be rejigged or sold.