Hundreds of existing and start-up entrepreneurs based in Oyo State have benefitted from the seventh edition of the First City Monument Bank (FCMB)-organised free comprehensive capacity building programme, tagged, “Business Enterprises and Sustainability Training (BEST)’’, for Small and Medium Scale Enterprises (SMEs).

The training, organised by FCMB Training Academy, the Bank’s Business Banking Group and seasoned facilitators, focused on business and skills development, marketing, finance and accounting for SMEs. It was held on Saturday, August 25, 2019 in Ibadan, Oyo State and attended by over 300 entrepreneurs across various segments of business.

The programme covered various topical areas such as identifying business opportunities, surviving in a harsh business environment and improving productivity. Other major areas covered also include raising capital, optimising sales, cost and revenue management, among others. It is one of the value-added offerings of FCMB to complement its efforts in the areas of lending and advisory services to SMEs with the objective of stimulating their growth and contributions to overall national development.

According to the Executive Director, Business Development of FCMB, Mrs. Bukola Smith, the Bank recognises the increasing role and impact of SMEs. ‘’The BEST initiative is one of the innovative ways we empower, promote and lay a solid foundation for the long-term success of our SME customers. Without effective training and exposure, it could be quite difficult for their businesses to succeed. We believe this training will go a long way to impact positively on the SME operators who have participated in this programme. It will propel them to further develop themselves in order to compete favourably within and outside the Nigerian market. We, therefore, urge the beneficiaries to take advantage of the unique opportunities provided by this exercise. It is a veritable platform for them to take the lead to drive the diversification and growth of the Nigerian economy’’, she said.

Also speaking, the Head, Training Academy of FCMB, Mr. Sola Oyegbade, stated that, ‘’BEST initiative is a proof of our commitment to the growth and sustainability of SMEs. We focus on helping and getting these businesses sustained, beyond just focusing on what value they add to our own Business on the immediate. We constantly keep our eyes on the critical need for SMEs to maximally contribute to the rapid development of the nation’s growing economy. Several of our SME partners who have participated in earlier versions of this training are much better off today”.

Participants expressed their immense gratitude to the Bank for providing such a very valuable platform without charges. The Managing Director of Precious Gems Medical Consults, Dr. Olusola-Taiwo Omolara, described the training as, ‘’an eye-opener’’. According to her, ‘’the first session enlightened me on some matters that I would not have given due consideration to as factors that drive business growth. But now with the knowledge gained, I will have a fresh approach towards doing business in my community. It is rare for a financial institution in Nigeria with a remarkable reputation such as FCMB to take out the time to help businesses, most especially SMEs, to equip them with practical knowledge to overcome the challenges of the harsh business environment. But FCMB has brought this to us right at our doorsteps completely free of charge and in a very grand manner’’.

On his part, the Chief Executive Officer of Scent Design Nig Ltd, Mr. Abayomi Lambo, said, “the entire programme was brilliant and well planned. I was blessed to be part of it. It is nice to see a Bank giving back to it’s customers”.

Beyond the BEST capacity building programme, FCMB has a suite of cutting-edge offerings in the SME segment. The financial institution is one of the top participating Banks appointed by the Central Bank of Nigeria (CBN) to drive the N220billion Development Fund instituted by the apex regulatory institution to provide loans to SMEs. In addition, the Bank offers free banking transactions for a period of three months to its new SME customers.

For more information about FCMB, please visit www.fcmb.com.

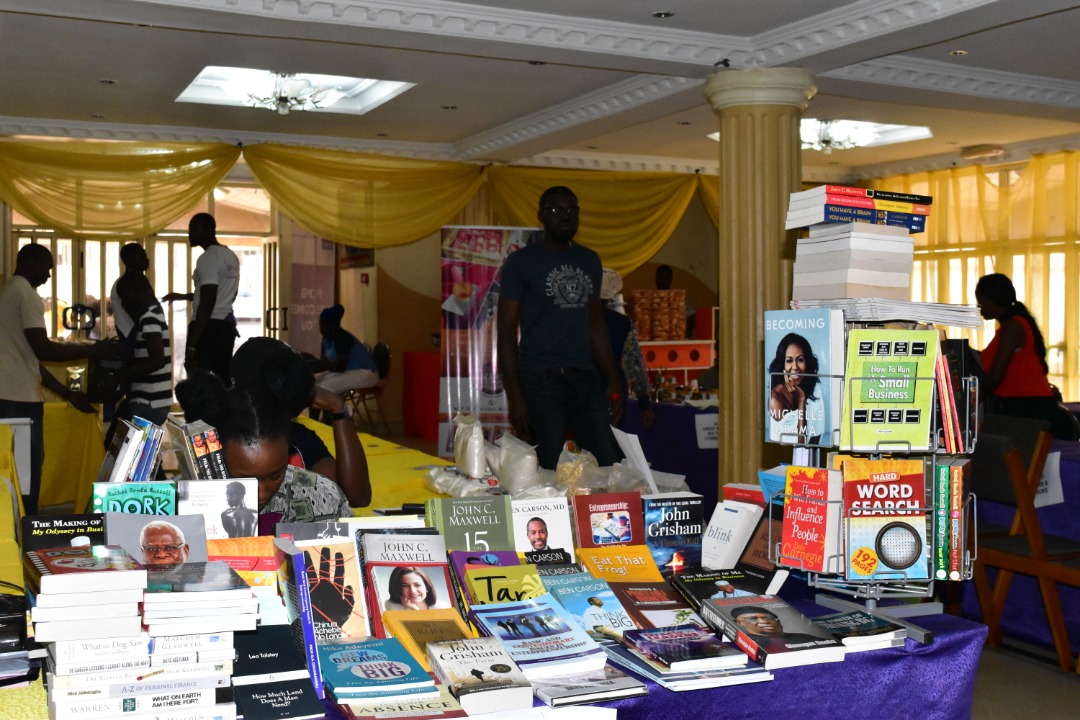

See pictures from the training below:

[READ ALSO: FCMB Introduces Revamped Agro-Commodity Trade Finance Facility]