This is the summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills and FGN Bonds.

This report is dated August 9.

Bonds: The FGN Bond market closed the week on a relatively calm note, having witnessed significant selloffs earlier in the week, which lifted yields higher by c.50bps w/w. Yields however compressed marginally by c.3bps on the day, following renewed demand on the long end of the curve, with the most interest witnessed on the FGN 2034 bond.

In the coming week, we expect continued demand from local investors to place a slight downward pressure on yields, following expectation for a continued downtrend in the July Inflation figure and Coupon payment of c.N47 billion to be paid on the FGN 2020 Bond. This is, however, barring a continued escalation in the global externalities witnessed earlier in the week.

[READ MORE: Over 600 masts at the risk of being demolished by NCC]

Treasury Bills: The T-bills market remained firmly bearish, as offshore selloffs persisted across most of the short and mid tenured bills. Yields trended higher by c.25bps on the day, culminating in a c.135bps w/w rise in the average NTB yields.

Upon resumption from the Salah break on Wednesday, the CBN will auction c.N34 billion T-bills to roll over existing FGN T-bill maturities. Despite the minuscule volume of T-bills on offer, we expect stop rates to clear above their previous level, due to the recent bearish trend in the market.

Money Market: Rates in the money market remained elevated at double-digit levels, as system liquidity remained depressed from the continued FX interventions by the CBN in the I&E FX window. The OBB and OVN rates consequently closed c.6pct higher w/w at 12.14% and 12.86% respectively.

We expect rates to remain elevated in the new week, due to expected funding pressures from a likely wholesale and retail FX interventions by the CBN.

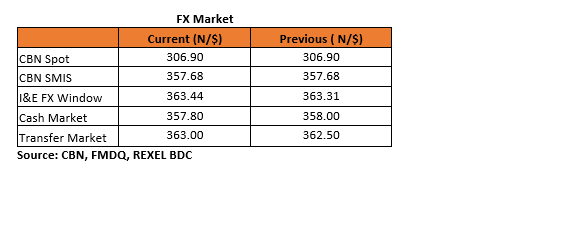

FX Market: At the interbank, the Naira/USD rate remained unchanged at N360.90/$ (Spot) and N357.68/$ (SMIS). The NAFEX rate at the I&E window rose further by 13k to a 6-month high of N363.44/$, due to continued profit-taking on T-bills by offshore investors. At the parallel market, the cash rate decreased by 20k to N357.80/$, while the transfer rate increased by 50k to N363.00/$.

[READ ALSO: CCNN Plc leads this week’s gainers as losses mount on the NSE]

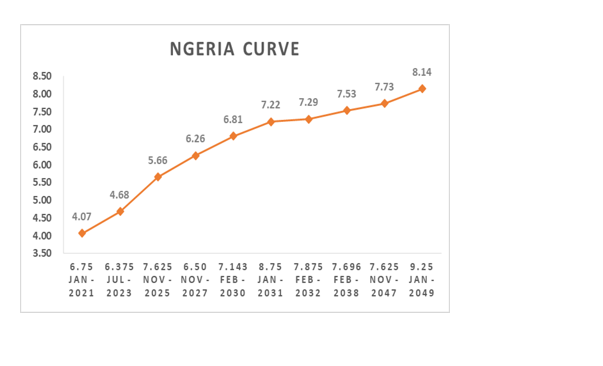

Eurobonds: The NIGERIA Sovereigns rebounded slightly following renewed interest from investors as oil prices gained 2pct from their lows of the week. Most of the tickers consequently recouped losses from earlier in the week, but remain c.4pct off their recent highs prior to the escalation in US-China trade tensions which dampened risk sentiments.

IN the NIGERIA Corps, there were slight interests on the ACCESS 21s and ZENITH 22s, but we witnessed continued selling interests in the ETINL 24s. Investors in the ECOTRA 2021 Bond would be repaid $250m on the 14th of August following an earlier call on the bond originally due to mature in 2021.

[READ FURTHER: Ecobank drags client to court over N25 billion unpaid ‘debt’]

_______________________________________________________________________

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not a piece of investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.