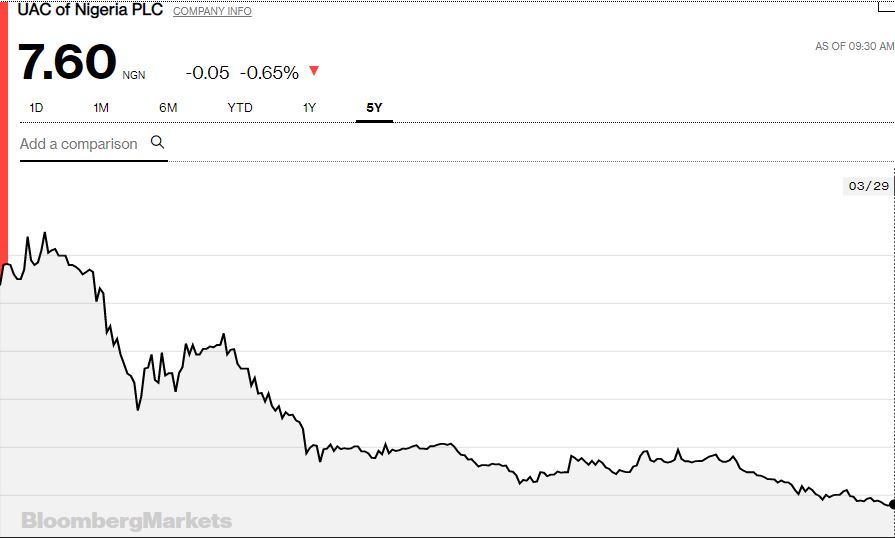

UAC of Nigeria Plc closed at N7.60 in yesterday’s trading session on the Nigerian Stock Exchange (NSE), down 0.65%. Year to date, the stock is

Investors that have held the stock, in the last 5 years, have lost a key chunk of their holdings. In April 2014, the stock was trading at N53.78. Investors that have held since then, have thus lost over 85% of their holdings, in terms of share value.

The 10-year decline is worse

Measured over the last ten years, the stock is trading at levels unseen in the last 10 years.

Investors that bought the stock at a peak of N68.58 sometime in January 2014 have thus lost over 88.9% of their holdings in terms of share value.

Drivers of the tumble

Investors have shown apathy towards the stock in view of a recent string of poor results.

H1 2018 results showed a sharp dip in revenue, while profit rose marginally. The stock subsequently fell to a 5 year low.

Results for the half year ended June 2018 show revenue dropped from N47.3 billion in 2017 to N36.9 billion in 2018. Profit before tax rose from N1.8 billion in 2017 to N2.1 billion in 2018, profit after tax rose marginally from N1.1 billion in 2017 to N1.3 billion in 2018.

Results for the third quarter ended September 30, 2018, were much worse and led to the stock price tanking further.

While revenue fell from N68.2 billion in 2017 to N55.7 billion in 2018, profit before tax fell sharply from N3.1 billion in 2017 to N483 million in 2018. Profit after tax also declined from N2.2 billion in 2017 to N347 million in 2018.

Full year results released last week were one of the worst in the conglomerate’s history.

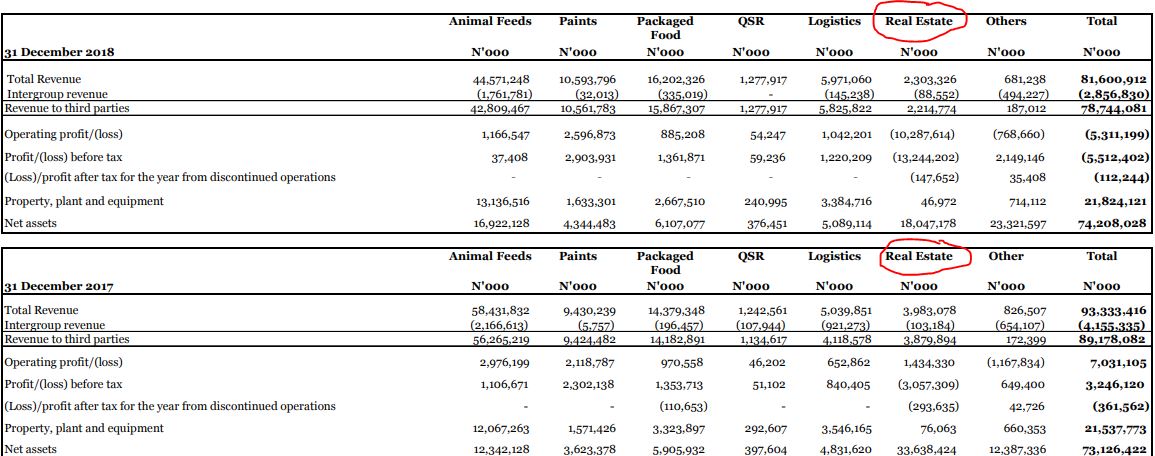

Results for the 2018 financial year show revenue fell from N89.1 billion in 2017 to N78.7 billion in 2018. The firm incurred a N9.4 billion loss after tax, compared to a profit after tax of N1.3 billion made in the corresponding period of 2017. The poor result was largely due to losses in the UPDC the company’s real estate division.

Where the problem lies

UAC’s real estate division was a major drag on group performance last year.

In an excerpt from a press release issued after the full year 2018 results were released, management gave a breakdown of the losses in that segment.

Revenue declined by 42.9% Y-o-Y in the Real Estate segment (2.8% of FY 2018 Group Revenue) to ₦2.2 billion in FY 2018, primarily because of reduced housing inventory sales. Market conditions, which remain challenging, together with capital constraints limited development activity. The segment incurred a ₦10.3 billion operating loss in FY 2018, against a ₦1.4 billion profit in FY 2017.

The decline in revenue was largely due to impairments and mark to market losses.

UPDC’s results include N4.0 billion in impairments on assets held for sale, N3.1 billion in impairment on JV receivables, N1.3 billion in mark to market losses on its real estate portfolio on account of pressure on asset values given the broader challenges in Nigeria’s real estate sector, and N0.4 billion in realised losses on disposed assets. UPDC fair valued its assets in Q4 2018.

How low will it go?

Movement in the company’s share price will largely depend on its performance going forward, as well as general market sentiments. If market sentiments remain negative, the stock may witness a downward decline.